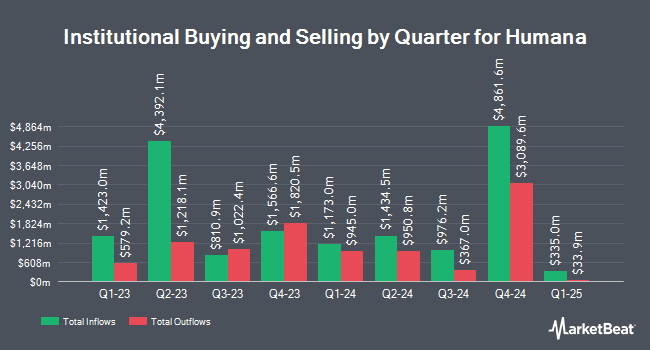

Ontario Teachers Pension Plan Board lifted its stake in Humana Inc. (NYSE:HUM - Free Report) by 8.6% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 666,684 shares of the insurance provider's stock after purchasing an additional 52,605 shares during the period. Humana comprises about 2.6% of Ontario Teachers Pension Plan Board's investment portfolio, making the stock its 15th largest position. Ontario Teachers Pension Plan Board owned 0.55% of Humana worth $176,405,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds have also recently made changes to their positions in the stock. Deutsche Bank AG lifted its stake in Humana by 18.2% in the fourth quarter. Deutsche Bank AG now owns 631,371 shares of the insurance provider's stock worth $160,185,000 after acquiring an additional 97,071 shares during the period. Janney Montgomery Scott LLC purchased a new stake in Humana in the first quarter worth about $1,309,000. Fred Alger Management LLC purchased a new stake in Humana in the fourth quarter worth about $451,000. Clearline Capital LP purchased a new stake in Humana in the fourth quarter worth about $1,102,000. Finally, Envestnet Asset Management Inc. lifted its stake in Humana by 2.4% in the first quarter. Envestnet Asset Management Inc. now owns 125,684 shares of the insurance provider's stock worth $33,256,000 after acquiring an additional 2,950 shares during the period. 92.38% of the stock is currently owned by institutional investors.

Humana Stock Performance

Shares of Humana stock traded up $10.51 during midday trading on Friday, hitting $266.65. The company had a trading volume of 1,678,249 shares, compared to its average volume of 1,999,296. The stock has a market cap of $32.07 billion, a price-to-earnings ratio of 20.46, a PEG ratio of 1.51 and a beta of 0.44. The company has a quick ratio of 1.95, a current ratio of 1.95 and a debt-to-equity ratio of 0.69. The company has a fifty day simple moving average of $237.88 and a 200 day simple moving average of $254.38. Humana Inc. has a 12-month low of $206.87 and a 12-month high of $382.72.

Humana (NYSE:HUM - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The insurance provider reported $6.27 EPS for the quarter, missing the consensus estimate of $6.32 by ($0.05). The company had revenue of $32.39 billion during the quarter, compared to analysts' expectations of $31.85 billion. Humana had a net margin of 1.28% and a return on equity of 13.67%. The business's revenue for the quarter was up 9.6% compared to the same quarter last year. During the same period in the previous year, the business earned $6.96 earnings per share. As a group, analysts predict that Humana Inc. will post 16.47 earnings per share for the current fiscal year.

Analyst Ratings Changes

HUM has been the subject of a number of research reports. Truist Financial lowered their price objective on shares of Humana from $280.00 to $260.00 and set a "hold" rating for the company in a research note on Wednesday, July 16th. Bank of America lowered their price objective on shares of Humana from $320.00 to $260.00 and set a "neutral" rating for the company in a research note on Tuesday, June 17th. Raymond James Financial raised shares of Humana from a "market perform" rating to an "outperform" rating and set a $315.00 price objective for the company in a research note on Thursday, May 1st. Morgan Stanley lowered their price objective on shares of Humana from $290.00 to $277.00 and set an "equal weight" rating for the company in a research note on Thursday, July 31st. Finally, Oppenheimer increased their price target on shares of Humana from $300.00 to $310.00 and gave the company an "outperform" rating in a research report on Thursday, May 1st. Seventeen equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $281.62.

Check Out Our Latest Research Report on HUM

Humana Profile

(

Free Report)

Humana Inc, together with its subsidiaries, provides medical and specialty insurance products in the United States. It operates through two segments, Insurance and CenterWell. The company offers medical and supplemental benefit plans to individuals. It has a contract with Centers for Medicare and Medicaid Services to administer the Limited Income Newly Eligible Transition prescription drug plan program; and contracts with various states to provide Medicaid, dual eligible, and long-term support services benefits.

Further Reading

Before you consider Humana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Humana wasn't on the list.

While Humana currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.