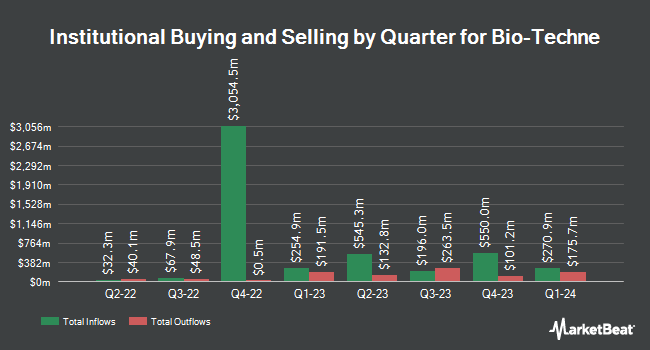

Private Advisor Group LLC trimmed its holdings in shares of Bio-Techne Corp (NASDAQ:TECH - Free Report) by 57.0% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 6,339 shares of the biotechnology company's stock after selling 8,390 shares during the quarter. Private Advisor Group LLC's holdings in Bio-Techne were worth $372,000 at the end of the most recent quarter.

A number of other institutional investors and hedge funds also recently modified their holdings of TECH. Price T Rowe Associates Inc. MD increased its position in Bio-Techne by 13.1% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 10,654,267 shares of the biotechnology company's stock worth $767,428,000 after buying an additional 1,229,954 shares during the last quarter. Brown Advisory Inc. increased its position in Bio-Techne by 45.7% in the first quarter. Brown Advisory Inc. now owns 1,912,377 shares of the biotechnology company's stock worth $112,123,000 after buying an additional 599,982 shares during the last quarter. Select Equity Group L.P. increased its position in Bio-Techne by 26.9% in the fourth quarter. Select Equity Group L.P. now owns 2,335,359 shares of the biotechnology company's stock worth $168,216,000 after buying an additional 495,404 shares during the last quarter. Massachusetts Financial Services Co. MA increased its position in Bio-Techne by 18.5% in the first quarter. Massachusetts Financial Services Co. MA now owns 3,025,409 shares of the biotechnology company's stock worth $177,380,000 after buying an additional 472,847 shares during the last quarter. Finally, Freestone Grove Partners LP purchased a new stake in Bio-Techne in the fourth quarter worth $30,047,000. 98.95% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

TECH has been the subject of a number of recent research reports. KeyCorp reissued a "sector weight" rating on shares of Bio-Techne in a research report on Wednesday, April 9th. Scotiabank decreased their target price on Bio-Techne from $90.00 to $75.00 and set a "sector outperform" rating for the company in a research report on Friday, July 11th. Wells Fargo & Company initiated coverage on Bio-Techne in a research report on Friday, May 30th. They issued an "overweight" rating and a $59.00 target price for the company. Royal Bank Of Canada decreased their target price on Bio-Techne from $72.00 to $63.00 and set a "sector perform" rating for the company in a research report on Thursday, May 8th. Finally, Stifel Nicolaus cut their price target on Bio-Techne from $75.00 to $60.00 and set a "hold" rating for the company in a report on Thursday, May 8th. Seven research analysts have rated the stock with a hold rating, six have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $69.58.

View Our Latest Analysis on Bio-Techne

Bio-Techne Price Performance

NASDAQ:TECH opened at $54.73 on Friday. The firm has a market capitalization of $8.58 billion, a price-to-earnings ratio of 66.74, a P/E/G ratio of 2.76 and a beta of 1.39. Bio-Techne Corp has a 52-week low of $46.01 and a 52-week high of $83.62. The stock has a fifty day moving average of $51.75 and a 200 day moving average of $57.20. The company has a debt-to-equity ratio of 0.16, a quick ratio of 2.58 and a current ratio of 3.71.

Bio-Techne (NASDAQ:TECH - Get Free Report) last posted its quarterly earnings data on Wednesday, May 7th. The biotechnology company reported $0.56 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.51 by $0.05. The company had revenue of $316.18 million during the quarter, compared to analyst estimates of $317.92 million. Bio-Techne had a return on equity of 13.17% and a net margin of 10.89%. The firm's quarterly revenue was up 4.2% on a year-over-year basis. During the same quarter last year, the company earned $0.48 earnings per share. On average, research analysts expect that Bio-Techne Corp will post 1.67 EPS for the current fiscal year.

Bio-Techne Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, May 30th. Investors of record on Monday, May 19th were paid a dividend of $0.08 per share. The ex-dividend date of this dividend was Monday, May 19th. This represents a $0.32 annualized dividend and a yield of 0.6%. Bio-Techne's dividend payout ratio (DPR) is currently 39.02%.

Bio-Techne announced that its board has initiated a stock buyback plan on Wednesday, May 7th that allows the company to buyback $500.00 million in shares. This buyback authorization allows the biotechnology company to buy up to 6.5% of its shares through open market purchases. Shares buyback plans are usually a sign that the company's board believes its shares are undervalued.

Bio-Techne Profile

(

Free Report)

Bio-Techne Corporation, together with its subsidiaries, develops, manufactures, and sells life science reagents, instruments, and services for the research and clinical diagnostic markets in the United States, the United Kingdom, rest of Europe, Middle East, and Africa, Greater China, rest of Asia-Pacific, and internationally.

Featured Stories

Want to see what other hedge funds are holding TECH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Bio-Techne Corp (NASDAQ:TECH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bio-Techne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bio-Techne wasn't on the list.

While Bio-Techne currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.