Pacer Advisors Inc. decreased its holdings in Extra Space Storage Inc (NYSE:EXR - Free Report) by 4.3% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 160,584 shares of the real estate investment trust's stock after selling 7,151 shares during the quarter. Pacer Advisors Inc. owned approximately 0.08% of Extra Space Storage worth $23,845,000 at the end of the most recent reporting period.

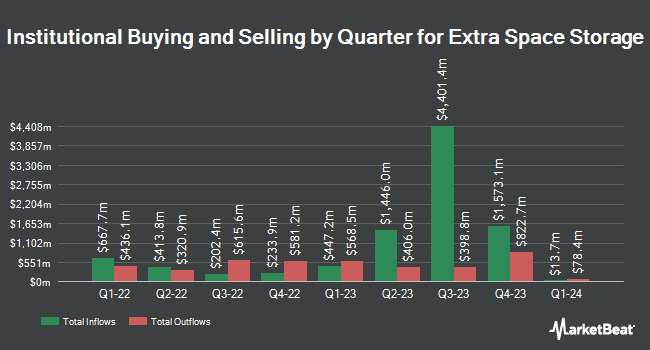

Several other institutional investors also recently modified their holdings of EXR. Quarry LP lifted its holdings in Extra Space Storage by 156.1% in the fourth quarter. Quarry LP now owns 356 shares of the real estate investment trust's stock valued at $53,000 after buying an additional 217 shares during the period. Golden State Wealth Management LLC lifted its holdings in Extra Space Storage by 147.0% in the first quarter. Golden State Wealth Management LLC now owns 405 shares of the real estate investment trust's stock valued at $60,000 after buying an additional 241 shares during the period. Parvin Asset Management LLC acquired a new position in Extra Space Storage in the fourth quarter valued at $62,000. Wayfinding Financial LLC acquired a new position in Extra Space Storage in the first quarter valued at $76,000. Finally, Global X Japan Co. Ltd. lifted its holdings in Extra Space Storage by 24.8% in the first quarter. Global X Japan Co. Ltd. now owns 558 shares of the real estate investment trust's stock valued at $83,000 after buying an additional 111 shares during the period. Institutional investors own 99.11% of the company's stock.

Analyst Ratings Changes

Several equities analysts recently issued reports on the stock. Wells Fargo & Company dropped their target price on shares of Extra Space Storage from $165.00 to $160.00 and set an "equal weight" rating on the stock in a report on Wednesday, July 23rd. Evercore ISI boosted their target price on shares of Extra Space Storage from $144.00 to $149.00 and gave the company an "in-line" rating in a report on Thursday, May 1st. Scotiabank boosted their target price on shares of Extra Space Storage from $149.00 to $166.00 and gave the company a "sector outperform" rating in a report on Monday, May 12th. Royal Bank Of Canada dropped their price objective on shares of Extra Space Storage from $163.00 to $160.00 and set a "sector perform" rating on the stock in a report on Thursday, May 1st. Finally, BNP Paribas Exane started coverage on shares of Extra Space Storage in a report on Tuesday, June 24th. They set a "neutral" rating and a $156.00 price objective on the stock. Nine analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $157.69.

View Our Latest Report on EXR

Insider Transactions at Extra Space Storage

In related news, CEO Joseph D. Margolis sold 7,500 shares of the firm's stock in a transaction that occurred on Tuesday, July 1st. The shares were sold at an average price of $150.35, for a total value of $1,127,625.00. Following the completion of the transaction, the chief executive officer directly owned 27,260 shares of the company's stock, valued at approximately $4,098,541. This trade represents a 21.58% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 1.36% of the company's stock.

Extra Space Storage Stock Down 0.4%

Shares of EXR traded down $0.58 on Wednesday, reaching $151.34. The company's stock had a trading volume of 263,379 shares, compared to its average volume of 1,158,866. The company has a current ratio of 0.33, a quick ratio of 0.33 and a debt-to-equity ratio of 0.85. Extra Space Storage Inc has a twelve month low of $121.03 and a twelve month high of $184.87. The stock has a market capitalization of $32.11 billion, a PE ratio of 35.12, a PEG ratio of 3.60 and a beta of 1.10. The firm has a fifty day moving average of $149.03 and a 200-day moving average of $148.47.

Extra Space Storage (NYSE:EXR - Get Free Report) last issued its quarterly earnings data on Tuesday, April 29th. The real estate investment trust reported $2.00 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.96 by $0.04. Extra Space Storage had a net margin of 27.84% and a return on equity of 6.11%. The business had revenue of $820.00 million during the quarter, compared to the consensus estimate of $705.12 million. During the same period in the prior year, the firm posted $1.96 EPS. The firm's quarterly revenue was up 2.6% compared to the same quarter last year. Equities analysts predict that Extra Space Storage Inc will post 8.1 EPS for the current year.

Extra Space Storage Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, June 30th. Shareholders of record on Monday, June 16th were given a $1.62 dividend. This represents a $6.48 dividend on an annualized basis and a yield of 4.28%. The ex-dividend date of this dividend was Monday, June 16th. Extra Space Storage's payout ratio is 150.35%.

Extra Space Storage Company Profile

(

Free Report)

Extra Space Storage Inc, headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500. As of December 31, 2023, the Company owned and/or operated 3,714 self-storage stores in 42 states and Washington, DC The Company's stores comprise approximately 2.6 million units and approximately 283.0 million square feet of rentable space operating under the Extra Space, Life Storage and Storage Express brands.

See Also

Before you consider Extra Space Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Extra Space Storage wasn't on the list.

While Extra Space Storage currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.