PFG Advisors increased its stake in BigBear.ai Holdings, Inc. (NYSE:BBAI - Free Report) by 97.3% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 78,445 shares of the company's stock after purchasing an additional 38,695 shares during the quarter. PFG Advisors' holdings in BigBear.ai were worth $224,000 at the end of the most recent quarter.

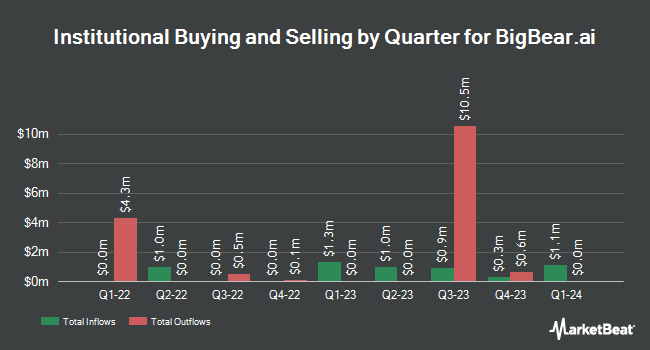

Other institutional investors have also bought and sold shares of the company. City State Bank acquired a new stake in BigBear.ai in the 1st quarter valued at about $29,000. Cornerstone Wealth Management LLC acquired a new stake in BigBear.ai in the 1st quarter valued at about $29,000. Blue Bell Private Wealth Management LLC lifted its holdings in BigBear.ai by 2,216.0% in the 1st quarter. Blue Bell Private Wealth Management LLC now owns 11,580 shares of the company's stock valued at $33,000 after acquiring an additional 11,080 shares during the last quarter. Opal Wealth Advisors LLC acquired a new stake in BigBear.ai in the 1st quarter valued at about $34,000. Finally, Fountainhead AM LLC acquired a new stake in BigBear.ai in the 1st quarter valued at about $40,000. Institutional investors and hedge funds own 7.55% of the company's stock.

Insider Activity

In related news, Director Dorothy D. Hayes sold 26,000 shares of the stock in a transaction that occurred on Thursday, May 15th. The stock was sold at an average price of $3.60, for a total value of $93,600.00. Following the transaction, the director owned 255,239 shares in the company, valued at approximately $918,860.40. This represents a 9.24% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, CFO Julie Peffer sold 50,000 shares of the stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $4.40, for a total value of $220,000.00. Following the completion of the transaction, the chief financial officer owned 634,153 shares in the company, valued at $2,790,273.20. This represents a 7.31% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 165,987 shares of company stock worth $614,608 in the last 90 days. Company insiders own 1.10% of the company's stock.

Wall Street Analyst Weigh In

Separately, HC Wainwright upped their price objective on shares of BigBear.ai from $6.00 to $9.00 and gave the company a "buy" rating in a research note on Tuesday, July 1st.

Read Our Latest Stock Analysis on BigBear.ai

BigBear.ai Trading Down 6.7%

BBAI stock traded down $0.48 during mid-day trading on Tuesday, reaching $6.67. 32,048,801 shares of the stock traded hands, compared to its average volume of 88,552,336. The company has a market cap of $1.94 billion, a P/E ratio of -8.56 and a beta of 3.46. BigBear.ai Holdings, Inc. has a 52-week low of $1.16 and a 52-week high of $10.36. The company has a current ratio of 1.66, a quick ratio of 1.66 and a debt-to-equity ratio of 0.55. The stock's fifty day moving average is $5.50 and its 200-day moving average is $4.64.

BigBear.ai (NYSE:BBAI - Get Free Report) last issued its earnings results on Thursday, May 1st. The company reported ($0.10) earnings per share for the quarter, missing analysts' consensus estimates of ($0.06) by ($0.04). The business had revenue of $34.76 million during the quarter, compared to analyst estimates of $36.26 million. BigBear.ai had a negative net margin of 121.31% and a negative return on equity of 57.83%. BigBear.ai's revenue for the quarter was up 4.9% on a year-over-year basis. During the same quarter in the prior year, the company earned ($0.67) EPS. As a group, sell-side analysts expect that BigBear.ai Holdings, Inc. will post -0.28 earnings per share for the current year.

About BigBear.ai

(

Free Report)

BigBear.ai Holdings, Inc provides artificial intelligence-powered decision intelligence solutions. It offers national security, supply chain management, and digital identity and biometrics solutions. The company also provides data ingestion, data enrichment, data processing, artificial intelligence, machine learning, predictive analytics, and predictive visualization solutions and services.

See Also

Before you consider BigBear.ai, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BigBear.ai wasn't on the list.

While BigBear.ai currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.