Patton Fund Management Inc. bought a new position in The Mosaic Company (NYSE:MOS - Free Report) in the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm bought 7,562 shares of the basic materials company's stock, valued at approximately $276,000.

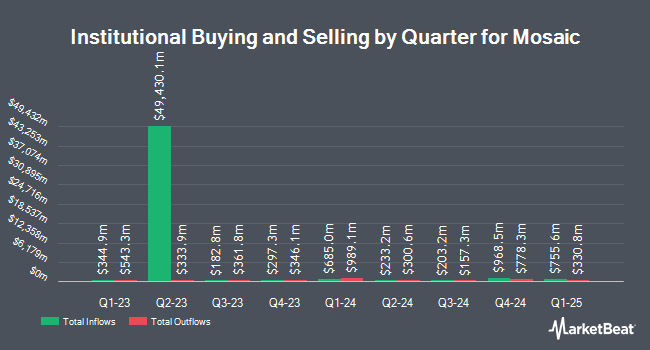

Several other hedge funds and other institutional investors have also recently made changes to their positions in the stock. Sylvest Advisors LLC lifted its stake in shares of Mosaic by 19.8% in the second quarter. Sylvest Advisors LLC now owns 20,992 shares of the basic materials company's stock valued at $766,000 after purchasing an additional 3,470 shares during the period. Public Employees Retirement System of Ohio lifted its stake in shares of Mosaic by 0.6% in the second quarter. Public Employees Retirement System of Ohio now owns 105,299 shares of the basic materials company's stock valued at $3,841,000 after purchasing an additional 585 shares during the period. Ballentine Partners LLC lifted its stake in shares of Mosaic by 34.8% in the second quarter. Ballentine Partners LLC now owns 15,317 shares of the basic materials company's stock valued at $559,000 after purchasing an additional 3,954 shares during the period. Fifth Third Bancorp lifted its stake in shares of Mosaic by 13.3% in the second quarter. Fifth Third Bancorp now owns 23,799 shares of the basic materials company's stock valued at $868,000 after purchasing an additional 2,802 shares during the period. Finally, GAMMA Investing LLC lifted its stake in shares of Mosaic by 18.3% in the second quarter. GAMMA Investing LLC now owns 19,746 shares of the basic materials company's stock valued at $720,000 after purchasing an additional 3,061 shares during the period. Institutional investors and hedge funds own 77.54% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on MOS. Scotiabank reduced their price objective on shares of Mosaic from $42.00 to $39.00 and set a "sector outperform" rating for the company in a research note on Monday, August 11th. Wall Street Zen cut shares of Mosaic from a "buy" rating to a "hold" rating in a research note on Saturday, September 13th. Zacks Research upgraded shares of Mosaic from a "hold" rating to a "strong-buy" rating in a research report on Thursday, August 14th. Oppenheimer restated an "outperform" rating and set a $43.00 target price (up previously from $39.00) on shares of Mosaic in a research report on Tuesday, July 15th. Finally, Wells Fargo & Company cut their target price on shares of Mosaic from $38.00 to $34.00 and set an "equal weight" rating for the company in a research report on Thursday, August 7th. Two investment analysts have rated the stock with a Strong Buy rating, seven have assigned a Buy rating and five have issued a Hold rating to the company's stock. According to MarketBeat, Mosaic currently has an average rating of "Moderate Buy" and a consensus target price of $36.42.

Check Out Our Latest Research Report on Mosaic

Mosaic Stock Performance

Shares of MOS opened at $35.30 on Friday. The stock has a market cap of $11.20 billion, a P/E ratio of 11.97, a PEG ratio of 1.62 and a beta of 0.99. The Mosaic Company has a 12-month low of $22.36 and a 12-month high of $38.23. The company has a current ratio of 1.14, a quick ratio of 0.44 and a debt-to-equity ratio of 0.26. The company has a 50-day moving average of $33.86 and a two-hundred day moving average of $32.52.

Mosaic (NYSE:MOS - Get Free Report) last issued its quarterly earnings results on Tuesday, August 5th. The basic materials company reported $0.51 EPS for the quarter, missing analysts' consensus estimates of $0.71 by ($0.20). The firm had revenue of $3.01 billion for the quarter, compared to analysts' expectations of $3.11 billion. Mosaic had a return on equity of 4.74% and a net margin of 8.35%.The business's quarterly revenue was up 6.7% compared to the same quarter last year. During the same quarter last year, the firm earned $0.54 earnings per share. As a group, research analysts predict that The Mosaic Company will post 2.04 EPS for the current fiscal year.

Mosaic Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, September 18th. Stockholders of record on Monday, September 8th were issued a dividend of $0.22 per share. The ex-dividend date was Monday, September 8th. This represents a $0.88 dividend on an annualized basis and a dividend yield of 2.5%. Mosaic's payout ratio is 29.83%.

Mosaic Profile

(

Free Report)

The Mosaic Company, through its subsidiaries, produces and markets concentrated phosphate and potash crop nutrients in North America and internationally. The company operates through three segments: Phosphates, Potash, and Mosaic Fertilizantes. It owns and operates mines, which produce concentrated phosphate crop nutrients, such as diammonium phosphate, monoammonium phosphate, and ammoniated phosphate products; and phosphate-based animal feed ingredients primarily under the Biofos and Nexfos brand names, as well as produces a double sulfate of potash magnesia product under K-Mag brand name.

Further Reading

Want to see what other hedge funds are holding MOS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The Mosaic Company (NYSE:MOS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Mosaic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mosaic wasn't on the list.

While Mosaic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.