Pacer Advisors Inc. reduced its holdings in shares of The Charles Schwab Corporation (NYSE:SCHW - Free Report) by 27.2% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 87,092 shares of the financial services provider's stock after selling 32,496 shares during the quarter. Pacer Advisors Inc.'s holdings in Charles Schwab were worth $6,818,000 as of its most recent filing with the Securities and Exchange Commission.

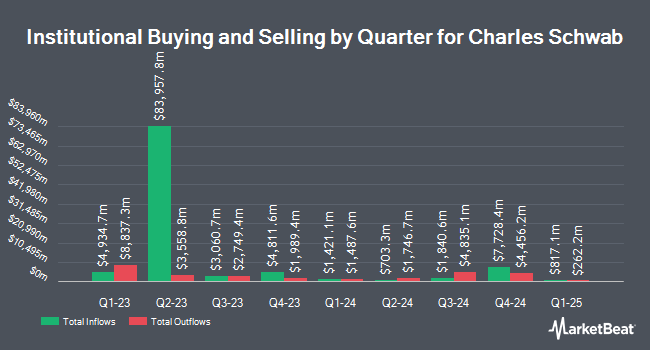

Other institutional investors and hedge funds have also made changes to their positions in the company. Atwood & Palmer Inc. bought a new position in Charles Schwab in the 1st quarter valued at about $25,000. Westside Investment Management Inc. grew its position in Charles Schwab by 75.0% during the 1st quarter. Westside Investment Management Inc. now owns 350 shares of the financial services provider's stock worth $27,000 after acquiring an additional 150 shares during the last quarter. WFA Asset Management Corp bought a new stake in shares of Charles Schwab during the first quarter valued at approximately $33,000. Cornerstone Planning Group LLC grew its position in shares of Charles Schwab by 90.5% during the 1st quarter. Cornerstone Planning Group LLC now owns 463 shares of the financial services provider's stock valued at $36,000 after acquiring an additional 220 shares during the period. Finally, Beacon Capital Management LLC raised its position in shares of Charles Schwab by 53.1% during the first quarter. Beacon Capital Management LLC now owns 487 shares of the financial services provider's stock valued at $38,000 after buying an additional 169 shares during the last quarter. 84.38% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several brokerages have recently issued reports on SCHW. Morgan Stanley raised their price objective on Charles Schwab from $117.00 to $131.00 and gave the stock an "overweight" rating in a research note on Tuesday. JMP Securities increased their price target on shares of Charles Schwab from $106.00 to $110.00 and gave the company a "market outperform" rating in a research report on Monday, July 21st. William Blair cut shares of Charles Schwab from a "strong-buy" rating to a "hold" rating in a research report on Thursday, July 3rd. Keefe, Bruyette & Woods lifted their target price on Charles Schwab from $102.00 to $108.00 and gave the company an "outperform" rating in a research note on Monday, July 21st. Finally, JPMorgan Chase & Co. raised their target price on shares of Charles Schwab from $92.00 to $95.00 and gave the company an "overweight" rating in a research note on Monday, April 21st. Two analysts have rated the stock with a sell rating, four have issued a hold rating and sixteen have assigned a buy rating to the company. Based on data from MarketBeat, Charles Schwab currently has an average rating of "Moderate Buy" and a consensus price target of $99.35.

Read Our Latest Analysis on SCHW

Charles Schwab Stock Performance

Shares of NYSE SCHW traded down $0.13 during trading hours on Thursday, hitting $98.44. 2,174,345 shares of the stock were exchanged, compared to its average volume of 10,162,659. The Charles Schwab Corporation has a one year low of $61.15 and a one year high of $99.59. The company has a debt-to-equity ratio of 0.53, a current ratio of 0.53 and a quick ratio of 0.53. The firm has a market capitalization of $178.86 billion, a P/E ratio of 26.46, a P/E/G ratio of 0.94 and a beta of 0.93. The company's 50 day moving average is $90.91 and its 200 day moving average is $83.33.

Charles Schwab (NYSE:SCHW - Get Free Report) last issued its earnings results on Friday, July 18th. The financial services provider reported $1.14 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.10 by $0.04. Charles Schwab had a return on equity of 19.73% and a net margin of 33.68%. The firm had revenue of $5.85 billion for the quarter, compared to analysts' expectations of $5.64 billion. During the same quarter last year, the business earned $0.73 earnings per share. The company's revenue was up 24.8% compared to the same quarter last year. On average, research analysts expect that The Charles Schwab Corporation will post 4.22 EPS for the current year.

Charles Schwab Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, August 22nd. Investors of record on Friday, August 8th will be paid a $0.27 dividend. This represents a $1.08 annualized dividend and a dividend yield of 1.10%. The ex-dividend date of this dividend is Friday, August 8th. Charles Schwab's dividend payout ratio (DPR) is currently 29.03%.

Charles Schwab declared that its board has approved a share buyback program on Thursday, July 24th that allows the company to repurchase $20.00 billion in outstanding shares. This repurchase authorization allows the financial services provider to repurchase up to 11.6% of its shares through open market purchases. Shares repurchase programs are generally an indication that the company's management believes its shares are undervalued.

Insider Activity

In other Charles Schwab news, insider Nigel J. Murtagh sold 20,872 shares of the business's stock in a transaction on Wednesday, June 18th. The shares were sold at an average price of $90.01, for a total transaction of $1,878,688.72. Following the sale, the insider owned 58,999 shares of the company's stock, valued at approximately $5,310,499.99. The trade was a 26.13% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, Director Paula A. Sneed sold 8,647 shares of the company's stock in a transaction dated Tuesday, May 27th. The shares were sold at an average price of $88.06, for a total transaction of $761,454.82. Following the transaction, the director owned 105,654 shares in the company, valued at $9,303,891.24. This represents a 7.57% decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 106,754 shares of company stock valued at $9,480,253. Company insiders own 6.30% of the company's stock.

Charles Schwab Company Profile

(

Free Report)

The Charles Schwab Corporation, together with its subsidiaries, operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally. The company operates in two segments, Investor Services and Advisor Services.

Read More

Before you consider Charles Schwab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles Schwab wasn't on the list.

While Charles Schwab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report