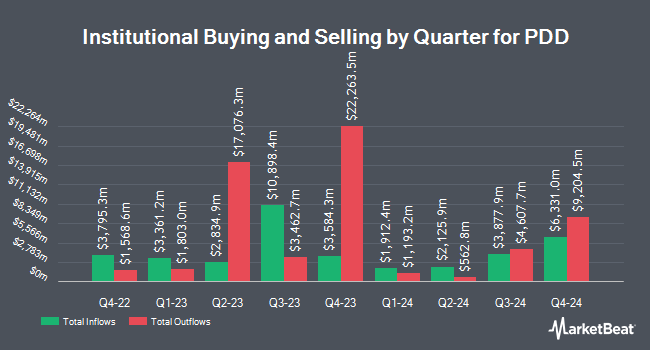

Orbis Allan Gray Ltd grew its holdings in PDD Holdings Inc. Sponsored ADR (NASDAQ:PDD - Free Report) by 2,354.9% during the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 2,397,312 shares of the company's stock after purchasing an additional 2,299,659 shares during the period. PDD makes up about 1.6% of Orbis Allan Gray Ltd's portfolio, making the stock its 26th biggest position. Orbis Allan Gray Ltd owned about 0.17% of PDD worth $283,722,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also bought and sold shares of PDD. Mirae Asset Global Investments Co. Ltd. grew its position in PDD by 9,469.7% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 39,678,479 shares of the company's stock worth $4,695,948,000 after acquiring an additional 39,263,851 shares during the last quarter. OVERSEA CHINESE BANKING Corp Ltd grew its position in PDD by 4,562.1% during the 1st quarter. OVERSEA CHINESE BANKING Corp Ltd now owns 14,419,327 shares of the company's stock worth $1,706,527,000 after acquiring an additional 14,110,042 shares during the last quarter. Krane Funds Advisors LLC lifted its holdings in PDD by 78.3% during the 1st quarter. Krane Funds Advisors LLC now owns 5,036,389 shares of the company's stock worth $596,057,000 after buying an additional 2,211,286 shares during the period. Baillie Gifford & Co. lifted its holdings in PDD by 5.2% during the 1st quarter. Baillie Gifford & Co. now owns 40,047,278 shares of the company's stock worth $4,739,595,000 after buying an additional 1,987,935 shares during the period. Finally, Dragoneer Investment Group LLC lifted its holdings in PDD by 48.8% during the 4th quarter. Dragoneer Investment Group LLC now owns 5,572,094 shares of the company's stock worth $540,437,000 after buying an additional 1,827,853 shares during the period. Institutional investors own 39.83% of the company's stock.

Analyst Upgrades and Downgrades

PDD has been the topic of several recent research reports. Citigroup reaffirmed a "buy" rating on shares of PDD in a report on Monday, August 25th. Barclays lifted their target price on PDD from $158.00 to $165.00 and gave the stock an "overweight" rating in a report on Tuesday, August 26th. JPMorgan Chase & Co. cut their target price on PDD from $125.00 to $105.00 and set a "neutral" rating on the stock in a report on Wednesday, May 28th. Benchmark reaffirmed a "buy" rating and set a $160.00 target price (up from $128.00) on shares of PDD in a report on Tuesday, August 26th. Finally, Macquarie set a $165.00 price objective on PDD and gave the company an "outperform" rating in a research note on Monday, August 25th. One equities research analyst has rated the stock with a Strong Buy rating, five have issued a Buy rating and eight have assigned a Hold rating to the stock. According to data from MarketBeat.com, PDD presently has an average rating of "Moderate Buy" and a consensus target price of $137.82.

Read Our Latest Research Report on PDD

PDD Trading Up 2.2%

PDD stock traded up $2.70 during midday trading on Wednesday, reaching $124.39. The stock had a trading volume of 7,691,885 shares, compared to its average volume of 9,092,080. PDD Holdings Inc. Sponsored ADR has a 12 month low of $87.11 and a 12 month high of $155.67. The company has a market capitalization of $173.17 billion, a P/E ratio of 13.49, a PEG ratio of 1.42 and a beta of 0.46. The company has a fifty day moving average price of $113.13 and a two-hundred day moving average price of $111.27.

PDD Profile

(

Free Report)

PDD Holdings Inc, a multinational commerce group, owns and operates a portfolio of businesses. It operates Pinduoduo, an e-commerce platform that offers products in various categories, including agricultural produce, apparel, shoes, bags, mother and childcare products, food and beverage, electronic appliances, furniture and household goods, cosmetics and other personal care, sports and fitness items and auto accessories; and Temu, an online marketplace.

See Also

Before you consider PDD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDD wasn't on the list.

While PDD currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.