Phocas Financial Corp. grew its holdings in QuidelOrtho Corporation (NASDAQ:QDEL - Free Report) by 46.2% during the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 114,223 shares of the company's stock after acquiring an additional 36,091 shares during the period. Phocas Financial Corp. owned about 0.17% of QuidelOrtho worth $3,994,000 as of its most recent filing with the Securities & Exchange Commission.

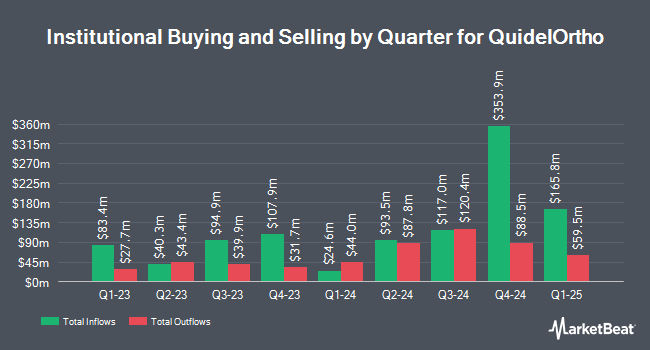

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Voya Investment Management LLC increased its position in QuidelOrtho by 7.7% during the 4th quarter. Voya Investment Management LLC now owns 7,551 shares of the company's stock valued at $336,000 after purchasing an additional 538 shares during the period. Yousif Capital Management LLC boosted its stake in shares of QuidelOrtho by 2.9% in the first quarter. Yousif Capital Management LLC now owns 25,950 shares of the company's stock worth $907,000 after acquiring an additional 734 shares during the last quarter. Rhumbline Advisers lifted its stake in shares of QuidelOrtho by 0.6% in the first quarter. Rhumbline Advisers now owns 129,025 shares of the company's stock worth $4,512,000 after buying an additional 770 shares in the last quarter. True Wealth Design LLC increased its holdings in shares of QuidelOrtho by 300.7% in the fourth quarter. True Wealth Design LLC now owns 1,074 shares of the company's stock valued at $48,000 after purchasing an additional 806 shares during the last quarter. Finally, New York State Teachers Retirement System lifted its stake in QuidelOrtho by 1.6% during the 1st quarter. New York State Teachers Retirement System now owns 56,900 shares of the company's stock worth $1,990,000 after acquiring an additional 900 shares in the last quarter. 99.00% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

QDEL has been the subject of a number of recent research reports. Citigroup decreased their price target on shares of QuidelOrtho from $50.00 to $40.00 and set a "buy" rating for the company in a research note on Wednesday. Jefferies Financial Group raised shares of QuidelOrtho from a "hold" rating to a "buy" rating and set a $44.00 price objective on the stock in a research note on Thursday, May 8th. UBS Group reduced their price objective on QuidelOrtho from $45.00 to $29.00 and set a "neutral" rating on the stock in a research report on Thursday, May 8th. JPMorgan Chase & Co. reduced their price target on QuidelOrtho from $38.00 to $25.00 and set an "underweight" rating on the stock in a research note on Monday, April 21st. Finally, Wall Street Zen downgraded QuidelOrtho from a "buy" rating to a "hold" rating in a research report on Saturday, July 26th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $42.67.

Read Our Latest Research Report on QuidelOrtho

QuidelOrtho Stock Up 2.5%

QuidelOrtho stock traded up $0.59 during midday trading on Thursday, hitting $24.03. The stock had a trading volume of 393,210 shares, compared to its average volume of 1,324,808. The business has a fifty day moving average price of $28.20 and a 200 day moving average price of $32.74. The company has a current ratio of 1.20, a quick ratio of 0.66 and a debt-to-equity ratio of 0.70. QuidelOrtho Corporation has a 12 month low of $22.05 and a 12 month high of $49.45. The stock has a market cap of $1.63 billion, a P/E ratio of -3.66 and a beta of -0.04.

QuidelOrtho (NASDAQ:QDEL - Get Free Report) last posted its quarterly earnings data on Tuesday, August 5th. The company reported $0.12 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.01 by $0.11. The business had revenue of $613.90 million during the quarter, compared to analysts' expectations of $612.36 million. QuidelOrtho had a negative net margin of 16.10% and a positive return on equity of 5.17%. The business's revenue was down 3.6% on a year-over-year basis. During the same period last year, the firm posted ($0.07) earnings per share. Research analysts predict that QuidelOrtho Corporation will post 2.3 EPS for the current year.

QuidelOrtho Profile

(

Free Report)

QuidelOrtho Corporation provides diagnostic testing solutions. The company operates through Labs, Transfusion Medicine, Point-of-Care, and Molecular Diagnostics business units. The Labs business unit provides clinical chemistry laboratory instruments and tests that measure target chemicals in bodily fluids for the evaluation of health and the clinical management of patients; immunoassay laboratory instruments and tests, which measure proteins as they act as antigens in the spread of disease, antibodies in the immune response spurred by disease, or markers of proper organ function and health; testing products to detect and monitor disease progression across a spectrum of therapeutic areas; and specialized diagnostic solutions.

Featured Stories

Before you consider QuidelOrtho, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QuidelOrtho wasn't on the list.

While QuidelOrtho currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.