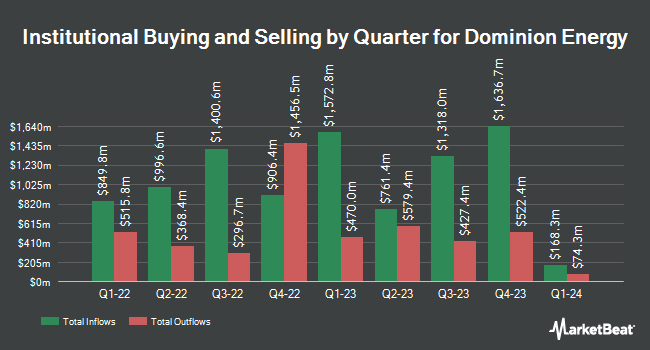

Panagora Asset Management Inc. trimmed its holdings in shares of Dominion Energy Inc. (NYSE:D - Free Report) by 59.5% in the first quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 50,216 shares of the utilities provider's stock after selling 73,865 shares during the quarter. Panagora Asset Management Inc.'s holdings in Dominion Energy were worth $2,816,000 as of its most recent filing with the SEC.

A number of other large investors have also recently added to or reduced their stakes in the company. Vident Advisory LLC raised its position in Dominion Energy by 49.5% in the 1st quarter. Vident Advisory LLC now owns 24,493 shares of the utilities provider's stock valued at $1,373,000 after buying an additional 8,113 shares during the last quarter. Evergreen Capital Management LLC lifted its position in shares of Dominion Energy by 18.1% in the first quarter. Evergreen Capital Management LLC now owns 5,737 shares of the utilities provider's stock valued at $322,000 after buying an additional 880 shares during the last quarter. Magnetar Financial LLC bought a new position in shares of Dominion Energy in the first quarter valued at about $328,000. Truvestments Capital LLC lifted its position in Dominion Energy by 1,770.7% during the first quarter. Truvestments Capital LLC now owns 61,190 shares of the utilities provider's stock worth $3,431,000 after acquiring an additional 57,919 shares during the last quarter. Finally, Guggenheim Capital LLC increased its position in Dominion Energy by 1.2% during the 1st quarter. Guggenheim Capital LLC now owns 175,356 shares of the utilities provider's stock worth $9,832,000 after buying an additional 2,131 shares during the period. Institutional investors own 73.04% of the company's stock.

Insider Activity

In other news, CEO Robert M. Blue purchased 4,152 shares of the company's stock in a transaction that occurred on Wednesday, August 27th. The shares were bought at an average cost of $60.35 per share, with a total value of $250,573.20. Following the completion of the transaction, the chief executive officer directly owned 161,237 shares of the company's stock, valued at approximately $9,730,652.95. This trade represents a 2.64% increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which can be accessed through this link. 0.11% of the stock is currently owned by insiders.

Dominion Energy Stock Down 1.1%

Shares of D traded down $0.62 during trading hours on Friday, reaching $58.17. The stock had a trading volume of 4,895,356 shares, compared to its average volume of 4,161,962. The company has a market capitalization of $49.65 billion, a price-to-earnings ratio of 20.06, a P/E/G ratio of 1.28 and a beta of 0.60. The firm has a 50-day simple moving average of $59.19 and a 200 day simple moving average of $56.33. The company has a current ratio of 0.67, a quick ratio of 0.49 and a debt-to-equity ratio of 1.35. Dominion Energy Inc. has a 12 month low of $48.07 and a 12 month high of $62.46.

Dominion Energy (NYSE:D - Get Free Report) last released its quarterly earnings data on Friday, August 1st. The utilities provider reported $0.75 earnings per share for the quarter, missing analysts' consensus estimates of $0.77 by ($0.02). The business had revenue of $3.81 billion during the quarter, compared to the consensus estimate of $3.73 billion. Dominion Energy had a net margin of 16.45% and a return on equity of 9.68%. The firm's quarterly revenue was up 9.3% on a year-over-year basis. During the same period last year, the business posted $0.65 earnings per share. Dominion Energy has set its FY 2025 guidance at 3.280-3.520 EPS. Equities research analysts predict that Dominion Energy Inc. will post 3.39 earnings per share for the current fiscal year.

Dominion Energy Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Saturday, September 20th. Investors of record on Friday, September 5th will be given a $0.6675 dividend. This represents a $2.67 dividend on an annualized basis and a yield of 4.6%. The ex-dividend date of this dividend is Friday, September 5th. Dominion Energy's dividend payout ratio is presently 92.07%.

Wall Street Analyst Weigh In

A number of equities research analysts have issued reports on D shares. Morgan Stanley reduced their price objective on shares of Dominion Energy from $62.00 to $60.00 and set an "equal weight" rating on the stock in a research note on Wednesday, June 18th. JPMorgan Chase & Co. increased their price objective on Dominion Energy from $56.00 to $59.00 and gave the company an "underweight" rating in a report on Thursday, August 21st. One equities research analyst has rated the stock with a Buy rating, six have assigned a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $59.57.

Check Out Our Latest Analysis on D

About Dominion Energy

(

Free Report)

Dominion Energy, Inc produces and distributes energy in the United States. It operates through three operating segments: Dominion Energy Virginia, Dominion Energy South Carolina, and Contracted Energy. The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to approximately 2.8 million residential, commercial, industrial, and governmental customers in Virginia and North Carolina.

See Also

Before you consider Dominion Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dominion Energy wasn't on the list.

While Dominion Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.