Primecap Management Co. CA trimmed its stake in Sony Corporation (NYSE:SONY - Free Report) by 7.9% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 93,959,475 shares of the company's stock after selling 8,036,380 shares during the quarter. Sony accounts for 2.0% of Primecap Management Co. CA's portfolio, making the stock its 12th biggest holding. Primecap Management Co. CA owned about 1.55% of Sony worth $2,385,631,000 as of its most recent filing with the Securities and Exchange Commission.

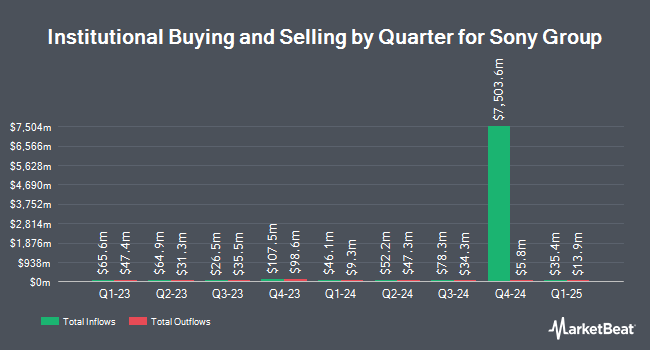

Other institutional investors and hedge funds have also recently modified their holdings of the company. Capital Analysts LLC grew its position in Sony by 400.0% during the 4th quarter. Capital Analysts LLC now owns 1,170 shares of the company's stock valued at $25,000 after purchasing an additional 936 shares during the last quarter. City Holding Co. purchased a new stake in shares of Sony during the first quarter valued at approximately $30,000. Bartlett & CO. Wealth Management LLC bought a new stake in shares of Sony during the first quarter valued at approximately $31,000. Operose Advisors LLC lifted its position in Sony by 400.0% in the 4th quarter. Operose Advisors LLC now owns 1,520 shares of the company's stock valued at $32,000 after acquiring an additional 1,216 shares in the last quarter. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its stake in Sony by 155.4% during the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 2,268 shares of the company's stock valued at $48,000 after purchasing an additional 1,380 shares during the last quarter. 14.05% of the stock is currently owned by institutional investors.

Sony Trading Down 1.0%

Shares of SONY stock opened at $24.51 on Wednesday. The stock has a fifty day simple moving average of $25.33 and a two-hundred day simple moving average of $24.43. Sony Corporation has a 52-week low of $16.41 and a 52-week high of $26.94. The firm has a market capitalization of $148.20 billion, a PE ratio of 19.86, a PEG ratio of 12.08 and a beta of 0.91. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.57 and a current ratio of 0.70.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen downgraded Sony from a "buy" rating to a "hold" rating in a report on Thursday, May 22nd. Two analysts have rated the stock with a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, Sony presently has an average rating of "Moderate Buy" and a consensus price target of $28.00.

View Our Latest Stock Report on Sony

Sony Company Profile

(

Free Report)

Sony Group Corporation designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally. The company distributes software titles and add-on content through digital networks; network services related to game, video, and music content; and home gaming consoles, packaged and game software, and peripheral devices.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sony, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sony wasn't on the list.

While Sony currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.