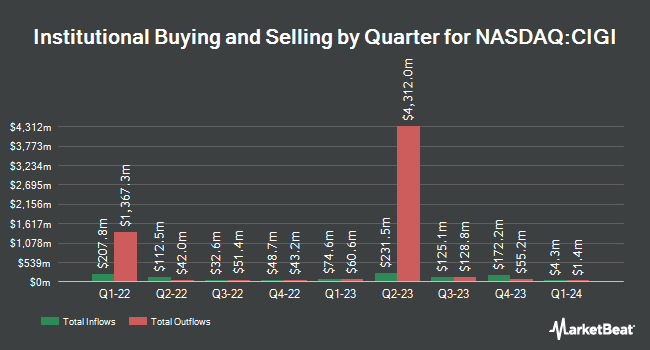

Quantbot Technologies LP lessened its holdings in Colliers International Group Inc. (NASDAQ:CIGI - Free Report) TSE: CIGI by 48.0% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 6,977 shares of the financial services provider's stock after selling 6,432 shares during the period. Quantbot Technologies LP's holdings in Colliers International Group were worth $846,000 at the end of the most recent reporting period.

A number of other institutional investors have also modified their holdings of the company. Aviso Financial Inc. raised its position in shares of Colliers International Group by 7.8% in the first quarter. Aviso Financial Inc. now owns 33,905 shares of the financial services provider's stock valued at $4,105,000 after buying an additional 2,457 shares during the last quarter. Northwest & Ethical Investments L.P. raised its position in shares of Colliers International Group by 51.9% in the first quarter. Northwest & Ethical Investments L.P. now owns 22,419 shares of the financial services provider's stock valued at $2,715,000 after buying an additional 7,656 shares during the last quarter. Caitong International Asset Management Co. Ltd acquired a new position in shares of Colliers International Group in the first quarter valued at approximately $33,000. AGF Management Ltd. raised its position in shares of Colliers International Group by 34.2% in the first quarter. AGF Management Ltd. now owns 76,502 shares of the financial services provider's stock valued at $9,258,000 after buying an additional 19,478 shares during the last quarter. Finally, Nuveen LLC acquired a new position in shares of Colliers International Group in the first quarter valued at approximately $4,398,000. Institutional investors and hedge funds own 80.09% of the company's stock.

Wall Street Analyst Weigh In

CIGI has been the subject of a number of analyst reports. JMP Securities initiated coverage on shares of Colliers International Group in a research report on Monday, July 21st. They issued a "market perform" rating for the company. National Bankshares boosted their price objective on shares of Colliers International Group from $169.00 to $175.00 and gave the company an "outperform" rating in a research report on Friday, August 1st. Raymond James Financial boosted their price objective on shares of Colliers International Group from $170.00 to $180.00 and gave the company an "outperform" rating in a research report on Friday, August 1st. JPMorgan Chase & Co. upped their price target on shares of Colliers International Group from $137.00 to $181.00 and gave the stock a "neutral" rating in a research report on Tuesday. Finally, CIBC upped their price target on shares of Colliers International Group from $149.00 to $175.00 and gave the stock an "outperformer" rating in a research report on Friday, August 1st. Two investment analysts have rated the stock with a Strong Buy rating, six have assigned a Buy rating and five have given a Hold rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $172.30.

Check Out Our Latest Report on Colliers International Group

Colliers International Group Trading Down 0.1%

CIGI stock traded down $0.22 on Friday, hitting $165.35. 128,170 shares of the company were exchanged, compared to its average volume of 151,570. Colliers International Group Inc. has a twelve month low of $100.86 and a twelve month high of $170.65. The company has a debt-to-equity ratio of 1.24, a current ratio of 1.17 and a quick ratio of 1.17. The business's fifty day moving average is $146.64 and its two-hundred day moving average is $130.72. The stock has a market capitalization of $8.18 billion, a price-to-earnings ratio of 75.16 and a beta of 1.44.

Colliers International Group (NASDAQ:CIGI - Get Free Report) TSE: CIGI last issued its quarterly earnings results on Thursday, July 31st. The financial services provider reported $1.72 EPS for the quarter, topping the consensus estimate of $1.52 by $0.20. Colliers International Group had a net margin of 2.17% and a return on equity of 20.82%. The firm had revenue of $1.37 billion during the quarter, compared to analyst estimates of $1.29 billion. During the same quarter in the prior year, the business posted $1.36 earnings per share. Colliers International Group's revenue for the quarter was up 18.3% compared to the same quarter last year. As a group, research analysts forecast that Colliers International Group Inc. will post 6.2 earnings per share for the current year.

About Colliers International Group

(

Free Report)

Colliers International Group Inc provides commercial real estate professional and investment management services to corporate and institutional clients in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers outsourcing and advisory services, such as engineering and project management, property management, valuation, and other services, as well as loan servicing for commercial real estate clients.

See Also

Before you consider Colliers International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Colliers International Group wasn't on the list.

While Colliers International Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.