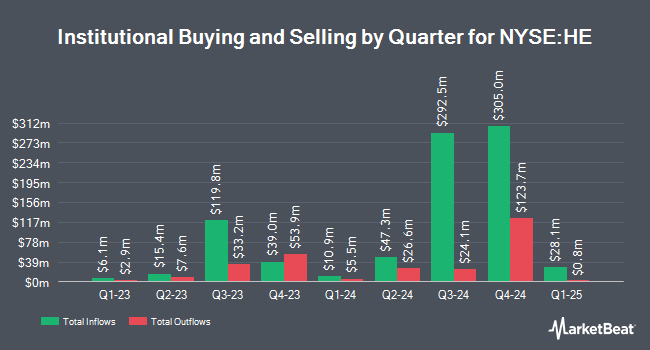

PDT Partners LLC bought a new stake in Hawaiian Electric Industries, Inc. (NYSE:HE - Free Report) during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 179,513 shares of the utilities provider's stock, valued at approximately $1,966,000. PDT Partners LLC owned approximately 0.10% of Hawaiian Electric Industries at the end of the most recent reporting period.

Other institutional investors and hedge funds have also bought and sold shares of the company. Raymond James Financial Inc. purchased a new position in shares of Hawaiian Electric Industries during the fourth quarter worth approximately $342,000. Dimensional Fund Advisors LP grew its holdings in shares of Hawaiian Electric Industries by 13.7% in the fourth quarter. Dimensional Fund Advisors LP now owns 1,052,117 shares of the utilities provider's stock worth $10,237,000 after purchasing an additional 126,614 shares during the last quarter. Hsbc Holdings PLC grew its holdings in shares of Hawaiian Electric Industries by 88.4% in the fourth quarter. Hsbc Holdings PLC now owns 64,476 shares of the utilities provider's stock worth $633,000 after purchasing an additional 30,244 shares during the last quarter. Price T Rowe Associates Inc. MD grew its holdings in shares of Hawaiian Electric Industries by 18.5% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 139,848 shares of the utilities provider's stock worth $1,361,000 after purchasing an additional 21,873 shares during the last quarter. Finally, The Manufacturers Life Insurance Company grew its holdings in shares of Hawaiian Electric Industries by 41.9% in the fourth quarter. The Manufacturers Life Insurance Company now owns 82,070 shares of the utilities provider's stock worth $799,000 after purchasing an additional 24,247 shares during the last quarter. 59.91% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several research analysts have recently issued reports on HE shares. Wall Street Zen upgraded shares of Hawaiian Electric Industries from a "sell" rating to a "hold" rating in a report on Monday, May 12th. Barclays cut their price target on shares of Hawaiian Electric Industries from $11.00 to $10.00 and set an "equal weight" rating on the stock in a report on Thursday, July 10th. Finally, Jefferies Financial Group lifted their price target on shares of Hawaiian Electric Industries from $11.00 to $11.25 and gave the company a "hold" rating in a report on Wednesday, May 28th. One research analyst has rated the stock with a Buy rating and three have given a Hold rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus price target of $11.94.

View Our Latest Stock Report on Hawaiian Electric Industries

Hawaiian Electric Industries Trading Down 0.9%

HE stock traded down $0.12 during trading on Monday, reaching $12.20. 531,750 shares of the stock traded hands, compared to its average volume of 2,292,649. The business's 50 day moving average price is $11.29 and its 200-day moving average price is $10.82. The firm has a market capitalization of $2.10 billion, a PE ratio of -12.07 and a beta of 0.69. Hawaiian Electric Industries, Inc. has a 52-week low of $8.14 and a 52-week high of $13.41. The company has a debt-to-equity ratio of 1.52, a current ratio of 1.07 and a quick ratio of 1.07.

Hawaiian Electric Industries (NYSE:HE - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The utilities provider reported $0.20 EPS for the quarter, missing the consensus estimate of $0.24 by ($0.04). Hawaiian Electric Industries had a positive return on equity of 10.76% and a negative net margin of 3.66%.The business had revenue of $746.39 million during the quarter. As a group, sell-side analysts forecast that Hawaiian Electric Industries, Inc. will post 1.71 earnings per share for the current year.

About Hawaiian Electric Industries

(

Free Report)

Hawaiian Electric Industries, Inc, together with its subsidiaries, engages in the electric utility businesses in the United States. It operates in three segments: Electric Utility, Bank, and Other. The Electric Utility segment engages in the production, purchase, transmission, distribution, and sale of electricity in the islands of Oahu, Hawaii, Maui, Lanai, and Molokai.

Read More

Before you consider Hawaiian Electric Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hawaiian Electric Industries wasn't on the list.

While Hawaiian Electric Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.