Cetera Investment Advisers trimmed its stake in Performance Food Group Company (NYSE:PFGC - Free Report) by 78.2% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 7,063 shares of the food distribution company's stock after selling 25,398 shares during the period. Cetera Investment Advisers' holdings in Performance Food Group were worth $555,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

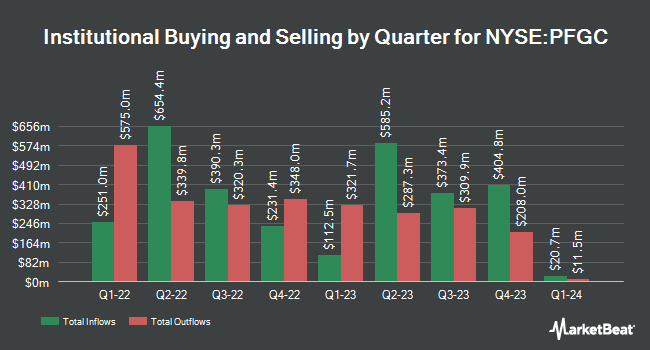

Other large investors also recently added to or reduced their stakes in the company. CENTRAL TRUST Co raised its holdings in shares of Performance Food Group by 476.5% in the 1st quarter. CENTRAL TRUST Co now owns 490 shares of the food distribution company's stock valued at $39,000 after purchasing an additional 405 shares in the last quarter. Farther Finance Advisors LLC raised its holdings in shares of Performance Food Group by 203.7% in the 1st quarter. Farther Finance Advisors LLC now owns 498 shares of the food distribution company's stock valued at $40,000 after purchasing an additional 334 shares in the last quarter. Signaturefd LLC raised its holdings in shares of Performance Food Group by 60.9% in the 1st quarter. Signaturefd LLC now owns 830 shares of the food distribution company's stock valued at $65,000 after purchasing an additional 314 shares in the last quarter. Golden State Wealth Management LLC raised its holdings in shares of Performance Food Group by 353.5% in the 1st quarter. Golden State Wealth Management LLC now owns 907 shares of the food distribution company's stock valued at $71,000 after purchasing an additional 707 shares in the last quarter. Finally, Versant Capital Management Inc raised its holdings in shares of Performance Food Group by 34,133.3% in the 1st quarter. Versant Capital Management Inc now owns 1,027 shares of the food distribution company's stock valued at $81,000 after purchasing an additional 1,024 shares in the last quarter. 96.87% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities research analysts have recently commented on PFGC shares. Wells Fargo & Company boosted their price target on shares of Performance Food Group from $100.00 to $115.00 and gave the company an "overweight" rating in a report on Wednesday, August 13th. Sanford C. Bernstein set a $112.00 price target on shares of Performance Food Group and gave the company an "overweight" rating in a report on Thursday, May 29th. Truist Financial boosted their price target on shares of Performance Food Group from $101.00 to $118.00 and gave the company a "buy" rating in a report on Thursday, August 14th. Morgan Stanley boosted their price target on shares of Performance Food Group from $93.00 to $96.00 and gave the company an "equal weight" rating in a report on Monday, July 14th. Finally, UBS Group boosted their price target on shares of Performance Food Group from $110.00 to $120.00 and gave the company a "buy" rating in a report on Thursday, August 14th. One equities research analyst has rated the stock with a Strong Buy rating, eight have issued a Buy rating and four have given a Hold rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $106.00.

Get Our Latest Analysis on PFGC

Performance Food Group Stock Down 1.5%

Shares of NYSE PFGC traded down $1.5470 during trading hours on Thursday, hitting $99.5430. 1,105,594 shares of the stock were exchanged, compared to its average volume of 1,921,386. The company has a quick ratio of 0.72, a current ratio of 1.58 and a debt-to-equity ratio of 1.51. The company has a market cap of $15.58 billion, a PE ratio of 45.87, a PEG ratio of 1.14 and a beta of 1.20. The firm has a fifty day moving average price of $94.35 and a 200-day moving average price of $86.19. Performance Food Group Company has a 12 month low of $68.39 and a 12 month high of $103.50.

Performance Food Group (NYSE:PFGC - Get Free Report) last posted its quarterly earnings data on Wednesday, August 13th. The food distribution company reported $1.55 EPS for the quarter, topping the consensus estimate of $1.45 by $0.10. The firm had revenue of $16.94 billion during the quarter, compared to analyst estimates of $16.85 billion. Performance Food Group had a net margin of 0.54% and a return on equity of 16.23%. Performance Food Group's revenue was up 11.2% on a year-over-year basis. During the same quarter in the previous year, the business posted $1.45 EPS. Performance Food Group has set its FY 2026 guidance at EPS. Q1 2026 guidance at EPS. On average, sell-side analysts expect that Performance Food Group Company will post 4.58 EPS for the current year.

Insider Activity at Performance Food Group

In other news, insider Erika T. Davis sold 4,316 shares of Performance Food Group stock in a transaction on Wednesday, August 20th. The shares were sold at an average price of $100.52, for a total transaction of $433,844.32. Following the completion of the sale, the insider directly owned 55,373 shares in the company, valued at approximately $5,566,093.96. The trade was a 7.23% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, insider A Brent King sold 9,136 shares of Performance Food Group stock in a transaction on Wednesday, August 20th. The stock was sold at an average price of $100.51, for a total transaction of $918,259.36. Following the sale, the insider owned 66,540 shares of the company's stock, valued at $6,687,935.40. The trade was a 12.07% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 71,531 shares of company stock valued at $6,749,551. 2.80% of the stock is currently owned by corporate insiders.

About Performance Food Group

(

Free Report)

Performance Food Group Company, through its subsidiaries, markets and distributes food and food-related products in the United States. It operates through three segments: Foodservice, Vistar, and Convenience. The company offers a range of frozen foods, groceries, candy, snacks, beverages, cigarettes, and other tobacco products; beef, pork, poultry, and seafood; and health and beauty care products.

Featured Stories

Before you consider Performance Food Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Performance Food Group wasn't on the list.

While Performance Food Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.