Pacer Advisors Inc. lowered its position in shares of Steven Madden, Ltd. (NASDAQ:SHOO - Free Report) by 71.0% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 496,648 shares of the textile maker's stock after selling 1,215,379 shares during the quarter. Pacer Advisors Inc. owned 0.68% of Steven Madden worth $13,231,000 at the end of the most recent quarter.

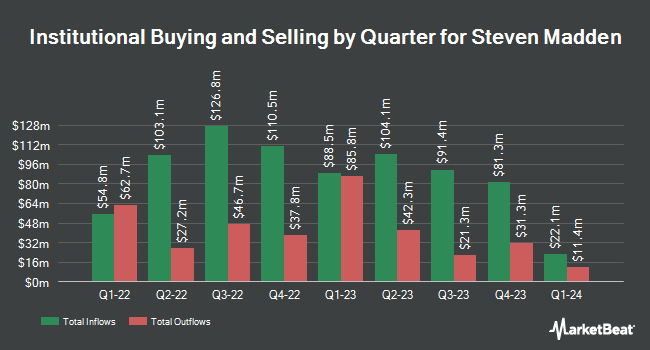

Other large investors have also bought and sold shares of the company. Pictet Asset Management Holding SA boosted its stake in Steven Madden by 17.9% during the fourth quarter. Pictet Asset Management Holding SA now owns 10,503 shares of the textile maker's stock valued at $447,000 after buying an additional 1,594 shares in the last quarter. Deutsche Bank AG boosted its stake in Steven Madden by 49.0% during the fourth quarter. Deutsche Bank AG now owns 64,998 shares of the textile maker's stock valued at $2,764,000 after buying an additional 21,363 shares in the last quarter. Principal Financial Group Inc. boosted its position in shares of Steven Madden by 2.8% in the 1st quarter. Principal Financial Group Inc. now owns 391,937 shares of the textile maker's stock valued at $10,441,000 after purchasing an additional 10,741 shares during the period. Bank of Montreal Can boosted its position in shares of Steven Madden by 5.5% in the 4th quarter. Bank of Montreal Can now owns 10,660 shares of the textile maker's stock valued at $453,000 after purchasing an additional 554 shares during the period. Finally, Allspring Global Investments Holdings LLC boosted its position in shares of Steven Madden by 29.6% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 1,455,381 shares of the textile maker's stock valued at $39,907,000 after purchasing an additional 332,689 shares during the period. Institutional investors own 99.88% of the company's stock.

Steven Madden Price Performance

Steven Madden stock traded down $1.94 during mid-day trading on Wednesday, hitting $24.38. The company's stock had a trading volume of 1,476,406 shares, compared to its average volume of 1,528,688. The firm's 50 day moving average is $25.05 and its 200 day moving average is $28.13. The company has a market cap of $1.77 billion, a PE ratio of 10.55 and a beta of 1.10. Steven Madden, Ltd. has a 52-week low of $19.05 and a 52-week high of $50.01.

Steven Madden (NASDAQ:SHOO - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The textile maker reported $0.20 earnings per share for the quarter, missing analysts' consensus estimates of $0.24 by ($0.04). Steven Madden had a return on equity of 21.63% and a net margin of 7.26%. The firm had revenue of $556.09 million for the quarter, compared to analysts' expectations of $575.83 million. During the same period last year, the business earned $0.57 earnings per share. The firm's revenue for the quarter was up 6.8% on a year-over-year basis. As a group, analysts forecast that Steven Madden, Ltd. will post 2.66 EPS for the current year.

Steven Madden Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, June 20th. Stockholders of record on Monday, June 9th were paid a dividend of $0.21 per share. This represents a $0.84 dividend on an annualized basis and a dividend yield of 3.45%. The ex-dividend date of this dividend was Monday, June 9th. Steven Madden's dividend payout ratio (DPR) is presently 36.21%.

Analyst Upgrades and Downgrades

A number of research firms recently weighed in on SHOO. UBS Group increased their price target on Steven Madden from $23.00 to $26.00 and gave the company a "neutral" rating in a research report on Monday. Citigroup upgraded Steven Madden from a "neutral" rating to a "buy" rating and increased their price target for the company from $26.00 to $32.00 in a research report on Thursday, July 17th. Piper Sandler decreased their price target on Steven Madden from $35.00 to $25.00 and set a "neutral" rating for the company in a research report on Friday, April 11th. Needham & Company LLC reiterated a "hold" rating on shares of Steven Madden in a research report on Friday, May 2nd. Finally, Telsey Advisory Group reiterated a "market perform" rating and issued a $24.00 price target on shares of Steven Madden in a research report on Wednesday, July 23rd. Eight research analysts have rated the stock with a hold rating and one has assigned a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $30.50.

View Our Latest Stock Analysis on Steven Madden

Steven Madden Profile

(

Free Report)

Steven Madden, Ltd. designs, sources, and markets fashion-forward branded and private label footwear, accessories, and apparel in the United States and internationally. It operates through Wholesale Footwear, Wholesale Accessories/Apparel, Direct-to- Consumer, and Licensing segments. The Wholesale Footwear segment designs, sources, and markets various products, including dress shoes, boots, booties, fashion sneakers, sandals, and casual shoes under the Steve Madden, Dolce Vita, Betsey Johnson, Blondo, GREATS, and Anne Klein brands.

Further Reading

Before you consider Steven Madden, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Steven Madden wasn't on the list.

While Steven Madden currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.