Pacer Advisors Inc. lowered its position in Haemonetics Corporation (NYSE:HAE - Free Report) by 70.2% in the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 3,011 shares of the medical instruments supplier's stock after selling 7,093 shares during the quarter. Pacer Advisors Inc.'s holdings in Haemonetics were worth $191,000 as of its most recent SEC filing.

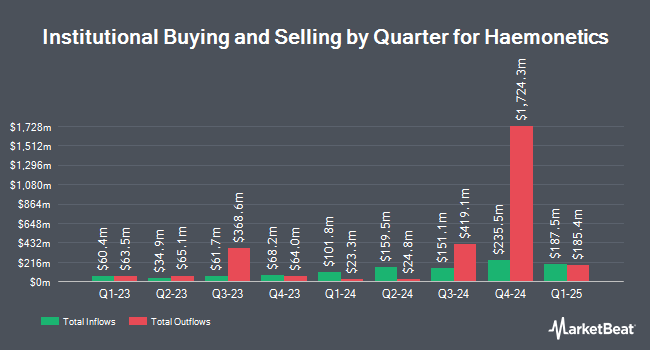

Several other large investors also recently added to or reduced their stakes in the company. TD Waterhouse Canada Inc. purchased a new position in shares of Haemonetics in the fourth quarter valued at $25,000. Covestor Ltd grew its position in shares of Haemonetics by 146.8% in the fourth quarter. Covestor Ltd now owns 738 shares of the medical instruments supplier's stock valued at $58,000 after purchasing an additional 439 shares in the last quarter. KBC Group NV grew its position in shares of Haemonetics by 19.9% in the first quarter. KBC Group NV now owns 2,417 shares of the medical instruments supplier's stock valued at $154,000 after purchasing an additional 401 shares in the last quarter. Vise Technologies Inc. grew its holdings in Haemonetics by 8.7% during the 4th quarter. Vise Technologies Inc. now owns 2,825 shares of the medical instruments supplier's stock valued at $221,000 after buying an additional 225 shares in the last quarter. Finally, CWC Advisors LLC. grew its holdings in Haemonetics by 7.4% during the 4th quarter. CWC Advisors LLC. now owns 3,083 shares of the medical instruments supplier's stock valued at $241,000 after buying an additional 212 shares in the last quarter. Hedge funds and other institutional investors own 99.67% of the company's stock.

Haemonetics Price Performance

Shares of NYSE HAE traded up $1.49 during mid-day trading on Monday, reaching $76.26. 451,069 shares of the company were exchanged, compared to its average volume of 555,083. The company has a quick ratio of 0.99, a current ratio of 1.62 and a debt-to-equity ratio of 1.12. The company's 50 day moving average price is $72.88 and its 200 day moving average price is $67.57. Haemonetics Corporation has a 52 week low of $55.30 and a 52 week high of $94.99. The stock has a market capitalization of $3.66 billion, a PE ratio of 23.04, a PEG ratio of 1.21 and a beta of 0.40.

Haemonetics (NYSE:HAE - Get Free Report) last issued its quarterly earnings results on Thursday, May 8th. The medical instruments supplier reported $1.24 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.22 by $0.02. The firm had revenue of $330.60 million during the quarter, compared to analyst estimates of $329.38 million. Haemonetics had a return on equity of 26.37% and a net margin of 12.32%. The company's revenue was down 3.5% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.90 earnings per share. Sell-side analysts forecast that Haemonetics Corporation will post 4.55 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

HAE has been the subject of several recent analyst reports. Raymond James Financial reaffirmed a "strong-buy" rating and set a $105.00 price objective (down previously from $115.00) on shares of Haemonetics in a research note on Friday, May 9th. Barrington Research restated an "outperform" rating and set a $95.00 price target on shares of Haemonetics in a research report on Friday, July 11th. Needham & Company LLC dropped their price objective on Haemonetics from $104.00 to $84.00 and set a "buy" rating for the company in a research note on Thursday, May 8th. Citigroup raised Haemonetics from a "neutral" rating to a "buy" rating and set a $90.00 price objective for the company in a research note on Wednesday, July 9th. Finally, Baird R W raised Haemonetics to a "strong-buy" rating in a research note on Wednesday, June 25th. One investment analyst has rated the stock with a sell rating, one has given a hold rating, eight have assigned a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $97.30.

Read Our Latest Stock Analysis on HAE

Haemonetics Profile

(

Free Report)

Haemonetics Corporation, a healthcare company, provides suite of medical products and solutions in the United States and internationally. The company offers automated plasma collection systems, donor management software, and supporting software solutions including NexSys PCS and PCS2 plasmapheresis equipment and related disposables and solutions, as well as integrated information technology platforms for plasma customers to manage their donors, operations, and supply chain; and NexLynk DMS donor management system and Donor360 app.

Featured Stories

Before you consider Haemonetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Haemonetics wasn't on the list.

While Haemonetics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.