Panagora Asset Management Inc. increased its position in shares of Netflix, Inc. (NASDAQ:NFLX - Free Report) by 1.8% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 89,786 shares of the Internet television network's stock after acquiring an additional 1,593 shares during the quarter. Panagora Asset Management Inc.'s holdings in Netflix were worth $83,728,000 as of its most recent filing with the Securities and Exchange Commission.

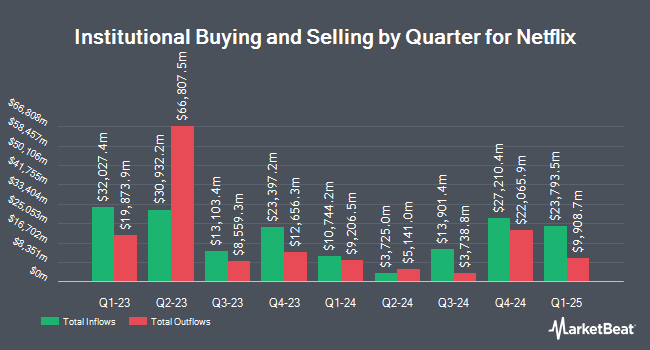

Several other institutional investors and hedge funds have also recently modified their holdings of the company. Activest Wealth Management boosted its position in shares of Netflix by 28.8% during the 1st quarter. Activest Wealth Management now owns 447 shares of the Internet television network's stock valued at $417,000 after acquiring an additional 100 shares during the last quarter. Aperture Investors LLC purchased a new stake in Netflix in the 1st quarter valued at about $1,975,000. Stony Point Capital LLC raised its holdings in Netflix by 79.9% in the 1st quarter. Stony Point Capital LLC now owns 13,058 shares of the Internet television network's stock valued at $12,177,000 after buying an additional 5,798 shares during the period. Kodai Capital Management LP purchased a new stake in Netflix in the 1st quarter valued at about $56,053,000. Finally, Evergreen Capital Management LLC raised its holdings in Netflix by 3.4% in the 1st quarter. Evergreen Capital Management LLC now owns 6,587 shares of the Internet television network's stock valued at $6,143,000 after buying an additional 218 shares during the period. Institutional investors and hedge funds own 80.93% of the company's stock.

Netflix Trading Down 1.9%

NASDAQ:NFLX traded down $23.20 on Friday, reaching $1,208.25. 3,206,585 shares of the company's stock were exchanged, compared to its average volume of 2,696,834. The company has a quick ratio of 1.34, a current ratio of 1.34 and a debt-to-equity ratio of 0.58. The firm has a market capitalization of $513.42 billion, a price-to-earnings ratio of 51.48, a price-to-earnings-growth ratio of 2.03 and a beta of 1.60. The business has a fifty day moving average of $1,231.11 and a 200-day moving average of $1,118.55. Netflix, Inc. has a 52-week low of $660.80 and a 52-week high of $1,341.15.

Netflix (NASDAQ:NFLX - Get Free Report) last issued its quarterly earnings results on Thursday, July 17th. The Internet television network reported $7.19 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $7.07 by $0.12. The company had revenue of $11.08 billion for the quarter, compared to analyst estimates of $11.04 billion. Netflix had a net margin of 24.58% and a return on equity of 42.50%. The business's revenue for the quarter was up 15.9% compared to the same quarter last year. During the same period in the prior year, the firm earned $4.88 earnings per share. Netflix has set its FY 2025 guidance at EPS. Q3 2025 guidance at 6.870-6.870 EPS. As a group, analysts expect that Netflix, Inc. will post 24.58 earnings per share for the current year.

Wall Street Analyst Weigh In

Several analysts recently issued reports on the stock. BMO Capital Markets restated an "outperform" rating and issued a $1,425.00 price objective (up from $1,200.00) on shares of Netflix in a report on Tuesday, July 15th. Wells Fargo & Company boosted their price objective on shares of Netflix from $1,500.00 to $1,560.00 and gave the company an "overweight" rating in a report on Friday, July 18th. Loop Capital restated a "hold" rating on shares of Netflix in a report on Tuesday, July 15th. Wedbush restated an "outperform" rating and issued a $1,500.00 price objective (up from $1,400.00) on shares of Netflix in a report on Monday, July 14th. Finally, Wolfe Research set a $1,340.00 price objective on shares of Netflix and gave the company an "outperform" rating in a report on Friday, May 16th. One research analyst has rated the stock with a Strong Buy rating, twenty-two have given a Buy rating, ten have issued a Hold rating and three have given a Sell rating to the company's stock. According to MarketBeat, Netflix has an average rating of "Moderate Buy" and an average price target of $1,297.66.

Read Our Latest Report on Netflix

Insider Buying and Selling at Netflix

In other news, Director Jay C. Hoag sold 31,750 shares of the business's stock in a transaction dated Thursday, June 5th. The stock was sold at an average price of $1,252.35, for a total transaction of $39,762,112.50. Following the completion of the transaction, the director directly owned 63,040 shares of the company's stock, valued at approximately $78,948,144. The trade was a 33.50% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, CEO Theodore A. Sarandos sold 2,026 shares of the business's stock in a transaction dated Tuesday, August 5th. The stock was sold at an average price of $1,160.62, for a total value of $2,351,416.12. Following the transaction, the chief executive officer directly owned 15,168 shares of the company's stock, valued at approximately $17,604,284.16. This represents a 11.78% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 123,163 shares of company stock valued at $151,917,174. 1.37% of the stock is currently owned by company insiders.

Netflix Profile

(

Free Report)

Netflix, Inc provides entertainment services. It offers TV series, documentaries, feature films, and games across various genres and languages. The company also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

Featured Articles

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report