Quantbot Technologies LP increased its position in NMI Holdings Inc (NASDAQ:NMIH - Free Report) by 87.4% during the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 62,140 shares of the financial services provider's stock after purchasing an additional 28,987 shares during the period. Quantbot Technologies LP owned approximately 0.08% of NMI worth $2,240,000 at the end of the most recent quarter.

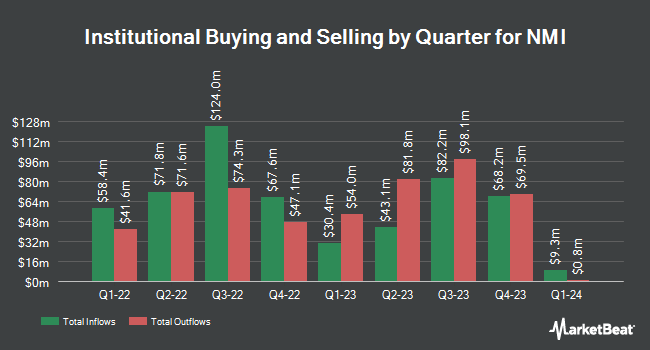

Several other large investors have also bought and sold shares of the stock. Sumitomo Mitsui Trust Group Inc. increased its position in shares of NMI by 18.2% during the 1st quarter. Sumitomo Mitsui Trust Group Inc. now owns 7,800 shares of the financial services provider's stock valued at $281,000 after purchasing an additional 1,200 shares during the last quarter. Principal Financial Group Inc. increased its holdings in NMI by 2.3% in the 1st quarter. Principal Financial Group Inc. now owns 462,641 shares of the financial services provider's stock worth $16,678,000 after acquiring an additional 10,377 shares during the last quarter. Wealth Enhancement Advisory Services LLC boosted its stake in NMI by 90.8% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 11,543 shares of the financial services provider's stock worth $416,000 after purchasing an additional 5,492 shares during the period. Entropy Technologies LP boosted its stake in NMI by 136.9% in the 1st quarter. Entropy Technologies LP now owns 18,688 shares of the financial services provider's stock worth $674,000 after purchasing an additional 10,800 shares during the period. Finally, Allspring Global Investments Holdings LLC boosted its stake in NMI by 53.9% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 19,012 shares of the financial services provider's stock worth $696,000 after purchasing an additional 6,659 shares during the period. 94.12% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

A number of analysts have recently issued reports on the company. Wall Street Zen downgraded NMI from a "buy" rating to a "hold" rating in a research report on Saturday, July 12th. Compass Point reiterated a "buy" rating and issued a $37.00 price objective (up previously from $34.00) on shares of NMI in a research report on Friday, May 23rd. Keefe, Bruyette & Woods downgraded NMI from an "outperform" rating to a "market perform" rating and boosted their price objective for the company from $42.00 to $43.00 in a research report on Monday, July 7th. Barclays boosted their target price on NMI from $41.00 to $42.00 and gave the company an "equal weight" rating in a research note on Tuesday, July 8th. Finally, JPMorgan Chase & Co. boosted their target price on NMI from $41.00 to $44.00 and gave the company an "overweight" rating in a research note on Friday, July 11th. Three equities research analysts have rated the stock with a Buy rating and three have assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, NMI has an average rating of "Moderate Buy" and an average target price of $42.33.

Get Our Latest Research Report on NMIH

Insider Activity

In other NMI news, Chairman Bradley M. Shuster sold 21,545 shares of the firm's stock in a transaction that occurred on Friday, June 6th. The stock was sold at an average price of $39.56, for a total transaction of $852,320.20. Following the completion of the transaction, the chairman owned 409,792 shares in the company, valued at $16,211,371.52. This trade represents a 4.99% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Corporate insiders own 3.00% of the company's stock.

NMI Stock Performance

Shares of NASDAQ:NMIH traded down $0.09 during midday trading on Tuesday, reaching $39.53. 32,752 shares of the company's stock traded hands, compared to its average volume of 561,579. NMI Holdings Inc has a one year low of $31.90 and a one year high of $43.20. The stock has a 50 day moving average of $39.54 and a 200 day moving average of $37.44. The company has a debt-to-equity ratio of 0.17, a quick ratio of 0.74 and a current ratio of 0.74. The company has a market cap of $3.07 billion, a price-to-earnings ratio of 8.39, a P/E/G ratio of 1.17 and a beta of 0.57.

NMI (NASDAQ:NMIH - Get Free Report) last posted its earnings results on Tuesday, July 29th. The financial services provider reported $1.22 earnings per share for the quarter, beating analysts' consensus estimates of $1.16 by $0.06. The company had revenue of $149.07 million for the quarter, compared to the consensus estimate of $173.39 million. NMI had a return on equity of 16.51% and a net margin of 55.57%.NMI's revenue was up 7.2% on a year-over-year basis. During the same quarter in the prior year, the company earned $1.20 earnings per share. As a group, equities research analysts anticipate that NMI Holdings Inc will post 4.62 EPS for the current fiscal year.

NMI Company Profile

(

Free Report)

NMI Holdings, Inc provides private mortgage guaranty insurance services in the United States. The company offers mortgage insurance services, such as primary and pool insurance; and outsourced loan review services to mortgage loan originators. It serves national and regional mortgage banks, money center banks, credit unions, community banks, builder-owned mortgage lenders, internet-sourced lenders, and other non-bank lenders.

Featured Articles

Before you consider NMI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NMI wasn't on the list.

While NMI currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.