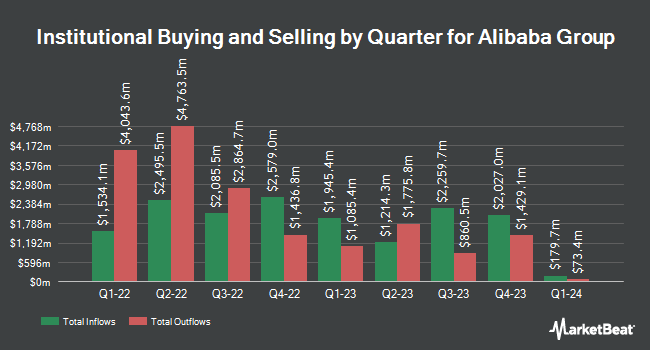

Raiffeisen Bank International AG increased its position in Alibaba Group Holding Limited (NYSE:BABA - Free Report) by 95.9% during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 17,423 shares of the specialty retailer's stock after buying an additional 8,530 shares during the period. Raiffeisen Bank International AG's holdings in Alibaba Group were worth $2,306,000 at the end of the most recent quarter.

A number of other hedge funds also recently made changes to their positions in BABA. Blair William & Co. IL increased its stake in Alibaba Group by 4.7% during the first quarter. Blair William & Co. IL now owns 93,217 shares of the specialty retailer's stock worth $12,326,000 after acquiring an additional 4,219 shares during the last quarter. Powell Investment Advisors LLC purchased a new position in Alibaba Group in the 1st quarter valued at about $331,000. DCF Advisers LLC acquired a new stake in shares of Alibaba Group during the 1st quarter worth approximately $5,131,000. MASO CAPITAL PARTNERS Ltd acquired a new stake in shares of Alibaba Group during the 1st quarter worth approximately $926,000. Finally, OVERSEA CHINESE BANKING Corp Ltd acquired a new position in shares of Alibaba Group in the first quarter worth $9,954,000. 13.47% of the stock is currently owned by hedge funds and other institutional investors.

Alibaba Group Stock Performance

NYSE BABA opened at $117.06 on Monday. The company has a market cap of $279.23 billion, a P/E ratio of 15.71, a P/E/G ratio of 1.72 and a beta of 0.17. The company has a debt-to-equity ratio of 0.19, a quick ratio of 1.55 and a current ratio of 1.55. The business's 50 day moving average price is $115.61 and its 200-day moving average price is $118.45. Alibaba Group Holding Limited has a fifty-two week low of $73.87 and a fifty-two week high of $148.43.

Alibaba Group Cuts Dividend

The company also recently disclosed a -- dividend, which was paid on Thursday, July 10th. Stockholders of record on Thursday, June 12th were issued a $0.95 dividend. The ex-dividend date of this dividend was Thursday, June 12th. This represents a dividend yield of 80.0%. Alibaba Group's dividend payout ratio is currently 12.75%.

Analysts Set New Price Targets

A number of equities research analysts have recently commented on BABA shares. Arete cut shares of Alibaba Group from a "buy" rating to a "neutral" rating and set a $153.00 target price for the company. in a report on Tuesday, June 24th. Mizuho cut their price target on shares of Alibaba Group from $170.00 to $160.00 and set an "outperform" rating on the stock in a research note on Friday, May 16th. Loop Capital set a $176.00 price target on shares of Alibaba Group in a report on Friday, May 16th. Benchmark reiterated a "buy" rating on shares of Alibaba Group in a research report on Monday, July 21st. Finally, Robert W. Baird dropped their target price on shares of Alibaba Group from $147.00 to $142.00 and set an "outperform" rating on the stock in a report on Friday, May 16th. Three research analysts have rated the stock with a hold rating and thirteen have given a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $153.29.

Check Out Our Latest Analysis on BABA

Alibaba Group Profile

(

Free Report)

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. The company operates through seven segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.