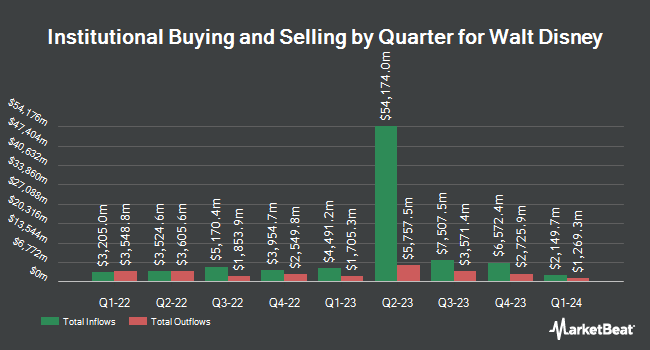

Panagora Asset Management Inc. raised its stake in The Walt Disney Company (NYSE:DIS - Free Report) by 559.1% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 75,063 shares of the entertainment giant's stock after buying an additional 63,675 shares during the quarter. Panagora Asset Management Inc.'s holdings in Walt Disney were worth $7,409,000 at the end of the most recent quarter.

Several other large investors also recently added to or reduced their stakes in the stock. Orbis Allan Gray Ltd grew its holdings in Walt Disney by 20.9% in the 1st quarter. Orbis Allan Gray Ltd now owns 3,588,463 shares of the entertainment giant's stock valued at $354,181,000 after buying an additional 620,166 shares in the last quarter. Activest Wealth Management grew its holdings in Walt Disney by 28.6% in the 1st quarter. Activest Wealth Management now owns 3,274 shares of the entertainment giant's stock valued at $323,000 after buying an additional 729 shares in the last quarter. Palogic Value Management L.P. grew its holdings in Walt Disney by 12.8% in the 1st quarter. Palogic Value Management L.P. now owns 9,649 shares of the entertainment giant's stock valued at $952,000 after buying an additional 1,092 shares in the last quarter. Vident Advisory LLC lifted its stake in shares of Walt Disney by 106.3% in the 1st quarter. Vident Advisory LLC now owns 19,111 shares of the entertainment giant's stock valued at $1,886,000 after purchasing an additional 9,848 shares during the last quarter. Finally, The Manufacturers Life Insurance Company lifted its stake in shares of Walt Disney by 29.0% in the 1st quarter. The Manufacturers Life Insurance Company now owns 4,695,528 shares of the entertainment giant's stock valued at $463,449,000 after purchasing an additional 1,055,222 shares during the last quarter. 65.71% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on the company. Loop Capital upped their price target on Walt Disney from $125.00 to $130.00 and gave the company a "buy" rating in a research note on Tuesday, June 10th. Guggenheim upped their price target on Walt Disney from $120.00 to $140.00 and gave the company a "buy" rating in a research note on Friday, June 27th. Needham & Company LLC reissued a "buy" rating and set a $125.00 target price on shares of Walt Disney in a research note on Thursday, August 7th. Susquehanna reissued a "neutral" rating on shares of Walt Disney in a research note on Monday, August 11th. Finally, Evercore ISI increased their target price on Walt Disney from $134.00 to $140.00 and gave the stock an "outperform" rating in a research note on Monday, August 4th. One analyst has rated the stock with a Strong Buy rating, nineteen have assigned a Buy rating and eight have given a Hold rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $131.18.

Get Our Latest Stock Analysis on DIS

Walt Disney Stock Down 0.9%

Shares of DIS traded down $1.01 during mid-day trading on Wednesday, reaching $117.26. The company's stock had a trading volume of 6,188,274 shares, compared to its average volume of 9,530,331. The Walt Disney Company has a 12-month low of $80.10 and a 12-month high of $124.69. The stock has a market cap of $210.83 billion, a PE ratio of 18.38, a price-to-earnings-growth ratio of 1.71 and a beta of 1.55. The company has a debt-to-equity ratio of 0.32, a current ratio of 0.72 and a quick ratio of 0.66. The company's 50 day moving average is $119.20 and its 200 day moving average is $108.62.

Walt Disney (NYSE:DIS - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The entertainment giant reported $1.61 EPS for the quarter, beating analysts' consensus estimates of $1.45 by $0.16. The business had revenue of $23.65 billion for the quarter, compared to the consensus estimate of $23.69 billion. Walt Disney had a return on equity of 9.67% and a net margin of 12.22%.The business's revenue for the quarter was up 2.1% on a year-over-year basis. During the same quarter in the prior year, the business posted $1.39 EPS. Equities analysts anticipate that The Walt Disney Company will post 5.47 EPS for the current fiscal year.

Walt Disney Company Profile

(

Free Report)

The Walt Disney Company operates as an entertainment company worldwide. It operates through three segments: Entertainment, Sports, and Experiences. The company produces and distributes film and television video streaming content under the ABC Television Network, Disney, Freeform, FX, Fox, National Geographic, and Star brand television channels, as well as ABC television stations and A+E television networks; and produces original content under the ABC Signature, Disney Branded Television, FX Productions, Lucasfilm, Marvel, National Geographic Studios, Pixar, Searchlight Pictures, Twentieth Century Studios, 20th Television, and Walt Disney Pictures banners.

See Also

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.