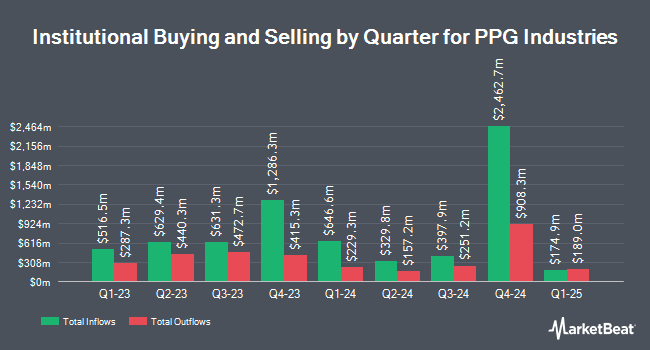

Principal Financial Group Inc. increased its stake in PPG Industries, Inc. (NYSE:PPG - Free Report) by 4.4% in the 1st quarter, according to its most recent disclosure with the SEC. The institutional investor owned 302,962 shares of the specialty chemicals company's stock after acquiring an additional 12,650 shares during the period. Principal Financial Group Inc. owned about 0.13% of PPG Industries worth $33,129,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Vanguard Group Inc. boosted its position in PPG Industries by 2.6% during the fourth quarter. Vanguard Group Inc. now owns 29,369,691 shares of the specialty chemicals company's stock valued at $3,508,210,000 after buying an additional 756,937 shares during the period. Wellington Management Group LLP boosted its position in PPG Industries by 17.7% during the fourth quarter. Wellington Management Group LLP now owns 10,567,051 shares of the specialty chemicals company's stock valued at $1,262,234,000 after buying an additional 1,590,041 shares during the period. Geode Capital Management LLC boosted its position in PPG Industries by 1.7% during the fourth quarter. Geode Capital Management LLC now owns 5,546,472 shares of the specialty chemicals company's stock valued at $660,752,000 after buying an additional 93,455 shares during the period. Invesco Ltd. boosted its position in PPG Industries by 6.1% during the fourth quarter. Invesco Ltd. now owns 4,726,630 shares of the specialty chemicals company's stock valued at $564,596,000 after buying an additional 271,699 shares during the period. Finally, Kovitz Investment Group Partners LLC boosted its position in PPG Industries by 482.2% during the fourth quarter. Kovitz Investment Group Partners LLC now owns 4,337,649 shares of the specialty chemicals company's stock valued at $518,132,000 after buying an additional 3,592,655 shares during the period. 81.86% of the stock is currently owned by hedge funds and other institutional investors.

PPG Industries Stock Down 1.5%

PPG traded down $1.73 during midday trading on Friday, reaching $117.34. The company's stock had a trading volume of 770,595 shares, compared to its average volume of 1,858,167. The firm has a market capitalization of $26.64 billion, a price-to-earnings ratio of 25.13, a PEG ratio of 2.49 and a beta of 1.16. The company has a current ratio of 1.35, a quick ratio of 0.99 and a debt-to-equity ratio of 0.79. PPG Industries, Inc. has a 1 year low of $90.24 and a 1 year high of $137.24. The stock's 50-day moving average is $112.37 and its 200-day moving average is $112.23.

PPG Industries (NYSE:PPG - Get Free Report) last posted its quarterly earnings results on Tuesday, April 29th. The specialty chemicals company reported $1.72 EPS for the quarter, beating analysts' consensus estimates of $1.62 by $0.10. PPG Industries had a net margin of 6.49% and a return on equity of 24.84%. The firm had revenue of $3.68 billion for the quarter, compared to analysts' expectations of $3.67 billion. During the same quarter in the prior year, the company posted $1.87 earnings per share. The business's revenue for the quarter was down 4.3% on a year-over-year basis. As a group, research analysts expect that PPG Industries, Inc. will post 7.95 EPS for the current year.

PPG Industries Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, June 12th. Investors of record on Monday, May 12th were issued a $0.68 dividend. This represents a $2.72 annualized dividend and a yield of 2.32%. The ex-dividend date of this dividend was Monday, May 12th. PPG Industries's dividend payout ratio is currently 58.24%.

Analyst Upgrades and Downgrades

Several analysts have issued reports on the stock. Fermium Researc upgraded shares of PPG Industries to a "strong-buy" rating in a research report on Thursday, May 1st. UBS Group upped their price target on shares of PPG Industries from $111.00 to $125.00 and gave the company a "neutral" rating in a research report on Wednesday. Royal Bank Of Canada upped their price objective on shares of PPG Industries from $112.00 to $113.00 and gave the company a "sector perform" rating in a research note on Friday, May 2nd. Deutsche Bank Aktiengesellschaft upped their price objective on shares of PPG Industries from $125.00 to $140.00 and gave the company a "buy" rating in a research note on Monday, May 12th. Finally, Citigroup upped their price objective on shares of PPG Industries from $125.00 to $130.00 and gave the company a "buy" rating in a research note on Friday, June 13th. Nine equities research analysts have rated the stock with a hold rating, six have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $131.83.

View Our Latest Research Report on PPG Industries

PPG Industries Profile

(

Free Report)

PPG Industries, Inc manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa. It operates through two segments, Performance Coatings and Industrial Coatings. The Performance Coatings segment offers coatings, solvents, adhesives, sealants, sundries, and software for automotive and commercial transport/fleet repair and refurbishing, light industrial coatings, and specialty coatings for signs; wood stains; paints, thermoplastics, pavement marking products, and other advanced technologies for pavement marking for government, commercial infrastructure, painting, and maintenance contractors; and coatings, sealants, transparencies, transparent armor, adhesives, engineered materials, and packaging and chemical management services for commercial, military, regional jet, and general aviation aircraft.

Further Reading

Before you consider PPG Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PPG Industries wasn't on the list.

While PPG Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report