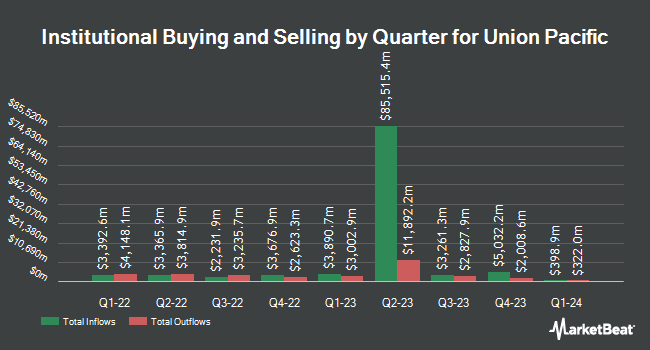

Phoenix Financial Ltd. boosted its position in Union Pacific Corporation (NYSE:UNP - Free Report) by 27.4% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 41,478 shares of the railroad operator's stock after acquiring an additional 8,925 shares during the quarter. Phoenix Financial Ltd.'s holdings in Union Pacific were worth $9,803,000 at the end of the most recent quarter.

Several other hedge funds have also recently added to or reduced their stakes in UNP. Virtu Financial LLC acquired a new stake in Union Pacific in the fourth quarter valued at approximately $350,000. Congress Wealth Management LLC DE raised its holdings in Union Pacific by 5.7% during the fourth quarter. Congress Wealth Management LLC DE now owns 7,471 shares of the railroad operator's stock worth $1,704,000 after purchasing an additional 403 shares in the last quarter. EntryPoint Capital LLC acquired a new stake in Union Pacific during the fourth quarter worth approximately $355,000. PKS Advisory Services LLC acquired a new stake in Union Pacific during the fourth quarter worth approximately $214,000. Finally, Financial Engines Advisors L.L.C. raised its holdings in Union Pacific by 319.2% during the fourth quarter. Financial Engines Advisors L.L.C. now owns 4,381 shares of the railroad operator's stock worth $999,000 after purchasing an additional 3,336 shares in the last quarter. Institutional investors and hedge funds own 80.38% of the company's stock.

Analysts Set New Price Targets

A number of analysts have weighed in on the stock. Redburn Atlantic raised shares of Union Pacific from a "neutral" rating to a "buy" rating and set a $259.00 price objective on the stock in a report on Wednesday, April 16th. Robert W. Baird assumed coverage on shares of Union Pacific in a report on Tuesday, July 1st. They set a "neutral" rating and a $231.00 price objective on the stock. Bank of America raised their price objective on shares of Union Pacific from $256.00 to $262.00 and gave the stock a "buy" rating in a report on Friday, May 16th. Raymond James Financial reissued a "strong-buy" rating on shares of Union Pacific in a report on Tuesday, July 15th. Finally, Wells Fargo & Company raised their price objective on shares of Union Pacific from $250.00 to $260.00 and gave the stock an "overweight" rating in a report on Friday. One research analyst has rated the stock with a sell rating, nine have given a hold rating, sixteen have issued a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $259.46.

Read Our Latest Stock Report on UNP

Union Pacific Trading Down 2.9%

Shares of NYSE:UNP traded down $6.74 during trading on Tuesday, reaching $222.50. 11,314,332 shares of the stock were exchanged, compared to its average volume of 3,215,531. The company has a debt-to-equity ratio of 1.86, a quick ratio of 0.53 and a current ratio of 0.65. Union Pacific Corporation has a 12-month low of $204.66 and a 12-month high of $258.07. The firm has a market cap of $132.94 billion, a price-to-earnings ratio of 19.33, a price-to-earnings-growth ratio of 2.24 and a beta of 1.05. The firm's 50-day moving average price is $227.17 and its 200 day moving average price is $231.05.

Union Pacific (NYSE:UNP - Get Free Report) last released its quarterly earnings results on Thursday, July 24th. The railroad operator reported $3.03 earnings per share for the quarter, topping analysts' consensus estimates of $2.84 by $0.19. The firm had revenue of $6.15 billion during the quarter, compared to analysts' expectations of $6.09 billion. Union Pacific had a return on equity of 41.73% and a net margin of 28.43%. Union Pacific's quarterly revenue was up 2.4% compared to the same quarter last year. During the same quarter in the prior year, the business earned $2.74 EPS. On average, sell-side analysts anticipate that Union Pacific Corporation will post 11.99 earnings per share for the current fiscal year.

Union Pacific Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Friday, August 29th will be issued a $1.38 dividend. This represents a $5.52 dividend on an annualized basis and a yield of 2.48%. The ex-dividend date of this dividend is Friday, August 29th. This is a boost from Union Pacific's previous quarterly dividend of $1.34. Union Pacific's dividend payout ratio is currently 46.57%.

Union Pacific Company Profile

(

Free Report)

Union Pacific Corporation, through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States. The company offers transportation services for grain and grain products, fertilizers, food and refrigerated products, and coal and renewables to grain processors, animal feeders, ethanol producers, renewable biofuel producers, and other agricultural users; and construction products, industrial chemicals, plastics, forest products, specialized products, metals and ores, petroleum, liquid petroleum gases, soda ash, and sand, as well as finished automobiles, automotive parts, and merchandise in intermodal containers.

Read More

Before you consider Union Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Union Pacific wasn't on the list.

While Union Pacific currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.