Raymond James Financial Inc. reduced its holdings in shares of Tractor Supply Company (NASDAQ:TSCO - Free Report) by 12.4% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 5,439,030 shares of the specialty retailer's stock after selling 770,139 shares during the quarter. Raymond James Financial Inc. owned 1.02% of Tractor Supply worth $299,691,000 as of its most recent SEC filing.

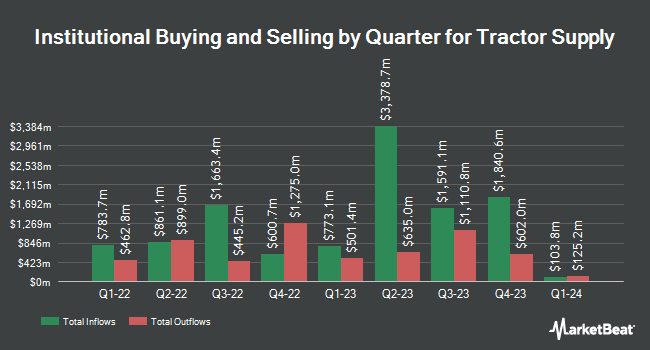

Several other institutional investors and hedge funds also recently made changes to their positions in TSCO. Capital World Investors raised its position in shares of Tractor Supply by 403.7% during the 4th quarter. Capital World Investors now owns 19,433,135 shares of the specialty retailer's stock valued at $1,031,122,000 after acquiring an additional 15,575,311 shares in the last quarter. Capital International Investors raised its position in shares of Tractor Supply by 334.7% during the 4th quarter. Capital International Investors now owns 15,429,288 shares of the specialty retailer's stock valued at $818,421,000 after acquiring an additional 11,880,010 shares in the last quarter. Price T Rowe Associates Inc. MD raised its position in shares of Tractor Supply by 287.6% during the 4th quarter. Price T Rowe Associates Inc. MD now owns 10,417,152 shares of the specialty retailer's stock valued at $552,735,000 after acquiring an additional 7,729,628 shares in the last quarter. Stifel Financial Corp raised its position in shares of Tractor Supply by 398.6% during the 4th quarter. Stifel Financial Corp now owns 8,233,999 shares of the specialty retailer's stock valued at $436,899,000 after acquiring an additional 6,582,562 shares in the last quarter. Finally, Select Equity Group L.P. raised its position in shares of Tractor Supply by 405.6% during the 4th quarter. Select Equity Group L.P. now owns 7,669,224 shares of the specialty retailer's stock valued at $406,929,000 after acquiring an additional 6,152,333 shares in the last quarter. 98.72% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities research analysts recently issued reports on TSCO shares. Guggenheim dropped their price target on Tractor Supply from $60.00 to $55.00 and set a "buy" rating on the stock in a research report on Friday, April 25th. UBS Group upped their price target on Tractor Supply from $54.00 to $61.00 and gave the company a "neutral" rating in a research report on Friday, July 25th. The Goldman Sachs Group reissued a "buy" rating on shares of Tractor Supply in a research report on Friday, July 25th. Evercore ISI increased their target price on Tractor Supply from $60.00 to $65.00 and gave the stock an "in-line" rating in a research report on Friday, July 25th. Finally, Telsey Advisory Group set a $70.00 target price on Tractor Supply in a research note on Friday, July 25th. Nine analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $61.80.

Get Our Latest Analysis on TSCO

Insider Activity

In related news, EVP Colin Yankee sold 6,680 shares of Tractor Supply stock in a transaction dated Monday, July 28th. The stock was sold at an average price of $58.40, for a total transaction of $390,112.00. Following the transaction, the executive vice president directly owned 40,142 shares of the company's stock, valued at $2,344,292.80. The trade was a 14.27% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Denise L. Jackson sold 4,630 shares of Tractor Supply stock in a transaction dated Monday, July 7th. The stock was sold at an average price of $55.93, for a total value of $258,955.90. Following the transaction, the director directly owned 35,288 shares in the company, valued at approximately $1,973,657.84. The trade was a 11.60% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 204,680 shares of company stock valued at $12,071,552 over the last quarter. Insiders own 0.65% of the company's stock.

Tractor Supply Price Performance

Shares of TSCO opened at $60.49 on Friday. The firm has a market capitalization of $32.06 billion, a price-to-earnings ratio of 29.68, a price-to-earnings-growth ratio of 3.11 and a beta of 0.75. The company has a debt-to-equity ratio of 0.68, a quick ratio of 0.16 and a current ratio of 1.28. Tractor Supply Company has a one year low of $46.85 and a one year high of $63.99. The stock's fifty day moving average is $56.02 and its 200-day moving average is $53.76.

Tractor Supply (NASDAQ:TSCO - Get Free Report) last issued its quarterly earnings results on Thursday, July 24th. The specialty retailer reported $0.81 EPS for the quarter, beating analysts' consensus estimates of $0.80 by $0.01. The company had revenue of $4.44 billion for the quarter, compared to analyst estimates of $4.40 billion. Tractor Supply had a return on equity of 46.83% and a net margin of 7.18%. The company's quarterly revenue was up 4.5% compared to the same quarter last year. During the same period last year, the company earned $3.93 earnings per share. Equities analysts anticipate that Tractor Supply Company will post 2.17 EPS for the current year.

Tractor Supply Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, September 9th. Investors of record on Monday, August 25th will be issued a dividend of $0.23 per share. This represents a $0.92 dividend on an annualized basis and a yield of 1.5%. The ex-dividend date of this dividend is Monday, August 25th. Tractor Supply's payout ratio is presently 45.10%.

Tractor Supply Profile

(

Free Report)

Tractor Supply Company operates as a rural lifestyle retailer in the United States. The company offers various merchandise, including livestock and equine feed and equipment, poultry, fencing, and sprayers and chemicals; food, treats, and equipment for dogs, cats, and other small animals, as well as dog wellness products; seasonal and recreation products comprising tractors and riders, lawn and garden, bird feeding, power equipment, and other recreational products; truck, tool, and hardware products, such as truck accessories, trailers, generators, lubricants, batteries, and hardware and tools; and clothing, gift, and décor products consist of clothing, footwear, toys, snacks, and decorative merchandise.

Further Reading

Want to see what other hedge funds are holding TSCO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Tractor Supply Company (NASDAQ:TSCO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tractor Supply, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tractor Supply wasn't on the list.

While Tractor Supply currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report