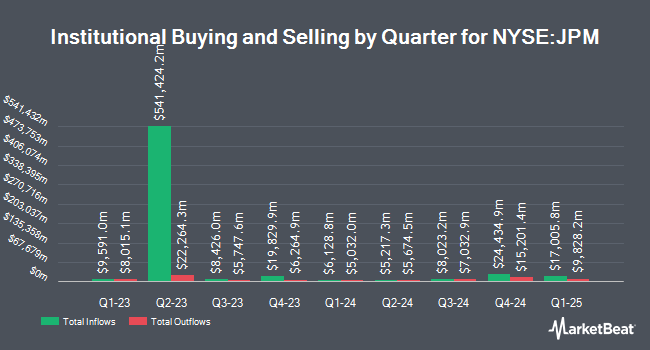

R. W. Roge & Company Inc. boosted its holdings in JPMorgan Chase & Co. (NYSE:JPM - Free Report) by 61.8% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 2,501 shares of the financial services provider's stock after buying an additional 955 shares during the period. R. W. Roge & Company Inc.'s holdings in JPMorgan Chase & Co. were worth $613,000 as of its most recent SEC filing.

Several other hedge funds also recently bought and sold shares of JPM. Florida Financial Advisors LLC raised its holdings in shares of JPMorgan Chase & Co. by 62.5% during the first quarter. Florida Financial Advisors LLC now owns 9,863 shares of the financial services provider's stock worth $2,416,000 after acquiring an additional 3,792 shares during the period. Fourth Dimension Wealth LLC acquired a new stake in shares of JPMorgan Chase & Co. during the fourth quarter worth $471,000. Crown Wealth Group LLC raised its holdings in shares of JPMorgan Chase & Co. by 5.4% during the first quarter. Crown Wealth Group LLC now owns 4,320 shares of the financial services provider's stock worth $1,060,000 after acquiring an additional 222 shares during the period. Morse Asset Management Inc raised its holdings in shares of JPMorgan Chase & Co. by 19.5% during the first quarter. Morse Asset Management Inc now owns 2,569 shares of the financial services provider's stock worth $630,000 after acquiring an additional 420 shares during the period. Finally, Hidden Cove Wealth Management LLC raised its holdings in shares of JPMorgan Chase & Co. by 4.2% during the first quarter. Hidden Cove Wealth Management LLC now owns 2,758 shares of the financial services provider's stock worth $677,000 after acquiring an additional 112 shares during the period. 71.55% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In other JPMorgan Chase & Co. news, COO Jennifer Piepszak sold 6,128 shares of JPMorgan Chase & Co. stock in a transaction dated Thursday, June 5th. The shares were sold at an average price of $262.47, for a total value of $1,608,416.16. Following the completion of the sale, the chief operating officer owned 62,455 shares in the company, valued at $16,392,563.85. The trade was a 8.94% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, General Counsel Stacey Friedman sold 2,821 shares of JPMorgan Chase & Co. stock in a transaction dated Tuesday, May 20th. The stock was sold at an average price of $265.71, for a total transaction of $749,567.91. Following the completion of the sale, the general counsel owned 68,757 shares of the company's stock, valued at $18,269,422.47. This trade represents a 3.94% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 15,557 shares of company stock valued at $4,113,796 in the last quarter. Corporate insiders own 0.47% of the company's stock.

JPMorgan Chase & Co. Stock Performance

Shares of JPM stock traded up $3.50 during midday trading on Thursday, hitting $294.03. 4,196,981 shares of the company were exchanged, compared to its average volume of 9,936,453. The firm has a market capitalization of $808.52 billion, a P/E ratio of 15.09, a PEG ratio of 1.95 and a beta of 1.11. The company has a debt-to-equity ratio of 1.25, a quick ratio of 0.88 and a current ratio of 0.88. The firm's 50 day moving average price is $285.29 and its two-hundred day moving average price is $263.25. JPMorgan Chase & Co. has a 52 week low of $200.61 and a 52 week high of $301.29.

JPMorgan Chase & Co. (NYSE:JPM - Get Free Report) last announced its earnings results on Tuesday, July 15th. The financial services provider reported $4.96 EPS for the quarter, topping the consensus estimate of $4.48 by $0.48. The business had revenue of $44.91 billion during the quarter, compared to the consensus estimate of $43.76 billion. JPMorgan Chase & Co. had a net margin of 20.52% and a return on equity of 16.93%. JPMorgan Chase & Co.'s revenue was down 10.5% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $6.12 EPS. As a group, equities research analysts anticipate that JPMorgan Chase & Co. will post 18.1 earnings per share for the current year.

JPMorgan Chase & Co. Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, July 31st. Shareholders of record on Thursday, July 3rd were paid a $1.40 dividend. The ex-dividend date was Thursday, July 3rd. This represents a $5.60 annualized dividend and a yield of 1.9%. JPMorgan Chase & Co.'s payout ratio is 28.73%.

Wall Street Analyst Weigh In

A number of brokerages recently commented on JPM. Truist Financial raised their price objective on shares of JPMorgan Chase & Co. from $280.00 to $290.00 and gave the stock a "hold" rating in a report on Wednesday, July 9th. Cowen reaffirmed a "buy" rating on shares of JPMorgan Chase & Co. in a research report on Wednesday, July 16th. Hsbc Global Res downgraded shares of JPMorgan Chase & Co. from a "hold" rating to a "moderate sell" rating in a research report on Tuesday, July 8th. Keefe, Bruyette & Woods raised their target price on shares of JPMorgan Chase & Co. from $327.00 to $330.00 and gave the company an "outperform" rating in a research report on Wednesday, July 16th. Finally, Evercore ISI set a $298.00 target price on shares of JPMorgan Chase & Co. and gave the company an "outperform" rating in a research report on Monday, July 7th. Three analysts have rated the stock with a sell rating, seven have assigned a hold rating, thirteen have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $288.68.

Read Our Latest Research Report on JPM

About JPMorgan Chase & Co.

(

Free Report)

JPMorgan Chase & Co is a financial holding company, which engages in the provision of financial and investment banking services. It focuses on investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. It operates through the following segments: Consumer and Community Banking (CCB), Commercial and Investment Bank (CIB), Asset and Wealth Management (AWM), and Corporate.

Recommended Stories

Before you consider JPMorgan Chase & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JPMorgan Chase & Co. wasn't on the list.

While JPMorgan Chase & Co. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report