Penn Mutual Asset Management acquired a new position in shares of Molson Coors Beverage Company (NYSE:TAP - Free Report) in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm acquired 6,700 shares of the company's stock, valued at approximately $408,000.

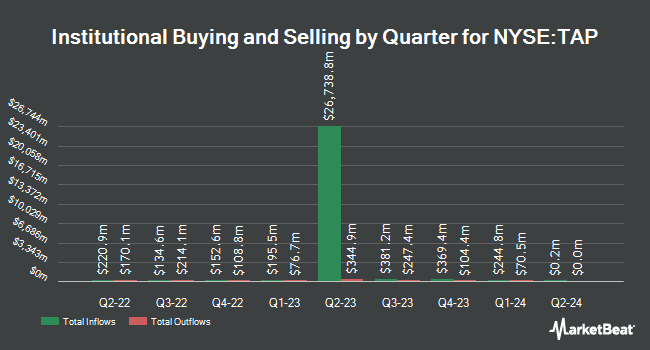

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Randolph Co Inc lifted its holdings in shares of Molson Coors Beverage by 26.2% during the 4th quarter. Randolph Co Inc now owns 477,187 shares of the company's stock worth $27,352,000 after acquiring an additional 98,984 shares during the period. Principal Financial Group Inc. lifted its holdings in Molson Coors Beverage by 14.7% during the 1st quarter. Principal Financial Group Inc. now owns 238,178 shares of the company's stock valued at $14,498,000 after purchasing an additional 30,463 shares during the last quarter. Kendall Capital Management lifted its holdings in Molson Coors Beverage by 42.7% during the 1st quarter. Kendall Capital Management now owns 19,995 shares of the company's stock valued at $1,217,000 after purchasing an additional 5,985 shares during the last quarter. Estuary Capital Management LP bought a new position in Molson Coors Beverage during the 4th quarter valued at about $39,052,000. Finally, Mirae Asset Global Investments Co. Ltd. lifted its holdings in Molson Coors Beverage by 7.7% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 22,330 shares of the company's stock valued at $1,352,000 after purchasing an additional 1,606 shares during the last quarter. 78.46% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several equities analysts recently issued reports on TAP shares. Morgan Stanley cut their price target on shares of Molson Coors Beverage from $58.00 to $53.00 and set an "equal weight" rating for the company in a report on Wednesday, August 6th. Barclays cut their price target on shares of Molson Coors Beverage from $53.00 to $49.00 and set an "equal weight" rating for the company in a report on Thursday, August 7th. Wall Street Zen downgraded shares of Molson Coors Beverage from a "buy" rating to a "hold" rating in a report on Saturday, May 17th. Roth Capital set a $71.00 price target on shares of Molson Coors Beverage and gave the company a "buy" rating in a report on Tuesday, May 20th. Finally, Evercore ISI cut their price target on shares of Molson Coors Beverage from $58.00 to $53.00 and set an "outperform" rating for the company in a report on Wednesday, August 6th. Six equities research analysts have rated the stock with a Buy rating and ten have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $58.12.

View Our Latest Stock Report on TAP

Molson Coors Beverage Trading Up 0.7%

Shares of NYSE:TAP traded up $0.3750 during trading on Tuesday, hitting $51.4950. 1,942,624 shares of the company's stock were exchanged, compared to its average volume of 2,839,222. Molson Coors Beverage Company has a 1-year low of $46.94 and a 1-year high of $64.66. The firm has a 50-day moving average price of $49.75 and a two-hundred day moving average price of $54.94. The company has a current ratio of 0.95, a quick ratio of 0.67 and a debt-to-equity ratio of 0.46. The firm has a market cap of $10.41 billion, a P/E ratio of 10.16, a PEG ratio of 1.86 and a beta of 0.67.

Molson Coors Beverage (NYSE:TAP - Get Free Report) last issued its quarterly earnings results on Tuesday, August 5th. The company reported $2.05 EPS for the quarter, topping the consensus estimate of $1.83 by $0.22. Molson Coors Beverage had a net margin of 7.81% and a return on equity of 8.61%. The company had revenue of $3.20 billion during the quarter, compared to analysts' expectations of $3.12 billion. During the same quarter in the previous year, the company earned $1.92 EPS. Molson Coors Beverage's revenue was down 1.6% on a year-over-year basis. Molson Coors Beverage has set its FY 2025 guidance at 5.360-5.540 EPS. Equities analysts predict that Molson Coors Beverage Company will post 6.35 earnings per share for the current year.

Molson Coors Beverage Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, September 19th. Stockholders of record on Friday, September 5th will be given a dividend of $0.47 per share. The ex-dividend date is Friday, September 5th. This represents a $1.88 annualized dividend and a dividend yield of 3.7%. Molson Coors Beverage's payout ratio is currently 37.08%.

Insider Activity at Molson Coors Beverage

In other news, Director Geoffrey E. Molson sold 1,333 shares of Molson Coors Beverage stock in a transaction that occurred on Wednesday, May 21st. The shares were sold at an average price of $56.29, for a total transaction of $75,034.57. Following the completion of the sale, the director owned 27,595 shares in the company, valued at $1,553,322.55. The trade was a 4.61% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 2.71% of the stock is currently owned by corporate insiders.

Molson Coors Beverage Profile

(

Free Report)

Molson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers flavored malt beverages including hard seltzers, craft, spirits and energy, and ready to drink beverages.

See Also

Before you consider Molson Coors Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molson Coors Beverage wasn't on the list.

While Molson Coors Beverage currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.