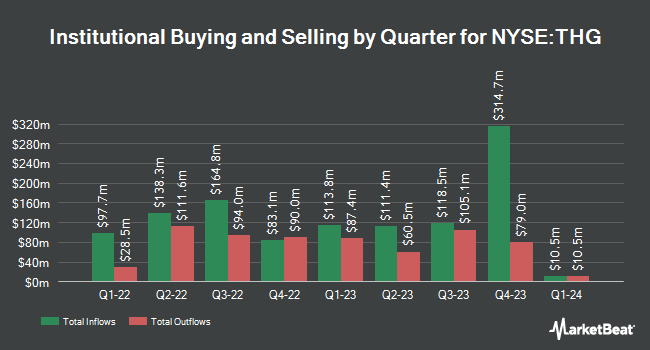

Price T Rowe Associates Inc. MD grew its holdings in The Hanover Insurance Group, Inc. (NYSE:THG - Free Report) by 0.2% in the first quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 1,283,395 shares of the insurance provider's stock after buying an additional 2,564 shares during the period. Price T Rowe Associates Inc. MD owned approximately 3.57% of The Hanover Insurance Group worth $223,248,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors and hedge funds have also made changes to their positions in the business. Vanguard Group Inc. grew its stake in shares of The Hanover Insurance Group by 0.6% in the 1st quarter. Vanguard Group Inc. now owns 3,635,173 shares of the insurance provider's stock worth $632,338,000 after buying an additional 21,221 shares in the last quarter. Fuller & Thaler Asset Management Inc. grew its holdings in The Hanover Insurance Group by 45.1% during the 1st quarter. Fuller & Thaler Asset Management Inc. now owns 907,760 shares of the insurance provider's stock valued at $157,905,000 after purchasing an additional 282,233 shares during the last quarter. Charles Schwab Investment Management Inc. grew its holdings in The Hanover Insurance Group by 5.9% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 389,634 shares of the insurance provider's stock valued at $67,777,000 after purchasing an additional 21,588 shares during the last quarter. Northern Trust Corp grew its holdings in The Hanover Insurance Group by 40.7% during the 4th quarter. Northern Trust Corp now owns 383,670 shares of the insurance provider's stock valued at $59,338,000 after purchasing an additional 110,944 shares during the last quarter. Finally, Vaughan Nelson Investment Management L.P. bought a new position in The Hanover Insurance Group during the 1st quarter valued at about $64,340,000. 86.61% of the stock is owned by hedge funds and other institutional investors.

The Hanover Insurance Group Stock Performance

Shares of NYSE:THG traded up $0.67 on Friday, hitting $174.09. 33,377 shares of the company were exchanged, compared to its average volume of 245,339. The Hanover Insurance Group, Inc. has a 1-year low of $139.37 and a 1-year high of $178.68. The stock's 50 day moving average price is $168.23 and its 200 day moving average price is $167.05. The company has a current ratio of 0.37, a quick ratio of 0.37 and a debt-to-equity ratio of 0.11. The firm has a market capitalization of $6.23 billion, a P/E ratio of 11.46 and a beta of 0.45.

The Hanover Insurance Group (NYSE:THG - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The insurance provider reported $4.35 EPS for the quarter, topping the consensus estimate of $3.07 by $1.28. The Hanover Insurance Group had a net margin of 8.67% and a return on equity of 20.24%. The business had revenue of $1.58 billion during the quarter, compared to the consensus estimate of $1.60 billion. During the same period in the previous year, the firm posted $1.88 earnings per share. The business's revenue for the quarter was up 3.1% compared to the same quarter last year. Sell-side analysts predict that The Hanover Insurance Group, Inc. will post 14.37 EPS for the current year.

The Hanover Insurance Group Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, June 27th. Investors of record on Friday, June 13th were issued a dividend of $0.90 per share. This represents a $3.60 annualized dividend and a dividend yield of 2.1%. The ex-dividend date of this dividend was Friday, June 13th. The Hanover Insurance Group's dividend payout ratio (DPR) is 23.70%.

Analysts Set New Price Targets

Several brokerages recently commented on THG. Citigroup reiterated an "outperform" rating on shares of The Hanover Insurance Group in a report on Thursday, July 31st. Keefe, Bruyette & Woods upgraded shares of The Hanover Insurance Group from a "market perform" rating to an "outperform" rating and set a $188.00 target price on the stock in a research note on Wednesday, July 9th. Morgan Stanley upped their target price on shares of The Hanover Insurance Group from $170.00 to $185.00 and gave the stock an "equal weight" rating in a research note on Friday, August 1st. Finally, JMP Securities set a $205.00 target price on shares of The Hanover Insurance Group in a research note on Thursday, July 31st. Six equities research analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $185.13.

View Our Latest Report on THG

The Hanover Insurance Group Company Profile

(

Free Report)

The Hanover Insurance Group, Inc, through its subsidiaries, provides various property and casualty insurance products and services in the United States. The company operates through four segments: Core Commercial, Specialty, Personal Lines, and Other. The Commercial Lines segment offers commercial multiple peril, commercial automobile, workers' compensation, and other commercial lines coverage.

Featured Stories

Before you consider The Hanover Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hanover Insurance Group wasn't on the list.

While The Hanover Insurance Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.