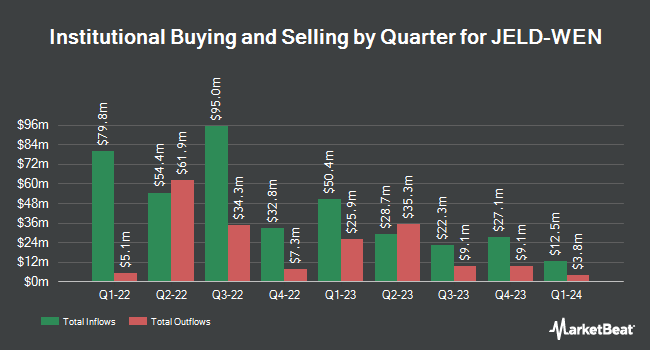

Public Employees Retirement System of Ohio lifted its holdings in JELD-WEN Holding, Inc. (NYSE:JELD - Free Report) by 914.1% during the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 135,247 shares of the company's stock after purchasing an additional 121,911 shares during the quarter. Public Employees Retirement System of Ohio owned 0.16% of JELD-WEN worth $530,000 as of its most recent SEC filing.

A number of other hedge funds have also added to or reduced their stakes in the business. CWM LLC increased its stake in JELD-WEN by 2,140.2% in the 1st quarter. CWM LLC now owns 6,407 shares of the company's stock valued at $38,000 after buying an additional 6,121 shares during the last quarter. Wealth Enhancement Advisory Services LLC bought a new position in shares of JELD-WEN in the 2nd quarter valued at about $52,000. Performa Ltd US LLC increased its position in shares of JELD-WEN by 119.0% in the first quarter. Performa Ltd US LLC now owns 9,200 shares of the company's stock valued at $55,000 after acquiring an additional 5,000 shares during the last quarter. AlphaQuest LLC increased its position in shares of JELD-WEN by 294.7% in the first quarter. AlphaQuest LLC now owns 11,169 shares of the company's stock valued at $67,000 after acquiring an additional 8,339 shares during the last quarter. Finally, Teacher Retirement System of Texas bought a new stake in JELD-WEN during the first quarter worth about $74,000. Institutional investors own 95.04% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on JELD. Wall Street Zen raised JELD-WEN from a "strong sell" rating to a "hold" rating in a research report on Saturday, August 9th. Jefferies Financial Group raised their target price on shares of JELD-WEN from $3.75 to $5.25 and gave the company a "hold" rating in a research note on Wednesday, August 20th. Weiss Ratings restated a "sell (e+)" rating on shares of JELD-WEN in a report on Saturday, September 27th. Barclays upped their price target on shares of JELD-WEN from $4.50 to $5.00 and gave the stock an "equal weight" rating in a research report on Thursday, August 7th. Finally, UBS Group lifted their price objective on shares of JELD-WEN from $5.00 to $5.75 and gave the company a "neutral" rating in a research report on Thursday, August 7th. Seven research analysts have rated the stock with a Hold rating and two have issued a Sell rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Reduce" and a consensus price target of $6.03.

Get Our Latest Analysis on JELD-WEN

JELD-WEN Stock Up 1.3%

JELD-WEN stock opened at $4.90 on Monday. The company's 50-day moving average price is $5.64 and its two-hundred day moving average price is $4.96. The company has a quick ratio of 1.04, a current ratio of 1.77 and a debt-to-equity ratio of 2.42. The stock has a market cap of $418.03 million, a P/E ratio of -1.21 and a beta of 1.70. JELD-WEN Holding, Inc. has a twelve month low of $3.27 and a twelve month high of $16.25.

About JELD-WEN

(

Free Report)

JELD-WEN Holding, Inc designs, manufactures, and sells wood, metal, and composite materials doors, windows, and related building products in North America and Europe. The company offers a line of residential interior and exterior door products, including patio doors, and folding or sliding wall systems; non-residential doors; stile and rail doors; and wood, vinyl, and wood composite windows.

Featured Stories

Want to see what other hedge funds are holding JELD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for JELD-WEN Holding, Inc. (NYSE:JELD - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider JELD-WEN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JELD-WEN wasn't on the list.

While JELD-WEN currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.