QSM Asset Management Ltd acquired a new position in PayPal Holdings, Inc. (NASDAQ:PYPL - Free Report) during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 99,531 shares of the credit services provider's stock, valued at approximately $8,512,000. PayPal makes up about 7.3% of QSM Asset Management Ltd's investment portfolio, making the stock its biggest position.

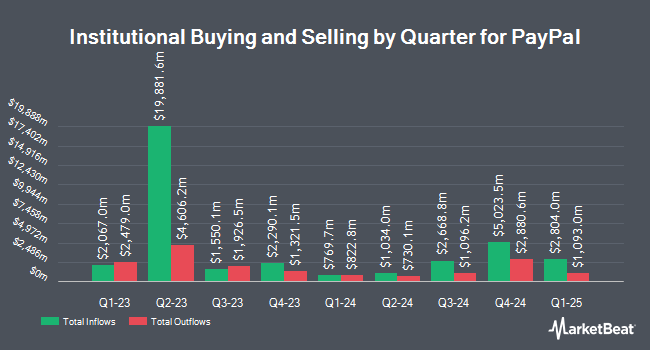

Other institutional investors have also made changes to their positions in the company. Mpwm Advisory Solutions LLC bought a new stake in shares of PayPal in the fourth quarter worth $25,000. Hurley Capital LLC acquired a new position in PayPal during the fourth quarter worth $27,000. Bernard Wealth Management Corp. acquired a new position in PayPal during the fourth quarter worth $34,000. Pinney & Scofield Inc. acquired a new position in PayPal during the fourth quarter worth $35,000. Finally, Fourth Dimension Wealth LLC acquired a new position in PayPal during the fourth quarter worth $38,000. Institutional investors own 68.32% of the company's stock.

PayPal Price Performance

Shares of PYPL traded down $0.04 during mid-day trading on Wednesday, reaching $71.44. The company had a trading volume of 6,271,190 shares, compared to its average volume of 11,202,010. The company's 50 day simple moving average is $66.32 and its 200 day simple moving average is $76.97. PayPal Holdings, Inc. has a 1-year low of $55.85 and a 1-year high of $93.66. The company has a debt-to-equity ratio of 0.48, a quick ratio of 1.26 and a current ratio of 1.26. The company has a market capitalization of $69.48 billion, a price-to-earnings ratio of 17.82, a P/E/G ratio of 1.27 and a beta of 1.51.

PayPal (NASDAQ:PYPL - Get Free Report) last posted its quarterly earnings results on Tuesday, April 29th. The credit services provider reported $1.33 earnings per share for the quarter, beating analysts' consensus estimates of $1.16 by $0.17. PayPal had a net margin of 13.04% and a return on equity of 23.67%. The company had revenue of $7.79 billion for the quarter, compared to the consensus estimate of $7.84 billion. During the same period last year, the company posted $1.08 EPS. The firm's quarterly revenue was up 1.2% compared to the same quarter last year. Analysts expect that PayPal Holdings, Inc. will post 5.03 EPS for the current year.

Insider Activity

In other news, Director Gail J. Mcgovern sold 2,446 shares of the firm's stock in a transaction that occurred on Thursday, February 27th. The shares were sold at an average price of $72.15, for a total value of $176,478.90. Following the sale, the director now directly owns 29,734 shares in the company, valued at approximately $2,145,308.10. This trade represents a 7.60% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 0.14% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

A number of equities analysts recently weighed in on PYPL shares. Royal Bank of Canada lowered their target price on shares of PayPal from $104.00 to $88.00 and set an "outperform" rating on the stock in a report on Wednesday, April 30th. Macquarie lowered their target price on shares of PayPal from $117.00 to $95.00 and set an "outperform" rating on the stock in a report on Tuesday, April 29th. Morgan Stanley boosted their target price on shares of PayPal from $79.00 to $80.00 and gave the stock an "equal weight" rating in a report on Wednesday, February 26th. UBS Group decreased their price objective on shares of PayPal from $88.00 to $75.00 and set a "neutral" rating on the stock in a report on Wednesday, April 30th. Finally, Barclays dropped their price objective on shares of PayPal from $110.00 to $80.00 and set an "overweight" rating on the stock in a research report on Tuesday, April 15th. Two research analysts have rated the stock with a sell rating, fifteen have issued a hold rating, twenty have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $83.68.

View Our Latest Stock Analysis on PYPL

About PayPal

(

Free Report)

PayPal Holdings, Inc operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide. It operates a two-sided network at scale that connects merchants and consumers that enables its customers to connect, transact, and send and receive payments through online and in person, as well as transfer and withdraw funds using various funding sources, such as bank accounts, PayPal or Venmo account balance, PayPal and Venmo branded credit products comprising its installment products, credit and debit cards, and cryptocurrencies, as well as other stored value products, including gift cards and eligible rewards.

Recommended Stories

Before you consider PayPal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PayPal wasn't on the list.

While PayPal currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.