Public Employees Retirement System of Ohio raised its position in shares of Avista Corporation (NYSE:AVA - Free Report) by 22.2% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 118,212 shares of the utilities provider's stock after purchasing an additional 21,500 shares during the period. Public Employees Retirement System of Ohio owned approximately 0.15% of Avista worth $4,486,000 at the end of the most recent reporting period.

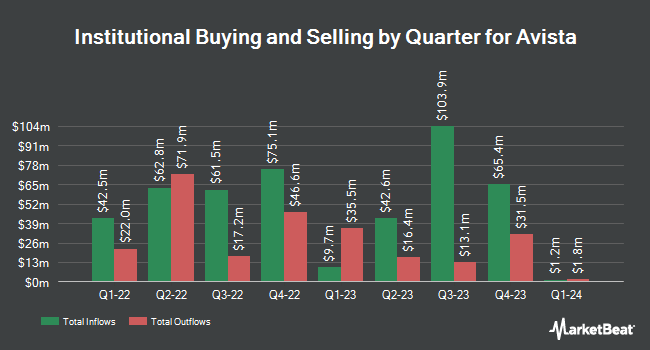

Several other institutional investors have also added to or reduced their stakes in the company. IMS Capital Management acquired a new position in Avista during the second quarter valued at approximately $291,000. GAMMA Investing LLC raised its position in Avista by 48.5% during the second quarter. GAMMA Investing LLC now owns 1,360 shares of the utilities provider's stock valued at $52,000 after purchasing an additional 444 shares in the last quarter. Sowell Financial Services LLC raised its position in Avista by 11.4% during the second quarter. Sowell Financial Services LLC now owns 8,816 shares of the utilities provider's stock valued at $335,000 after purchasing an additional 900 shares in the last quarter. Financiere des Professionnels Fonds d investissement inc. acquired a new position in Avista during the second quarter valued at approximately $144,000. Finally, Assenagon Asset Management S.A. raised its position in Avista by 502.3% during the second quarter. Assenagon Asset Management S.A. now owns 397,741 shares of the utilities provider's stock valued at $15,094,000 after purchasing an additional 331,706 shares in the last quarter. 85.24% of the stock is currently owned by institutional investors and hedge funds.

Avista Stock Down 0.2%

Shares of AVA opened at $37.55 on Tuesday. Avista Corporation has a one year low of $34.80 and a one year high of $43.09. The company has a market cap of $3.05 billion, a P/E ratio of 16.92, a P/E/G ratio of 2.49 and a beta of 0.41. The company has a debt-to-equity ratio of 1.06, a current ratio of 1.00 and a quick ratio of 0.68. The firm has a 50 day simple moving average of $36.93 and a two-hundred day simple moving average of $38.46.

Avista (NYSE:AVA - Get Free Report) last announced its quarterly earnings data on Wednesday, August 6th. The utilities provider reported $0.17 EPS for the quarter, missing the consensus estimate of $0.28 by ($0.11). Avista had a net margin of 9.13% and a return on equity of 6.86%. The firm had revenue of $400.00 million for the quarter, compared to analyst estimates of $416.06 million. During the same quarter in the prior year, the firm earned $0.29 earnings per share. Research analysts forecast that Avista Corporation will post 2.3 EPS for the current fiscal year.

Avista Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, September 15th. Stockholders of record on Tuesday, August 19th were issued a dividend of $0.49 per share. The ex-dividend date was Tuesday, August 19th. This represents a $1.96 annualized dividend and a dividend yield of 5.2%. Avista's dividend payout ratio is 88.29%.

Insider Buying and Selling at Avista

In related news, SVP Bryan Alden Cox purchased 3,671 shares of the stock in a transaction dated Tuesday, September 16th. The stock was bought at an average cost of $35.55 per share, for a total transaction of $130,504.05. Following the completion of the acquisition, the senior vice president owned 9,989 shares of the company's stock, valued at approximately $355,108.95. This represents a 58.10% increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, VP David J. Meyer sold 1,367 shares of the company's stock in a transaction on Friday, September 5th. The stock was sold at an average price of $36.72, for a total transaction of $50,196.24. Following the transaction, the vice president owned 8,394 shares of the company's stock, valued at $308,227.68. This trade represents a 14.00% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.96% of the stock is currently owned by corporate insiders.

About Avista

(

Free Report)

Avista Corporation, together with its subsidiaries, operates as an electric and natural gas utility company. It operates in two segments, Avista Utilities and AEL&P. The Avista Utilities segment provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho; and natural gas distribution services in parts of northeastern and southwestern Oregon, as well as generates electricity in Washington, Idaho, Oregon, and Montana.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Avista, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avista wasn't on the list.

While Avista currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.