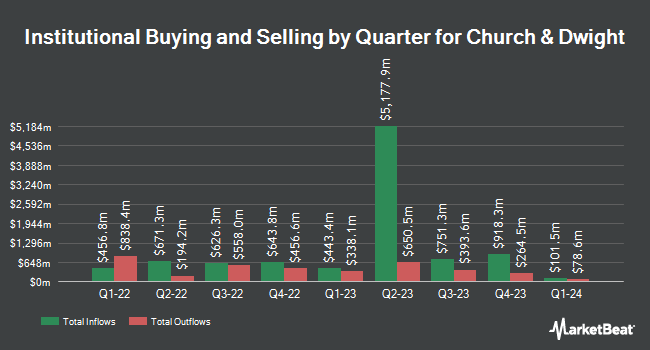

Public Sector Pension Investment Board grew its holdings in Church & Dwight Co., Inc. (NYSE:CHD - Free Report) by 9.4% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 33,562 shares of the company's stock after buying an additional 2,894 shares during the quarter. Public Sector Pension Investment Board's holdings in Church & Dwight were worth $3,695,000 as of its most recent SEC filing.

Several other large investors have also recently made changes to their positions in CHD. NewEdge Advisors LLC increased its position in shares of Church & Dwight by 30.8% during the fourth quarter. NewEdge Advisors LLC now owns 25,770 shares of the company's stock worth $2,698,000 after purchasing an additional 6,070 shares in the last quarter. GeoWealth Management LLC grew its holdings in Church & Dwight by 114.6% in the 4th quarter. GeoWealth Management LLC now owns 4,363 shares of the company's stock valued at $457,000 after buying an additional 2,330 shares in the last quarter. Forum Financial Management LP purchased a new stake in Church & Dwight in the 4th quarter valued at $300,000. Dimensional Fund Advisors LP grew its holdings in Church & Dwight by 8.2% in the 4th quarter. Dimensional Fund Advisors LP now owns 1,332,079 shares of the company's stock valued at $139,481,000 after buying an additional 100,502 shares in the last quarter. Finally, Natixis grew its holdings in Church & Dwight by 380.4% in the 4th quarter. Natixis now owns 79,029 shares of the company's stock valued at $8,275,000 after buying an additional 62,578 shares in the last quarter. 86.60% of the stock is currently owned by hedge funds and other institutional investors.

Church & Dwight Trading Up 0.0%

CHD traded up $0.0170 during mid-day trading on Friday, hitting $94.9770. 1,716,960 shares of the stock were exchanged, compared to its average volume of 2,402,085. The firm's fifty day moving average is $95.57 and its two-hundred day moving average is $100.34. Church & Dwight Co., Inc. has a 1-year low of $90.50 and a 1-year high of $116.46. The company has a current ratio of 1.84, a quick ratio of 1.33 and a debt-to-equity ratio of 0.50. The company has a market cap of $23.14 billion, a PE ratio of 44.80, a PEG ratio of 3.92 and a beta of 0.43.

Church & Dwight (NYSE:CHD - Get Free Report) last posted its earnings results on Friday, August 1st. The company reported $0.94 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.85 by $0.09. Church & Dwight had a return on equity of 19.27% and a net margin of 8.66%.The firm had revenue of $1.51 billion for the quarter, compared to analyst estimates of $1.48 billion. During the same quarter in the prior year, the company earned $0.93 EPS. Church & Dwight's revenue was down .3% on a year-over-year basis. Church & Dwight has set its FY 2025 guidance at 3.440-3.510 EPS. Q3 2025 guidance at 0.720-0.720 EPS. Equities analysts forecast that Church & Dwight Co., Inc. will post 3.7 earnings per share for the current fiscal year.

Church & Dwight Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, September 2nd. Shareholders of record on Friday, August 15th will be given a $0.295 dividend. The ex-dividend date of this dividend is Friday, August 15th. This represents a $1.18 dividend on an annualized basis and a yield of 1.2%. Church & Dwight's dividend payout ratio (DPR) is currently 55.66%.

Wall Street Analyst Weigh In

Several analysts have issued reports on the company. JPMorgan Chase & Co. dropped their target price on Church & Dwight from $97.00 to $92.00 and set an "underweight" rating for the company in a report on Monday, August 4th. Redburn Partners set a $83.00 target price on Church & Dwight in a report on Monday, July 14th. Wells Fargo & Company upped their target price on Church & Dwight from $105.00 to $108.00 and gave the company an "overweight" rating in a report on Wednesday, July 9th. TD Cowen cut Church & Dwight from a "buy" rating to a "hold" rating and set a $100.00 price target for the company. in a report on Tuesday, May 6th. Finally, Cowen cut Church & Dwight from a "buy" rating to a "hold" rating in a report on Tuesday, May 6th. Seven research analysts have rated the stock with a Buy rating, six have assigned a Hold rating and four have assigned a Sell rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $103.94.

Check Out Our Latest Stock Analysis on Church & Dwight

Insider Buying and Selling

In other Church & Dwight news, Director Ravichandra Krishnamu Saligram sold 14,660 shares of the stock in a transaction dated Friday, May 30th. The stock was sold at an average price of $99.00, for a total value of $1,451,340.00. Following the sale, the director owned 13,747 shares of the company's stock, valued at $1,360,953. This trade represents a 51.61% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP Lee B. Mcchesney purchased 5,409 shares of Church & Dwight stock in a transaction on Friday, August 8th. The stock was bought at an average cost of $91.38 per share, for a total transaction of $494,274.42. Following the transaction, the executive vice president directly owned 5,409 shares in the company, valued at $494,274.42. This represents a ∞ increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last ninety days, insiders have acquired 12,879 shares of company stock worth $1,177,702 and have sold 35,915 shares worth $3,545,300. 2.00% of the stock is currently owned by company insiders.

About Church & Dwight

(

Free Report)

Church & Dwight Co, Inc engages in the development, manufacture, and marketing of household, personal care, and specialty products. It operates through the following segments: Consumer Domestic, Consumer International, Specialty Products Division (SPD), and Corporate. The Consumer Domestic segment offers household products, such as laundry detergents, fabric softener sheets, cat litter, household cleaning products, and personal care products including antiperspirants, oral care products, depilatories, reproductive health products, oral analgesics, nasal saline moisturizers, and dietary supplements.

See Also

Before you consider Church & Dwight, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Church & Dwight wasn't on the list.

While Church & Dwight currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report