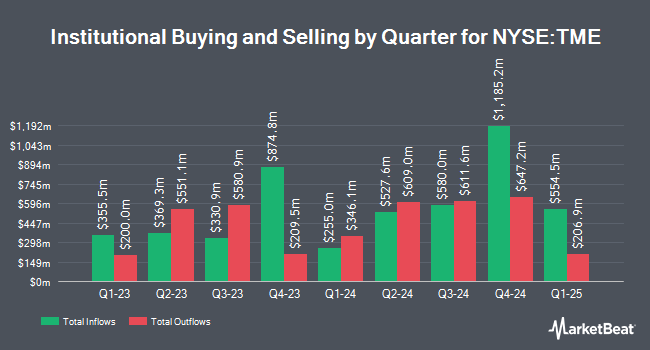

QRG Capital Management Inc. bought a new stake in Tencent Music Entertainment Group Sponsored ADR (NYSE:TME - Free Report) in the second quarter, according to its most recent Form 13F filing with the SEC. The institutional investor bought 12,462 shares of the company's stock, valued at approximately $243,000.

A number of other large investors have also recently made changes to their positions in TME. SVB Wealth LLC acquired a new stake in shares of Tencent Music Entertainment Group in the 1st quarter valued at about $34,000. Banque Transatlantique SA purchased a new position in shares of Tencent Music Entertainment Group in the 1st quarter valued at approximately $46,000. Brooklyn Investment Group grew its stake in shares of Tencent Music Entertainment Group by 957.1% in the 1st quarter. Brooklyn Investment Group now owns 4,757 shares of the company's stock valued at $69,000 after purchasing an additional 4,307 shares during the last quarter. Oppenheimer Asset Management Inc. grew its stake in shares of Tencent Music Entertainment Group by 35.6% in the 1st quarter. Oppenheimer Asset Management Inc. now owns 13,609 shares of the company's stock valued at $196,000 after purchasing an additional 3,570 shares during the last quarter. Finally, Eschler Asset Management LLP purchased a new position in shares of Tencent Music Entertainment Group in the 1st quarter valued at approximately $206,000. 24.32% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several research analysts have weighed in on the company. Daiwa Capital Markets upgraded Tencent Music Entertainment Group from a "neutral" rating to an "outperform" rating in a research note on Tuesday, August 12th. Weiss Ratings reiterated a "buy (b-)" rating on shares of Tencent Music Entertainment Group in a research note on Wednesday, October 8th. Benchmark lifted their target price on Tencent Music Entertainment Group from $19.00 to $28.00 and gave the company a "buy" rating in a research note on Wednesday, August 13th. Sanford C. Bernstein set a $27.50 target price on Tencent Music Entertainment Group and gave the company an "outperform" rating in a research note on Wednesday, August 13th. Finally, Wall Street Zen upgraded Tencent Music Entertainment Group from a "hold" rating to a "buy" rating in a research note on Friday, August 22nd. Two analysts have rated the stock with a Strong Buy rating and ten have given a Buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Buy" and a consensus price target of $24.47.

Check Out Our Latest Analysis on TME

Tencent Music Entertainment Group Stock Performance

Shares of TME stock opened at $22.45 on Monday. The company has a market cap of $38.53 billion, a price-to-earnings ratio of 24.67 and a beta of 0.51. The stock has a 50 day simple moving average of $24.28 and a 200-day simple moving average of $19.50. Tencent Music Entertainment Group Sponsored ADR has a 12-month low of $10.11 and a 12-month high of $26.70. The company has a current ratio of 1.87, a quick ratio of 1.87 and a debt-to-equity ratio of 0.04.

About Tencent Music Entertainment Group

(

Free Report)

Tencent Music Entertainment Group operates online music entertainment platforms to provide music streaming, online karaoke, and live streaming services in the People's Republic of China. It offers QQ Music, Kugou Music, and Kuwo Music that enable users to discover music in personalized ways; long-form audio content, including audiobooks, podcasts and talk shows, as well as music-oriented video content comprising music videos, live performances, and short videos; and WeSing, which enables users to sing along from its library of karaoke songs and share their performances in audio or video formats with friends.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tencent Music Entertainment Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tencent Music Entertainment Group wasn't on the list.

While Tencent Music Entertainment Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.