Ranch Capital Advisors Inc. purchased a new stake in shares of Evergy Inc. (NASDAQ:EVRG - Free Report) during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor purchased 26,304 shares of the company's stock, valued at approximately $1,814,000.

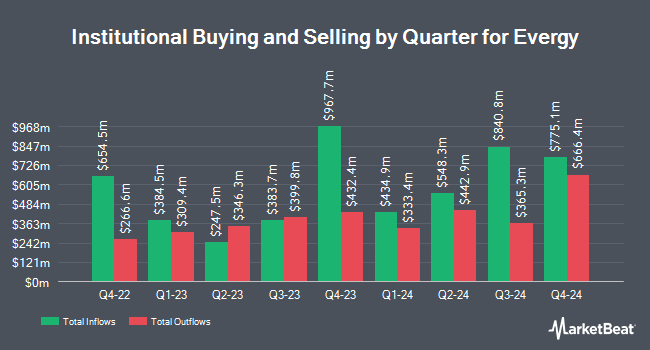

Several other institutional investors and hedge funds also recently made changes to their positions in EVRG. Stolper Co increased its position in Evergy by 0.5% in the 1st quarter. Stolper Co now owns 34,630 shares of the company's stock valued at $2,388,000 after buying an additional 169 shares in the last quarter. KCM Investment Advisors LLC increased its holdings in shares of Evergy by 3.7% during the fourth quarter. KCM Investment Advisors LLC now owns 5,946 shares of the company's stock valued at $366,000 after acquiring an additional 210 shares in the last quarter. Retirement Planning Group LLC increased its holdings in shares of Evergy by 0.9% during the fourth quarter. Retirement Planning Group LLC now owns 24,372 shares of the company's stock valued at $1,500,000 after acquiring an additional 210 shares in the last quarter. MainStreet Investment Advisors LLC raised its position in shares of Evergy by 4.7% during the fourth quarter. MainStreet Investment Advisors LLC now owns 4,877 shares of the company's stock worth $300,000 after purchasing an additional 221 shares during the period. Finally, Parallel Advisors LLC lifted its holdings in shares of Evergy by 2.5% in the 1st quarter. Parallel Advisors LLC now owns 9,338 shares of the company's stock worth $644,000 after purchasing an additional 227 shares in the last quarter. Institutional investors own 87.24% of the company's stock.

Evergy Stock Performance

EVRG traded down $0.38 during trading hours on Thursday, hitting $72.87. The stock had a trading volume of 3,368,161 shares, compared to its average volume of 2,532,348. The stock has a market cap of $16.77 billion, a PE ratio of 19.18, a price-to-earnings-growth ratio of 3.20 and a beta of 0.48. Evergy Inc. has a 1 year low of $57.28 and a 1 year high of $73.97. The company has a quick ratio of 0.29, a current ratio of 0.55 and a debt-to-equity ratio of 1.24. The company's fifty day simple moving average is $68.69 and its 200 day simple moving average is $67.39.

Evergy (NASDAQ:EVRG - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The company reported $0.82 EPS for the quarter, beating analysts' consensus estimates of $0.78 by $0.04. Evergy had a net margin of 14.87% and a return on equity of 8.84%. The company had revenue of $1.43 billion for the quarter, compared to analysts' expectations of $1.45 billion. During the same period in the prior year, the company posted $0.90 EPS. Evergy's revenue was down .7% compared to the same quarter last year. Equities analysts anticipate that Evergy Inc. will post 3.83 earnings per share for the current year.

Evergy Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, September 19th. Investors of record on Friday, August 22nd will be issued a dividend of $0.6675 per share. This represents a $2.67 dividend on an annualized basis and a yield of 3.7%. Evergy's dividend payout ratio (DPR) is 70.26%.

Analyst Upgrades and Downgrades

A number of analysts have commented on EVRG shares. LADENBURG THALM/SH SH upgraded shares of Evergy to a "strong-buy" rating in a research note on Thursday, May 8th. Wall Street Zen downgraded shares of Evergy from a "hold" rating to a "sell" rating in a research report on Thursday, May 22nd. Mizuho upped their target price on shares of Evergy from $70.00 to $74.00 and gave the stock an "outperform" rating in a report on Friday, July 18th. UBS Group upgraded Evergy from a "neutral" rating to a "buy" rating and raised their target price for the company from $68.00 to $78.00 in a report on Monday, April 28th. Finally, Citigroup boosted their price target on shares of Evergy from $77.00 to $79.00 and gave the stock a "buy" rating in a report on Friday, May 16th. One equities research analyst has rated the stock with a sell rating, eight have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $74.06.

View Our Latest Analysis on Evergy

Evergy Company Profile

(

Free Report)

Evergy, Inc, together with its subsidiaries, engages in the generation, transmission, distribution, and sale of electricity in the United States. The company generates electricity through coal, landfill gas, uranium, and natural gas and oil sources, as well as solar, wind, other renewable sources. It serves residences, commercial firms, industrials, municipalities, and other electric utilities.

Read More

Before you consider Evergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evergy wasn't on the list.

While Evergy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.