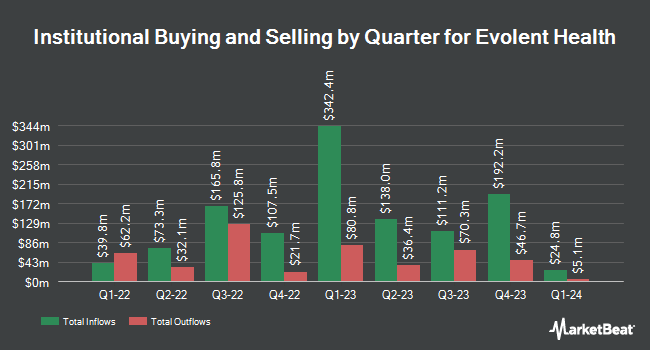

Quantbot Technologies LP cut its position in shares of Evolent Health, Inc (NYSE:EVH - Free Report) by 69.8% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 36,315 shares of the technology company's stock after selling 83,741 shares during the quarter. Quantbot Technologies LP's holdings in Evolent Health were worth $344,000 at the end of the most recent quarter.

A number of other institutional investors have also added to or reduced their stakes in EVH. Banque Cantonale Vaudoise acquired a new stake in Evolent Health during the first quarter worth about $25,000. US Bancorp DE grew its position in Evolent Health by 291.0% during the first quarter. US Bancorp DE now owns 5,153 shares of the technology company's stock worth $49,000 after buying an additional 3,835 shares in the last quarter. Signaturefd LLC grew its position in Evolent Health by 400.6% during the first quarter. Signaturefd LLC now owns 7,043 shares of the technology company's stock worth $67,000 after buying an additional 5,636 shares in the last quarter. GAMMA Investing LLC grew its position in Evolent Health by 5,036.4% during the first quarter. GAMMA Investing LLC now owns 9,451 shares of the technology company's stock worth $90,000 after buying an additional 9,267 shares in the last quarter. Finally, State of Wyoming acquired a new stake in Evolent Health during the fourth quarter worth about $95,000.

Analysts Set New Price Targets

A number of research firms recently weighed in on EVH. Piper Sandler lifted their target price on Evolent Health from $16.00 to $18.00 and gave the stock an "overweight" rating in a research report on Thursday. JMP Securities reissued a "market outperform" rating and issued a $13.00 price target on shares of Evolent Health in a research report on Friday, June 20th. Truist Financial increased their price target on shares of Evolent Health from $14.00 to $16.00 and gave the stock a "buy" rating in a research report on Thursday, July 17th. Needham & Company LLC reissued a "buy" rating and issued a $15.00 price target on shares of Evolent Health in a research report on Tuesday, May 13th. Finally, UBS Group increased their price target on shares of Evolent Health from $14.00 to $15.00 and gave the stock a "buy" rating in a research report on Friday, May 9th. One investment analyst has rated the stock with a Strong Buy rating, twelve have assigned a Buy rating and one has issued a Hold rating to the company. According to MarketBeat, the stock currently has an average rating of "Buy" and an average price target of $18.07.

Check Out Our Latest Report on Evolent Health

Evolent Health Price Performance

NYSE:EVH traded down $0.01 on Monday, reaching $9.63. The stock had a trading volume of 1,367,209 shares, compared to its average volume of 3,772,439. The company has a market capitalization of $1.13 billion, a P/E ratio of -5.98 and a beta of 0.73. Evolent Health, Inc has a 1-year low of $7.06 and a 1-year high of $32.35. The company has a quick ratio of 1.01, a current ratio of 1.01 and a debt-to-equity ratio of 0.72. The stock has a fifty day moving average price of $10.14 and a 200-day moving average price of $9.54.

Evolent Health (NYSE:EVH - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The technology company reported ($0.10) EPS for the quarter, missing analysts' consensus estimates of $0.10 by ($0.20). The firm had revenue of $444.33 million during the quarter, compared to analyst estimates of $459.43 million. Evolent Health had a negative net margin of 5.94% and a positive return on equity of 1.83%. Evolent Health's quarterly revenue was down 31.3% on a year-over-year basis. During the same quarter last year, the firm earned $0.30 earnings per share. Evolent Health has set its Q3 2025 guidance at EPS. Research analysts forecast that Evolent Health, Inc will post 0.08 EPS for the current year.

About Evolent Health

(

Free Report)

Evolent Health, Inc, through its subsidiary, Evolent Health LLC, offers specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States. The company provides platform for health plan administration and value-based business infrastructure. It offers administrative services, such as health plan services, pharmacy benefits management, risk management, analytics and reporting, and leadership and management; and Identifi, a proprietary technology system that aggregates and analyzes data, manages care workflows, and engages patients.

Read More

Before you consider Evolent Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evolent Health wasn't on the list.

While Evolent Health currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.