Petrus Trust Company LTA acquired a new position in shares of Royalty Pharma PLC (NASDAQ:RPRX - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm acquired 7,287 shares of the biopharmaceutical company's stock, valued at approximately $227,000.

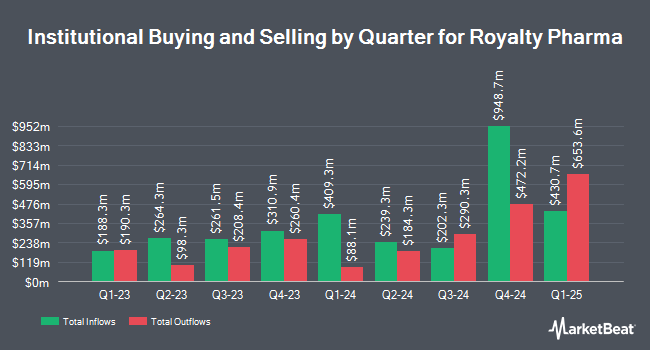

Several other hedge funds have also made changes to their positions in RPRX. Applied Finance Capital Management LLC boosted its holdings in Royalty Pharma by 3.0% in the first quarter. Applied Finance Capital Management LLC now owns 11,265 shares of the biopharmaceutical company's stock valued at $351,000 after acquiring an additional 329 shares during the last quarter. Nissay Asset Management Corp Japan ADV increased its position in shares of Royalty Pharma by 0.7% during the fourth quarter. Nissay Asset Management Corp Japan ADV now owns 48,481 shares of the biopharmaceutical company's stock worth $1,238,000 after acquiring an additional 349 shares during the last quarter. Sherbrooke Park Advisers LLC increased its position in shares of Royalty Pharma by 1.1% during the fourth quarter. Sherbrooke Park Advisers LLC now owns 34,891 shares of the biopharmaceutical company's stock worth $890,000 after acquiring an additional 380 shares during the last quarter. MassMutual Private Wealth & Trust FSB increased its position in shares of Royalty Pharma by 76.4% during the first quarter. MassMutual Private Wealth & Trust FSB now owns 956 shares of the biopharmaceutical company's stock worth $30,000 after acquiring an additional 414 shares during the last quarter. Finally, Allworth Financial LP increased its position in shares of Royalty Pharma by 41.6% during the first quarter. Allworth Financial LP now owns 1,539 shares of the biopharmaceutical company's stock worth $49,000 after acquiring an additional 452 shares during the last quarter. Institutional investors and hedge funds own 54.35% of the company's stock.

Royalty Pharma Price Performance

RPRX traded down $1.18 during trading on Monday, reaching $35.19. The stock had a trading volume of 1,057,262 shares, compared to its average volume of 4,318,149. The firm has a market capitalization of $20.52 billion, a price-to-earnings ratio of 20.35, a price-to-earnings-growth ratio of 2.27 and a beta of 0.58. The company has a quick ratio of 1.26, a current ratio of 1.26 and a debt-to-equity ratio of 0.74. Royalty Pharma PLC has a 1-year low of $24.05 and a 1-year high of $38.00. The stock has a 50 day moving average of $36.36 and a two-hundred day moving average of $34.30.

Royalty Pharma (NASDAQ:RPRX - Get Free Report) last released its earnings results on Wednesday, August 6th. The biopharmaceutical company reported $1.14 earnings per share for the quarter, topping analysts' consensus estimates of $1.10 by $0.04. The firm had revenue of $578.67 million during the quarter, compared to the consensus estimate of $750.06 million. Royalty Pharma had a return on equity of 25.54% and a net margin of 44.23%. As a group, equities analysts anticipate that Royalty Pharma PLC will post 4.49 EPS for the current fiscal year.

Royalty Pharma Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, September 10th. Shareholders of record on Friday, August 15th were paid a dividend of $0.22 per share. This represents a $0.88 annualized dividend and a yield of 2.5%. The ex-dividend date of this dividend was Friday, August 15th. Royalty Pharma's payout ratio is 50.87%.

Analysts Set New Price Targets

Several brokerages recently weighed in on RPRX. Morgan Stanley boosted their price objective on Royalty Pharma from $51.00 to $54.00 and gave the company an "overweight" rating in a report on Thursday, July 10th. Wall Street Zen lowered Royalty Pharma from a "buy" rating to a "hold" rating in a report on Saturday. Finally, Citigroup boosted their price objective on Royalty Pharma from $40.00 to $42.00 and gave the company a "buy" rating in a report on Tuesday, July 22nd. One investment analyst has rated the stock with a Strong Buy rating and two have given a Buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Buy" and a consensus target price of $48.00.

View Our Latest Stock Report on Royalty Pharma

Royalty Pharma Company Profile

(

Free Report)

Royalty Pharma plc operates as a buyer of biopharmaceutical royalties and a funder of innovations in the biopharmaceutical industry in the United States. It is also involved in the identification, evaluation, and acquisition of royalties on various biopharmaceutical therapies. In addition, the company collaborates with innovators from academic institutions, research hospitals and not-for-profits, small and mid-cap biotechnology companies, and pharmaceutical companies.

Read More

Before you consider Royalty Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royalty Pharma wasn't on the list.

While Royalty Pharma currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.