Premier Fund Managers Ltd cut its position in International Business Machines Corporation (NYSE:IBM - Free Report) by 21.9% in the first quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 36,760 shares of the technology company's stock after selling 10,320 shares during the quarter. Premier Fund Managers Ltd's holdings in International Business Machines were worth $8,965,000 at the end of the most recent reporting period.

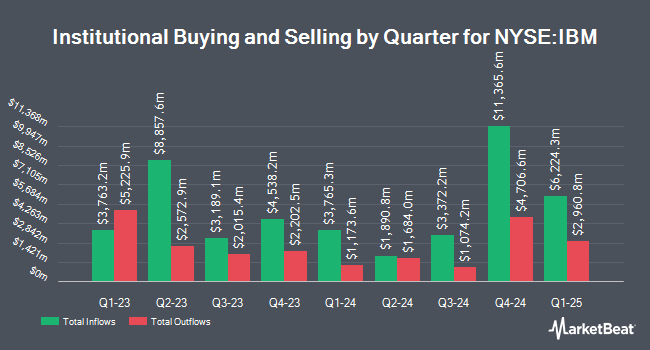

A number of other large investors have also added to or reduced their stakes in IBM. Brighton Jones LLC raised its holdings in International Business Machines by 12.4% in the fourth quarter. Brighton Jones LLC now owns 21,011 shares of the technology company's stock worth $4,619,000 after purchasing an additional 2,323 shares in the last quarter. Physician Wealth Advisors Inc. purchased a new stake in shares of International Business Machines during the fourth quarter worth about $90,000. O Shaughnessy Asset Management LLC grew its stake in shares of International Business Machines by 8.5% during the fourth quarter. O Shaughnessy Asset Management LLC now owns 120,164 shares of the technology company's stock worth $26,416,000 after acquiring an additional 9,411 shares during the last quarter. Wellington Management Group LLP grew its stake in shares of International Business Machines by 1.4% during the fourth quarter. Wellington Management Group LLP now owns 231,021 shares of the technology company's stock worth $50,785,000 after acquiring an additional 3,206 shares during the last quarter. Finally, Alliancebernstein L.P. grew its stake in shares of International Business Machines by 14.9% during the fourth quarter. Alliancebernstein L.P. now owns 1,591,471 shares of the technology company's stock worth $349,853,000 after acquiring an additional 206,944 shares during the last quarter. 58.96% of the stock is currently owned by institutional investors.

International Business Machines Price Performance

Shares of IBM stock traded down $4.54 during trading hours on Friday, hitting $248.61. 7,315,580 shares of the company's stock were exchanged, compared to its average volume of 4,666,929. The company has a quick ratio of 0.87, a current ratio of 0.91 and a debt-to-equity ratio of 2.00. The firm has a market cap of $231.06 billion, a P/E ratio of 40.41, a P/E/G ratio of 4.02 and a beta of 0.69. The firm has a 50 day moving average of $277.37 and a two-hundred day moving average of $256.88. International Business Machines Corporation has a fifty-two week low of $181.81 and a fifty-two week high of $296.16.

International Business Machines (NYSE:IBM - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The technology company reported $2.80 earnings per share for the quarter, topping the consensus estimate of $2.65 by $0.15. International Business Machines had a return on equity of 37.62% and a net margin of 9.11%. The business had revenue of $16.98 billion during the quarter, compared to the consensus estimate of $16.58 billion. During the same period in the prior year, the company posted $2.43 EPS. The business's quarterly revenue was up 7.7% on a year-over-year basis. Sell-side analysts forecast that International Business Machines Corporation will post 10.78 EPS for the current year.

Analyst Upgrades and Downgrades

IBM has been the topic of a number of research analyst reports. The Goldman Sachs Group boosted their price target on International Business Machines from $270.00 to $310.00 and gave the stock a "buy" rating in a research note on Wednesday, July 2nd. Royal Bank Of Canada boosted their price target on International Business Machines from $285.00 to $315.00 and gave the stock an "outperform" rating in a research note on Thursday, July 17th. BMO Capital Markets boosted their price target on International Business Machines from $260.00 to $300.00 and gave the stock a "market perform" rating in a research note on Friday, July 18th. Melius Research upgraded International Business Machines to a "strong-buy" rating in a research report on Monday, July 7th. Finally, UBS Group upped their target price on International Business Machines from $195.00 to $200.00 and gave the company a "sell" rating in a research report on Thursday, July 24th. One research analyst has rated the stock with a sell rating, eight have given a hold rating, nine have issued a buy rating and two have assigned a strong buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $268.75.

Get Our Latest Analysis on IBM

International Business Machines Company Profile

(

Free Report)

International Business Machines Corporation, together with its subsidiaries, provides integrated solutions and services worldwide. The company operates through Software, Consulting, Infrastructure, and Financing segments. The Software segment offers a hybrid cloud and AI platforms that allows clients to realize their digital and AI transformations across the applications, data, and environments in which they operate.

See Also

Before you consider International Business Machines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Business Machines wasn't on the list.

While International Business Machines currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.