Public Sector Pension Investment Board raised its stake in REX American Resources Corporation (NYSE:REX - Free Report) by 27.3% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 49,004 shares of the energy company's stock after purchasing an additional 10,496 shares during the quarter. Public Sector Pension Investment Board owned approximately 0.29% of REX American Resources worth $1,841,000 at the end of the most recent reporting period.

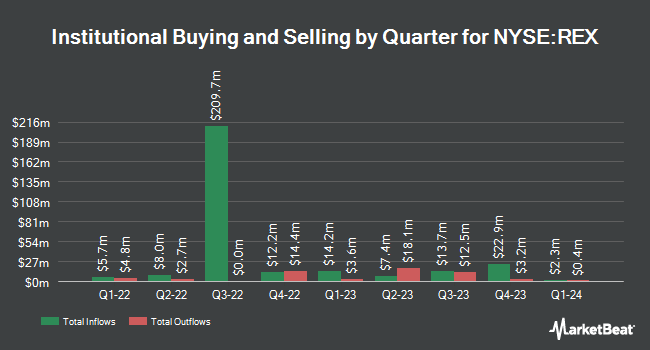

A number of other hedge funds have also recently bought and sold shares of REX. Wells Fargo & Company MN grew its stake in REX American Resources by 26.9% in the fourth quarter. Wells Fargo & Company MN now owns 8,955 shares of the energy company's stock valued at $373,000 after purchasing an additional 1,897 shares in the last quarter. Barclays PLC grew its stake in REX American Resources by 14.5% in the fourth quarter. Barclays PLC now owns 49,089 shares of the energy company's stock valued at $2,048,000 after purchasing an additional 6,234 shares in the last quarter. First Trust Advisors LP bought a new position in REX American Resources in the fourth quarter valued at approximately $244,000. Hsbc Holdings PLC grew its stake in REX American Resources by 33.8% in the fourth quarter. Hsbc Holdings PLC now owns 13,354 shares of the energy company's stock valued at $559,000 after purchasing an additional 3,377 shares in the last quarter. Finally, Northern Trust Corp grew its stake in REX American Resources by 1.3% in the fourth quarter. Northern Trust Corp now owns 231,773 shares of the energy company's stock valued at $9,663,000 after purchasing an additional 2,882 shares in the last quarter. 88.12% of the stock is currently owned by institutional investors.

REX American Resources Price Performance

REX stock traded up $2.8210 during mid-day trading on Friday, reaching $59.9310. The company had a trading volume of 102,538 shares, compared to its average volume of 71,852. The stock has a 50 day simple moving average of $52.71 and a two-hundred day simple moving average of $44.44. The company has a market capitalization of $987.06 million, a price-to-earnings ratio of 18.61 and a beta of 0.58. REX American Resources Corporation has a 52 week low of $33.45 and a 52 week high of $60.08.

REX American Resources (NYSE:REX - Get Free Report) last posted its quarterly earnings results on Wednesday, May 28th. The energy company reported $0.51 earnings per share for the quarter, beating analysts' consensus estimates of $0.34 by $0.17. REX American Resources had a return on equity of 8.97% and a net margin of 8.86%.The firm had revenue of $158.34 million during the quarter, compared to the consensus estimate of $161.00 million. On average, equities analysts predict that REX American Resources Corporation will post 2.93 EPS for the current year.

REX American Resources Company Profile

(

Free Report)

REX American Resources Corporation, together with its subsidiaries, produces and sells ethanol in the United States. The company also offers corn, distillers grains, ethanol, distillers corn oil, gasoline, and natural gas. In addition, it provides dry distillers grains with solubles, which is used as a protein in animal feed.

Featured Articles

Before you consider REX American Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and REX American Resources wasn't on the list.

While REX American Resources currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.