Palo Alto Wealth Advisors LLC lowered its position in Apple Inc. (NASDAQ:AAPL - Free Report) by 9.9% during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 31,003 shares of the iPhone maker's stock after selling 3,409 shares during the quarter. Apple comprises approximately 2.6% of Palo Alto Wealth Advisors LLC's portfolio, making the stock its 10th largest holding. Palo Alto Wealth Advisors LLC's holdings in Apple were worth $6,610,000 at the end of the most recent quarter.

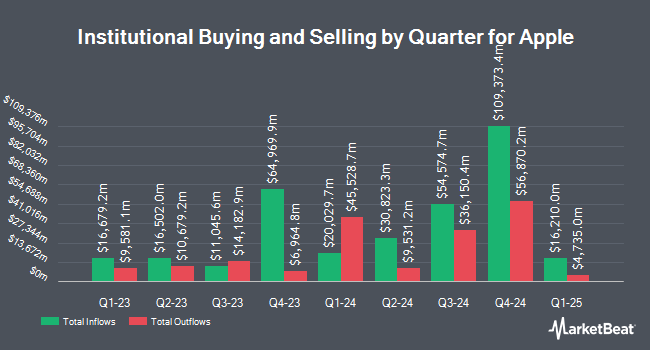

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in AAPL. Life Planning Partners Inc purchased a new position in Apple in the fourth quarter worth $47,000. Elite Financial Inc. purchased a new stake in Apple during the first quarter valued at about $58,000. Conquis Financial LLC purchased a new stake in Apple during the fourth quarter valued at about $63,000. LSV Asset Management purchased a new stake in Apple during the fourth quarter valued at about $65,000. Finally, Pillar Financial Advisors LLC purchased a new stake in Apple during the fourth quarter valued at about $82,000. 67.73% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several equities analysts have recently commented on the stock. Raymond James Financial reaffirmed an "outperform" rating and set a $240.00 price objective (up from $230.00) on shares of Apple in a research note on Friday, August 1st. Wedbush reaffirmed an "outperform" rating and set a $270.00 price objective on shares of Apple in a research note on Tuesday. Moffett Nathanson raised shares of Apple from a "sell" rating to a "neutral" rating and set a $225.00 price objective for the company in a research note on Thursday, September 4th. Evercore ISI upped their price objective on shares of Apple from $250.00 to $260.00 and gave the company an "outperform" rating in a research note on Wednesday. Finally, Rosenblatt Securities upped their price objective on shares of Apple from $223.00 to $241.00 and gave the company a "neutral" rating in a research note on Wednesday. Two research analysts have rated the stock with a Strong Buy rating, fifteen have assigned a Buy rating, fourteen have issued a Hold rating and two have given a Sell rating to the company. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $240.80.

Check Out Our Latest Report on AAPL

Apple Price Performance

Shares of NASDAQ AAPL opened at $230.03 on Friday. Apple Inc. has a fifty-two week low of $169.21 and a fifty-two week high of $260.10. The company has a 50 day simple moving average of $221.08 and a two-hundred day simple moving average of $212.48. The company has a market capitalization of $3.41 trillion, a price-to-earnings ratio of 34.91, a P/E/G ratio of 2.37 and a beta of 1.11. The company has a debt-to-equity ratio of 1.25, a quick ratio of 0.83 and a current ratio of 0.87.

Apple (NASDAQ:AAPL - Get Free Report) last announced its earnings results on Thursday, July 31st. The iPhone maker reported $1.57 earnings per share for the quarter, beating analysts' consensus estimates of $1.43 by $0.14. Apple had a net margin of 24.30% and a return on equity of 170.91%. The business had revenue of $94.04 billion during the quarter, compared to the consensus estimate of $88.64 billion. During the same quarter last year, the firm earned $1.40 earnings per share. The business's revenue for the quarter was up 9.6% on a year-over-year basis. Analysts expect that Apple Inc. will post 7.28 EPS for the current fiscal year.

Apple Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, August 14th. Shareholders of record on Monday, August 11th were paid a dividend of $0.26 per share. The ex-dividend date of this dividend was Monday, August 11th. This represents a $1.04 dividend on an annualized basis and a dividend yield of 0.5%. Apple's dividend payout ratio (DPR) is currently 15.78%.

Insider Buying and Selling at Apple

In other Apple news, SVP Deirdre O'brien sold 34,821 shares of the firm's stock in a transaction that occurred on Friday, August 8th. The shares were sold at an average price of $223.20, for a total transaction of $7,772,047.20. Following the completion of the transaction, the senior vice president owned 136,687 shares of the company's stock, valued at approximately $30,508,538.40. This trade represents a 20.30% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 0.06% of the company's stock.

About Apple

(

Free Report)

Apple Inc designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.