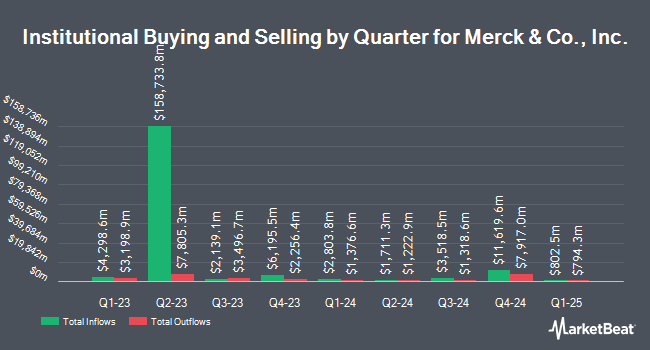

PKO Investment Management Joint Stock Co acquired a new stake in shares of Merck & Co., Inc. (NYSE:MRK - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund acquired 42,676 shares of the company's stock, valued at approximately $4,245,000.

Several other institutional investors and hedge funds have also bought and sold shares of the company. Midwest Capital Advisors LLC bought a new position in shares of Merck & Co., Inc. in the fourth quarter worth about $26,000. Financial Life Planners acquired a new stake in Merck & Co., Inc. during the 4th quarter valued at approximately $28,000. Noble Wealth Management PBC acquired a new position in shares of Merck & Co., Inc. in the 4th quarter valued at about $28,000. Halbert Hargrove Global Advisors LLC purchased a new position in Merck & Co., Inc. in the fourth quarter valued at $28,000. Finally, Promus Capital LLC purchased a new position in Merck & Co., Inc. during the fourth quarter worth approximately $30,000. 76.07% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

MRK has been the topic of several analyst reports. Citigroup reaffirmed a "neutral" rating and set a $84.00 price target (down previously from $115.00) on shares of Merck & Co., Inc. in a research report on Wednesday, May 14th. TD Securities downgraded Merck & Co., Inc. from a "buy" rating to a "hold" rating and dropped their price objective for the company from $121.00 to $100.00 in a report on Monday, February 10th. Deutsche Bank Aktiengesellschaft lowered Merck & Co., Inc. from a "buy" rating to a "hold" rating and dropped their price objective for the stock from $128.00 to $105.00 in a report on Tuesday, February 18th. Morgan Stanley reduced their price objective on Merck & Co., Inc. from $113.00 to $106.00 and set an "equal weight" rating for the company in a research note on Wednesday, February 5th. Finally, Wall Street Zen downgraded Merck & Co., Inc. from a "strong-buy" rating to a "buy" rating in a research note on Friday, April 25th. One equities research analyst has rated the stock with a sell rating, twelve have assigned a hold rating, seven have issued a buy rating and three have given a strong buy rating to the company's stock. According to MarketBeat, Merck & Co., Inc. has a consensus rating of "Moderate Buy" and a consensus price target of $109.19.

Read Our Latest Stock Analysis on Merck & Co., Inc.

Insiders Place Their Bets

In other Merck & Co., Inc. news, SVP Dalton E. Smart III sold 4,262 shares of the business's stock in a transaction dated Friday, April 25th. The stock was sold at an average price of $82.76, for a total transaction of $352,723.12. Following the transaction, the senior vice president now owns 7,778 shares in the company, valued at $643,707.28. The trade was a 35.40% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.09% of the stock is currently owned by insiders.

Merck & Co., Inc. Stock Up 0.2%

NYSE:MRK traded up $0.18 during mid-day trading on Thursday, reaching $76.35. The company's stock had a trading volume of 10,785,023 shares, compared to its average volume of 12,585,801. The firm has a market capitalization of $191.71 billion, a PE ratio of 11.34, a price-to-earnings-growth ratio of 0.77 and a beta of 0.43. Merck & Co., Inc. has a 1 year low of $73.31 and a 1 year high of $134.63. The company has a quick ratio of 1.15, a current ratio of 1.36 and a debt-to-equity ratio of 0.79. The stock has a fifty day moving average of $80.74 and a 200-day moving average of $90.95.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last released its quarterly earnings data on Thursday, April 24th. The company reported $2.22 earnings per share for the quarter, beating analysts' consensus estimates of $2.16 by $0.06. Merck & Co., Inc. had a net margin of 26.67% and a return on equity of 45.35%. The company had revenue of $15.53 billion during the quarter, compared to analysts' expectations of $15.59 billion. During the same quarter in the previous year, the company earned $2.07 earnings per share. The firm's revenue for the quarter was down 1.6% on a year-over-year basis. Equities research analysts forecast that Merck & Co., Inc. will post 9.01 earnings per share for the current year.

Merck & Co., Inc. Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, July 8th. Investors of record on Monday, June 16th will be paid a dividend of $0.81 per share. The ex-dividend date of this dividend is Monday, June 16th. This represents a $3.24 dividend on an annualized basis and a dividend yield of 4.24%. Merck & Co., Inc.'s payout ratio is currently 47.16%.

About Merck & Co., Inc.

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

Read More

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.