Foundations Investment Advisors LLC increased its holdings in shares of Oshkosh Corporation (NYSE:OSK - Free Report) by 130.6% during the first quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 6,347 shares of the company's stock after acquiring an additional 3,595 shares during the period. Foundations Investment Advisors LLC's holdings in Oshkosh were worth $597,000 as of its most recent SEC filing.

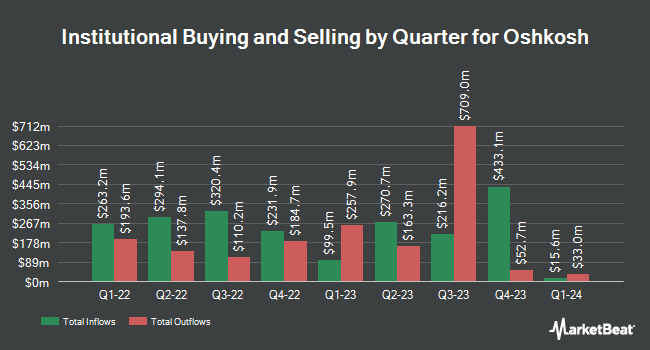

Several other institutional investors also recently bought and sold shares of the company. Dimensional Fund Advisors LP boosted its holdings in Oshkosh by 9.8% in the 4th quarter. Dimensional Fund Advisors LP now owns 2,317,709 shares of the company's stock worth $220,342,000 after buying an additional 206,377 shares during the last quarter. FMR LLC boosted its holdings in Oshkosh by 13.0% in the 4th quarter. FMR LLC now owns 1,383,558 shares of the company's stock worth $131,535,000 after buying an additional 159,667 shares during the last quarter. Invesco Ltd. boosted its holdings in Oshkosh by 2.3% in the 4th quarter. Invesco Ltd. now owns 1,243,561 shares of the company's stock worth $118,225,000 after buying an additional 27,659 shares during the last quarter. Geode Capital Management LLC boosted its holdings in Oshkosh by 3.7% in the 4th quarter. Geode Capital Management LLC now owns 1,130,190 shares of the company's stock worth $107,479,000 after buying an additional 40,260 shares during the last quarter. Finally, Norges Bank acquired a new stake in Oshkosh in the 4th quarter worth about $72,692,000. 92.36% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several research firms recently issued reports on OSK. The Goldman Sachs Group upgraded Oshkosh from a "neutral" rating to a "buy" rating and lifted their price objective for the stock from $124.00 to $131.00 in a report on Tuesday, July 1st. Truist Financial upgraded Oshkosh from a "hold" rating to a "buy" rating and boosted their target price for the stock from $93.00 to $127.00 in a report on Tuesday, June 3rd. DA Davidson boosted their target price on Oshkosh from $111.00 to $148.00 and gave the stock a "buy" rating in a report on Tuesday, July 22nd. UBS Group boosted their target price on Oshkosh from $119.00 to $149.00 and gave the stock a "buy" rating in a report on Thursday, July 10th. Finally, JPMorgan Chase & Co. boosted their target price on Oshkosh from $92.00 to $106.00 and gave the stock a "neutral" rating in a report on Friday, June 6th. One research analyst has rated the stock with a sell rating, three have issued a hold rating and ten have issued a buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $129.69.

Read Our Latest Stock Report on OSK

Oshkosh Stock Up 0.8%

OSK stock opened at $126.46 on Friday. The firm has a market cap of $8.14 billion, a PE ratio of 13.51, a PEG ratio of 2.02 and a beta of 1.43. The company has a debt-to-equity ratio of 0.26, a quick ratio of 0.86 and a current ratio of 1.77. The firm's 50 day moving average price is $115.39 and its 200-day moving average price is $102.90. Oshkosh Corporation has a one year low of $76.82 and a one year high of $130.43.

Oshkosh (NYSE:OSK - Get Free Report) last released its quarterly earnings results on Wednesday, April 30th. The company reported $1.92 EPS for the quarter, missing the consensus estimate of $2.02 by ($0.10). The firm had revenue of $2.31 billion for the quarter, compared to analysts' expectations of $2.42 billion. Oshkosh had a net margin of 5.84% and a return on equity of 17.22%. The firm's quarterly revenue was down 9.1% compared to the same quarter last year. During the same period in the previous year, the firm posted $2.89 EPS. On average, equities research analysts anticipate that Oshkosh Corporation will post 10.96 EPS for the current year.

Oshkosh Profile

(

Free Report)

Oshkosh Corporation provides purpose-built vehicles and equipment worldwide. The company operates through three segments: Access, Defense, and Vocational segment. Its Access Equipment segment design and manufacture aerial work platform and telehandlers for use in construction, industrial, and maintenance applications; offers financing and leasing solutions including rental fleet loans, leases, and floor plan and retail financing; and towing and recovery equipment, which includes carriers, wreckers, and rotators, as well as provides equipment installation and sale of chassis and service parts.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Oshkosh, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oshkosh wasn't on the list.

While Oshkosh currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.