PDT Partners LLC grew its holdings in On Holding AG (NYSE:ONON - Free Report) by 95.6% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 154,492 shares of the company's stock after purchasing an additional 75,499 shares during the quarter. ON comprises about 0.5% of PDT Partners LLC's portfolio, making the stock its 24th biggest position. PDT Partners LLC's holdings in ON were worth $6,785,000 at the end of the most recent quarter.

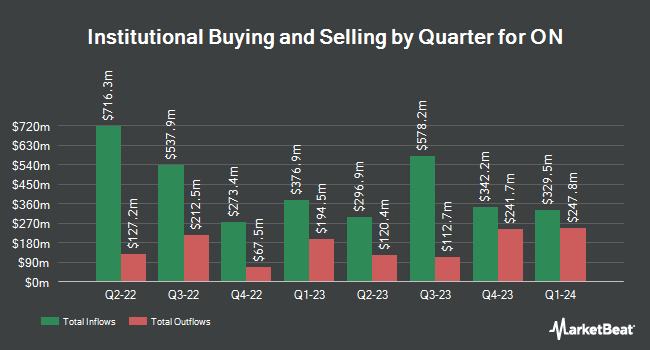

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. Maverick Capital Ltd. acquired a new position in shares of ON in the 1st quarter valued at about $2,535,000. Quarry LP acquired a new position in shares of ON in the 1st quarter valued at about $60,000. Nomura Holdings Inc. lifted its stake in shares of ON by 72.0% in the 1st quarter. Nomura Holdings Inc. now owns 8,791 shares of the company's stock valued at $386,000 after purchasing an additional 3,680 shares during the period. Titleist Asset Management LLC lifted its stake in shares of ON by 10.6% in the 1st quarter. Titleist Asset Management LLC now owns 19,550 shares of the company's stock valued at $859,000 after purchasing an additional 1,875 shares during the period. Finally, Aragon Global Management LP lifted its stake in shares of ON by 4.9% in the 1st quarter. Aragon Global Management LP now owns 306,121 shares of the company's stock valued at $13,445,000 after purchasing an additional 14,200 shares during the period. 36.39% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

ONON has been the topic of a number of recent analyst reports. Cowen reissued a "buy" rating on shares of ON in a research note on Wednesday, May 14th. Jefferies Financial Group set a $40.00 price target on ON and gave the stock an "underperform" rating in a research note on Wednesday, August 13th. Telsey Advisory Group reaffirmed an "outperform" rating and set a $65.00 price target on shares of ON in a research note on Thursday, August 7th. Raymond James Financial downgraded ON from a "strong-buy" rating to an "outperform" rating and set a $66.00 price target on the stock. in a research note on Tuesday, July 22nd. Finally, Stifel Nicolaus upped their price target on ON from $57.00 to $66.00 and gave the stock a "buy" rating in a research note on Wednesday, May 14th. One equities research analyst has rated the stock with a Strong Buy rating, nineteen have assigned a Buy rating, one has assigned a Hold rating and one has issued a Sell rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $64.20.

Check Out Our Latest Stock Report on ONON

ON Stock Performance

Shares of ONON stock traded up $0.03 during trading on Wednesday, hitting $44.82. The company's stock had a trading volume of 4,415,669 shares, compared to its average volume of 7,399,361. The company has a market cap of $28.22 billion, a PE ratio of 99.60, a P/E/G ratio of 4.97 and a beta of 2.23. The company has a current ratio of 2.53, a quick ratio of 2.00 and a debt-to-equity ratio of 0.31. The business has a fifty day moving average of $49.24 and a 200-day moving average of $49.55. On Holding AG has a 52 week low of $34.59 and a 52 week high of $64.05.

ON Company Profile

(

Free Report)

On Holding AG engages in the development and distribution of sports products such as footwear, apparel, and accessories for high-performance running, outdoor, all-day activities, and tennis. It sells its products worldwide through independent retailers and global distributors, its own online presence, and its own stores.

Recommended Stories

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.