Rathbones Group PLC trimmed its holdings in AppFolio, Inc. (NASDAQ:APPF - Free Report) by 67.7% in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 2,000 shares of the software maker's stock after selling 4,187 shares during the period. Rathbones Group PLC's holdings in AppFolio were worth $440,000 as of its most recent SEC filing.

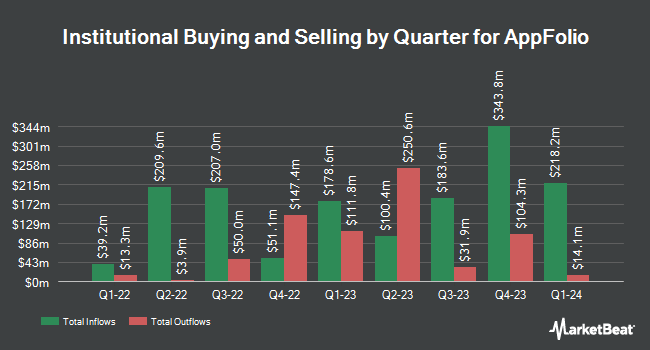

Several other large investors also recently added to or reduced their stakes in APPF. Raymond James Financial Inc. bought a new stake in AppFolio in the fourth quarter worth approximately $30,195,000. Treasurer of the State of North Carolina grew its position in AppFolio by 0.6% in the fourth quarter. Treasurer of the State of North Carolina now owns 9,960 shares of the software maker's stock worth $2,457,000 after acquiring an additional 60 shares in the last quarter. Barclays PLC boosted its holdings in shares of AppFolio by 82.9% during the 4th quarter. Barclays PLC now owns 18,084 shares of the software maker's stock worth $4,463,000 after buying an additional 8,196 shares during the period. Mariner LLC grew its stake in AppFolio by 9.0% in the 4th quarter. Mariner LLC now owns 2,107 shares of the software maker's stock valued at $520,000 after buying an additional 174 shares during the last quarter. Finally, Belpointe Asset Management LLC acquired a new position in AppFolio in the 4th quarter valued at $597,000. 85.19% of the stock is owned by institutional investors.

AppFolio Stock Down 0.0%

NASDAQ APPF traded down $0.10 during midday trading on Friday, hitting $265.30. The company had a trading volume of 274,355 shares, compared to its average volume of 416,965. The stock has a market cap of $9.51 billion, a price-to-earnings ratio of 47.89 and a beta of 0.95. The firm has a fifty day simple moving average of $251.01 and a two-hundred day simple moving average of $228.98. AppFolio, Inc. has a fifty-two week low of $189.01 and a fifty-two week high of $326.04.

AppFolio (NASDAQ:APPF - Get Free Report) last posted its quarterly earnings results on Thursday, July 31st. The software maker reported $1.38 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.27 by $0.11. The company had revenue of $235.58 million for the quarter, compared to analyst estimates of $230.10 million. AppFolio had a net margin of 23.54% and a return on equity of 26.32%. The business's quarterly revenue was up 19.4% on a year-over-year basis. During the same period last year, the business posted $1.12 EPS. As a group, equities analysts predict that AppFolio, Inc. will post 3.96 earnings per share for the current year.

Analyst Upgrades and Downgrades

APPF has been the topic of a number of research analyst reports. Piper Sandler upgraded shares of AppFolio from a "neutral" rating to an "overweight" rating and raised their target price for the company from $240.00 to $350.00 in a research note on Friday, August 1st. DA Davidson reiterated a "buy" rating and issued a $350.00 target price on shares of AppFolio in a research note on Friday, August 1st. Finally, Keefe, Bruyette & Woods upgraded shares of AppFolio from an "underperform" rating to a "market perform" rating and raised their target price for the company from $205.00 to $267.00 in a research note on Thursday, July 31st. Three research analysts have rated the stock with a hold rating and four have given a buy rating to the stock. Based on data from MarketBeat.com, AppFolio presently has an average rating of "Moderate Buy" and an average target price of $303.00.

Read Our Latest Research Report on AppFolio

Insider Transactions at AppFolio

In other AppFolio news, major shareholder Maurice J. Duca sold 2,324 shares of the firm's stock in a transaction on Tuesday, August 12th. The shares were sold at an average price of $276.80, for a total value of $643,283.20. Following the sale, the insider directly owned 35,376 shares in the company, valued at $9,792,076.80. This trade represents a 6.16% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. In the last quarter, insiders have acquired 18,500 shares of company stock valued at $4,024,220 and have sold 38,006 shares valued at $10,976,482. 4.68% of the stock is owned by corporate insiders.

AppFolio Company Profile

(

Free Report)

AppFolio, Inc, together with its subsidiaries, provides cloud business management solutions for the real estate industry in the United States. The company provides a cloud-based platform that enables users to automate and optimize common workflows; tools that assist with leasing, maintenance, and accounting; and other technology and services offered by third parties.

Featured Stories

Before you consider AppFolio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AppFolio wasn't on the list.

While AppFolio currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.