Primecap Management Co. CA decreased its position in Stratasys, Ltd. (NASDAQ:SSYS - Free Report) by 40.4% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 877,155 shares of the technology company's stock after selling 595,675 shares during the period. Primecap Management Co. CA owned approximately 1.22% of Stratasys worth $8,587,000 at the end of the most recent quarter.

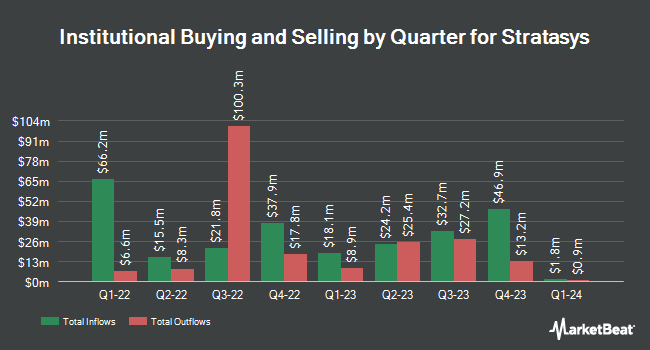

Several other hedge funds and other institutional investors have also bought and sold shares of SSYS. Migdal Insurance & Financial Holdings Ltd. lifted its holdings in Stratasys by 84.7% in the first quarter. Migdal Insurance & Financial Holdings Ltd. now owns 2,130,983 shares of the technology company's stock valued at $20,862,000 after buying an additional 977,403 shares during the period. Penn Capital Management Company LLC acquired a new position in shares of Stratasys during the fourth quarter valued at about $5,376,000. Royce & Associates LP raised its holdings in shares of Stratasys by 236.6% during the first quarter. Royce & Associates LP now owns 555,420 shares of the technology company's stock valued at $5,438,000 after purchasing an additional 390,420 shares during the period. Formula Growth Ltd. raised its holdings in shares of Stratasys by 58.3% during the fourth quarter. Formula Growth Ltd. now owns 760,000 shares of the technology company's stock valued at $6,756,000 after purchasing an additional 280,000 shares during the period. Finally, Tudor Investment Corp ET AL acquired a new position in shares of Stratasys during the fourth quarter valued at about $2,165,000. Institutional investors and hedge funds own 75.77% of the company's stock.

Stratasys Trading Up 4.9%

Shares of SSYS traded up $0.53 on Tuesday, reaching $11.31. The company's stock had a trading volume of 272,953 shares, compared to its average volume of 513,226. Stratasys, Ltd. has a twelve month low of $6.05 and a twelve month high of $12.88. The stock has a market capitalization of $960.02 million, a PE ratio of -7.53 and a beta of 1.57. The firm has a fifty day moving average of $10.95 and a 200-day moving average of $10.51.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen upgraded shares of Stratasys from a "hold" rating to a "buy" rating in a report on Saturday. One equities research analyst has rated the stock with a hold rating and five have issued a buy rating to the stock. According to MarketBeat, Stratasys presently has a consensus rating of "Moderate Buy" and an average target price of $12.20.

View Our Latest Report on SSYS

Stratasys Company Profile

(

Free Report)

Stratasys Ltd. provides connected polymer-based 3D printing solutions. It offers range of 3D printing systems, which includes polyjet printer, Fused Deposition Modeling (FDM) printers, stereolithography printing systems, origin P3 printers, and selective absorption fusion printer for additive manufacturing, and tooling and rapid prototyping for various vertical markets, such as automotive, aerospace, consumer products and healthcare.

Featured Articles

Before you consider Stratasys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stratasys wasn't on the list.

While Stratasys currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.