Raymond James Financial Inc. lifted its position in Annaly Capital Management Inc (NYSE:NLY - Free Report) by 18.6% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 821,476 shares of the real estate investment trust's stock after purchasing an additional 128,813 shares during the quarter. Raymond James Financial Inc. owned about 0.14% of Annaly Capital Management worth $16,684,000 at the end of the most recent reporting period.

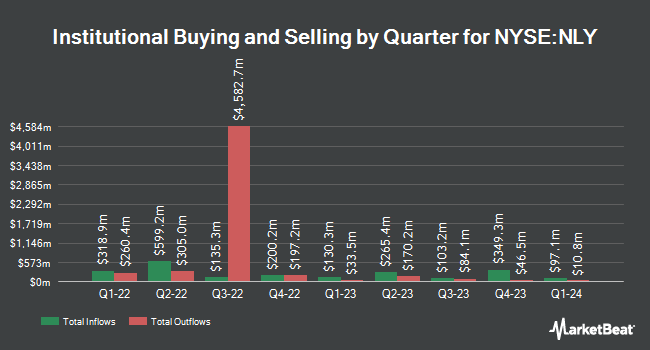

Other large investors have also recently made changes to their positions in the company. Inlight Wealth Management LLC bought a new stake in shares of Annaly Capital Management in the first quarter worth about $25,000. Financial Gravity Asset Management Inc. purchased a new position in Annaly Capital Management in the first quarter worth about $28,000. MCF Advisors LLC grew its position in Annaly Capital Management by 1,087.1% in the first quarter. MCF Advisors LLC now owns 1,745 shares of the real estate investment trust's stock worth $37,000 after acquiring an additional 1,598 shares in the last quarter. Smallwood Wealth Investment Management LLC purchased a new position in Annaly Capital Management in the first quarter worth about $36,000. Finally, Fourth Dimension Wealth LLC purchased a new position in Annaly Capital Management in the fourth quarter worth about $39,000. 51.56% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several research analysts have issued reports on NLY shares. Jones Trading restated a "buy" rating and set a $21.00 target price on shares of Annaly Capital Management in a research report on Thursday, July 24th. Zacks Research lowered Annaly Capital Management from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, August 19th. Royal Bank Of Canada dropped their target price on Annaly Capital Management from $22.00 to $21.00 and set an "outperform" rating for the company in a research report on Tuesday, May 27th. UBS Group restated a "neutral" rating and set a $20.00 target price (up previously from $18.00) on shares of Annaly Capital Management in a research report on Thursday, July 10th. Finally, Keefe, Bruyette & Woods boosted their price target on Annaly Capital Management from $20.50 to $21.50 and gave the company an "outperform" rating in a report on Friday, July 25th. Seven analysts have rated the stock with a Buy rating and four have given a Hold rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $20.72.

Check Out Our Latest Analysis on Annaly Capital Management

Annaly Capital Management Stock Down 1.3%

NYSE:NLY traded down $0.29 during trading hours on Tuesday, reaching $20.91. The company's stock had a trading volume of 3,113,793 shares, compared to its average volume of 7,646,115. The company has a market capitalization of $13.42 billion, a P/E ratio of 20.70, a price-to-earnings-growth ratio of 5.02 and a beta of 1.24. Annaly Capital Management Inc has a 12 month low of $16.59 and a 12 month high of $22.11. The company has a debt-to-equity ratio of 0.21, a quick ratio of 0.11 and a current ratio of 0.11. The stock has a 50 day moving average price of $20.25 and a two-hundred day moving average price of $19.96.

Annaly Capital Management (NYSE:NLY - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The real estate investment trust reported $0.73 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.72 by $0.01. The business had revenue of $273.20 million for the quarter, compared to the consensus estimate of $237.00 million. Annaly Capital Management had a return on equity of 15.53% and a net margin of 13.76%. Equities analysts predict that Annaly Capital Management Inc will post 2.81 EPS for the current fiscal year.

Annaly Capital Management Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, July 31st. Stockholders of record on Monday, June 30th were given a dividend of $0.70 per share. The ex-dividend date of this dividend was Monday, June 30th. This represents a $2.80 dividend on an annualized basis and a dividend yield of 13.4%. Annaly Capital Management's dividend payout ratio is presently 277.23%.

About Annaly Capital Management

(

Free Report)

Annaly Capital Management, Inc, a diversified capital manager, engages in mortgage finance. The company invests in agency mortgage-backed securities collateralized by residential mortgages; non-agency residential whole loans and securitized products within the residential and commercial markets; mortgage servicing rights; agency commercial mortgage-backed securities; to-be-announced forward contracts; residential mortgage loans; and agency or private label credit risk transfer securities.

See Also

Before you consider Annaly Capital Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Annaly Capital Management wasn't on the list.

While Annaly Capital Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.