Quantbot Technologies LP raised its holdings in Apollo Global Management Inc. (NYSE:APO - Free Report) by 233.1% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 39,650 shares of the financial services provider's stock after buying an additional 27,747 shares during the quarter. Quantbot Technologies LP's holdings in Apollo Global Management were worth $5,430,000 as of its most recent SEC filing.

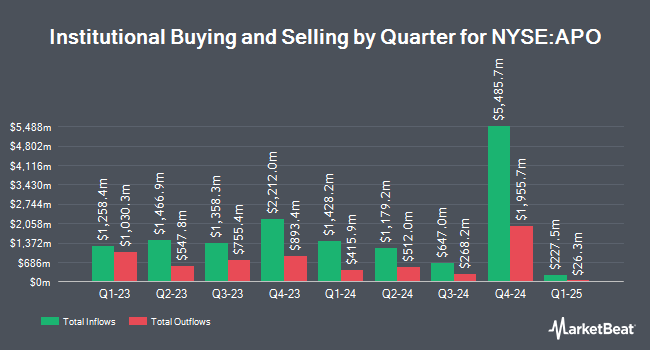

Other hedge funds and other institutional investors have also modified their holdings of the company. Boston Partners bought a new stake in Apollo Global Management during the 1st quarter worth approximately $370,543,000. Nuveen LLC bought a new position in shares of Apollo Global Management during the 1st quarter worth approximately $342,335,000. Price T Rowe Associates Inc. MD increased its stake in shares of Apollo Global Management by 36.9% during the 4th quarter. Price T Rowe Associates Inc. MD now owns 6,452,004 shares of the financial services provider's stock worth $1,065,615,000 after purchasing an additional 1,739,807 shares during the last quarter. Northern Trust Corp raised its stake in Apollo Global Management by 50.0% in the fourth quarter. Northern Trust Corp now owns 4,382,740 shares of the financial services provider's stock valued at $723,853,000 after buying an additional 1,460,689 shares during the period. Finally, Nuveen Asset Management LLC lifted its holdings in Apollo Global Management by 71.4% during the 4th quarter. Nuveen Asset Management LLC now owns 2,599,936 shares of the financial services provider's stock valued at $429,405,000 after purchasing an additional 1,082,825 shares during the last quarter. Institutional investors own 77.06% of the company's stock.

Apollo Global Management Stock Up 0.0%

APO stock traded up $0.0650 during midday trading on Friday, hitting $134.0750. The stock had a trading volume of 3,419,831 shares, compared to its average volume of 3,603,245. The business has a 50-day moving average of $142.87 and a two-hundred day moving average of $139.70. Apollo Global Management Inc. has a 52-week low of $102.58 and a 52-week high of $189.49. The firm has a market cap of $76.69 billion, a price-to-earnings ratio of 25.06, a price-to-earnings-growth ratio of 1.46 and a beta of 1.62. The company has a debt-to-equity ratio of 0.37, a current ratio of 1.27 and a quick ratio of 1.27.

Apollo Global Management (NYSE:APO - Get Free Report) last released its earnings results on Tuesday, August 5th. The financial services provider reported $1.92 EPS for the quarter, topping the consensus estimate of $1.84 by $0.08. The business had revenue of $6,550,000 billion for the quarter, compared to the consensus estimate of $1.01 billion. Apollo Global Management had a return on equity of 13.38% and a net margin of 13.25%.During the same period in the previous year, the company posted $1.64 earnings per share. As a group, equities research analysts forecast that Apollo Global Management Inc. will post 8 earnings per share for the current fiscal year.

Apollo Global Management Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, August 29th. Investors of record on Monday, August 18th will be given a dividend of $0.51 per share. This represents a $2.04 dividend on an annualized basis and a yield of 1.5%. The ex-dividend date is Monday, August 18th. Apollo Global Management's dividend payout ratio is 38.13%.

Insiders Place Their Bets

In related news, CFO Martin Kelly sold 15,500 shares of the stock in a transaction dated Tuesday, August 12th. The stock was sold at an average price of $145.11, for a total transaction of $2,249,205.00. Following the completion of the sale, the chief financial officer owned 332,399 shares in the company, valued at approximately $48,234,418.89. This trade represents a 4.46% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Whitney Chatterjee sold 4,500 shares of the stock in a transaction dated Wednesday, August 6th. The stock was sold at an average price of $146.03, for a total value of $657,135.00. Following the sale, the insider owned 83,192 shares of the company's stock, valued at $12,148,527.76. This represents a 5.13% decrease in their position. The disclosure for this sale can be found here. 8.20% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on APO. Cowen reissued a "buy" rating on shares of Apollo Global Management in a report on Monday, May 5th. Piper Sandler reduced their target price on Apollo Global Management from $193.00 to $174.00 and set an "overweight" rating on the stock in a report on Monday, May 5th. Citigroup lifted their price objective on shares of Apollo Global Management from $160.00 to $170.00 and gave the company a "buy" rating in a research note on Thursday, July 10th. Wells Fargo & Company raised their target price on Apollo Global Management from $160.00 to $173.00 and gave the company an "overweight" rating in a report on Friday, July 11th. Finally, Evercore ISI upped their price objective on Apollo Global Management from $155.00 to $160.00 and gave the company an "outperform" rating in a research note on Wednesday, August 6th. One analyst has rated the stock with a Strong Buy rating, sixteen have given a Buy rating and two have issued a Hold rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $163.28.

View Our Latest Research Report on Apollo Global Management

Apollo Global Management Profile

(

Free Report)

Apollo Global Management, Inc is a private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets. The firm prefers to invest in private and public markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth, venture capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions.

Featured Articles

Before you consider Apollo Global Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apollo Global Management wasn't on the list.

While Apollo Global Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report