Punch & Associates Investment Management Inc. reduced its stake in Silvercrest Asset Management Group Inc. (NASDAQ:SAMG - Free Report) by 46.7% in the first quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 229,211 shares of the asset manager's stock after selling 200,669 shares during the quarter. Punch & Associates Investment Management Inc. owned approximately 1.68% of Silvercrest Asset Management Group worth $3,750,000 as of its most recent SEC filing.

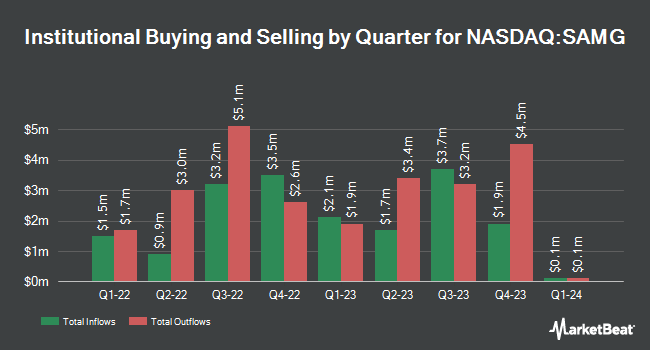

Several other large investors have also recently made changes to their positions in SAMG. Nuveen LLC purchased a new stake in shares of Silvercrest Asset Management Group during the 1st quarter valued at $331,000. R Squared Ltd increased its position in shares of Silvercrest Asset Management Group by 126.9% during the 1st quarter. R Squared Ltd now owns 15,111 shares of the asset manager's stock valued at $247,000 after purchasing an additional 8,451 shares during the last quarter. Northern Trust Corp increased its position in shares of Silvercrest Asset Management Group by 5.1% during the 4th quarter. Northern Trust Corp now owns 77,304 shares of the asset manager's stock valued at $1,422,000 after purchasing an additional 3,751 shares during the last quarter. Bank of America Corp DE increased its position in shares of Silvercrest Asset Management Group by 12.0% during the 4th quarter. Bank of America Corp DE now owns 29,825 shares of the asset manager's stock valued at $548,000 after purchasing an additional 3,185 shares during the last quarter. Finally, Martingale Asset Management L P increased its position in shares of Silvercrest Asset Management Group by 11.1% during the 1st quarter. Martingale Asset Management L P now owns 27,954 shares of the asset manager's stock valued at $457,000 after purchasing an additional 2,800 shares during the last quarter. 47.59% of the stock is owned by hedge funds and other institutional investors.

Silvercrest Asset Management Group Price Performance

Shares of Silvercrest Asset Management Group stock traded up $0.05 during trading hours on Friday, hitting $16.14. 10,957 shares of the company's stock traded hands, compared to its average volume of 43,214. Silvercrest Asset Management Group Inc. has a 12-month low of $13.54 and a 12-month high of $19.20. The stock has a market capitalization of $202.82 million, a price-to-earnings ratio of 18.34 and a beta of 0.81. The company has a fifty day simple moving average of $16.38 and a 200-day simple moving average of $15.91.

Silvercrest Asset Management Group Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, September 19th. Stockholders of record on Friday, September 12th will be given a dividend of $0.21 per share. The ex-dividend date of this dividend is Friday, September 12th. This represents a $0.84 annualized dividend and a dividend yield of 5.2%. This is a boost from Silvercrest Asset Management Group's previous quarterly dividend of $0.20. Silvercrest Asset Management Group's payout ratio is 90.91%.

About Silvercrest Asset Management Group

(

Free Report)

Silvercrest Asset Management Group Inc, a wealth management firm, provides financial advisory and related family office services in the United States. The company serves ultra-high net worth individuals and families, as well as their trusts; endowments; foundations; and other institutional investors.

Read More

Before you consider Silvercrest Asset Management Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silvercrest Asset Management Group wasn't on the list.

While Silvercrest Asset Management Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.