Allspring Global Investments Holdings LLC decreased its stake in Renasant Co. (NASDAQ:RNST - Free Report) by 1.2% during the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,804,279 shares of the financial services provider's stock after selling 21,131 shares during the period. Allspring Global Investments Holdings LLC owned 1.90% of Renasant worth $67,083,000 at the end of the most recent reporting period.

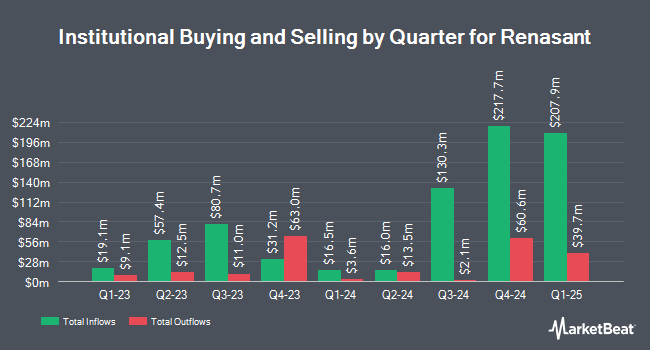

Several other hedge funds have also made changes to their positions in RNST. Vanguard Group Inc. lifted its holdings in shares of Renasant by 22.0% in the 1st quarter. Vanguard Group Inc. now owns 8,789,556 shares of the financial services provider's stock worth $298,230,000 after purchasing an additional 1,582,105 shares during the last quarter. Wellington Management Group LLP lifted its holdings in shares of Renasant by 232.8% in the 1st quarter. Wellington Management Group LLP now owns 1,590,935 shares of the financial services provider's stock worth $53,980,000 after purchasing an additional 1,112,946 shares during the last quarter. Jennison Associates LLC lifted its holdings in shares of Renasant by 33.5% in the 1st quarter. Jennison Associates LLC now owns 1,567,120 shares of the financial services provider's stock worth $53,172,000 after purchasing an additional 393,319 shares during the last quarter. Westwood Holdings Group Inc. increased its position in Renasant by 20.6% in the 1st quarter. Westwood Holdings Group Inc. now owns 2,121,838 shares of the financial services provider's stock valued at $71,994,000 after acquiring an additional 362,835 shares during the period. Finally, Nuveen LLC acquired a new stake in Renasant in the 1st quarter valued at approximately $11,878,000. Institutional investors own 77.31% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently commented on the company. Raymond James Financial restated a "strong-buy" rating on shares of Renasant in a research report on Wednesday, July 23rd. Cowen assumed coverage on Renasant in a research report on Wednesday, September 24th. They issued a "buy" rating on the stock. Hovde Group raised their target price on Renasant from $35.00 to $39.00 and gave the company a "market perform" rating in a research report on Wednesday, July 23rd. Finally, TD Cowen assumed coverage on Renasant in a research report on Thursday, September 25th. They issued a "buy" rating and a $45.00 target price on the stock. One equities research analyst has rated the stock with a Strong Buy rating, five have assigned a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat, Renasant currently has a consensus rating of "Buy" and a consensus target price of $43.00.

Check Out Our Latest Stock Analysis on RNST

Renasant Stock Up 3.4%

Shares of RNST stock opened at $36.59 on Wednesday. Renasant Co. has a 1 year low of $26.97 and a 1 year high of $40.40. The stock has a market cap of $3.48 billion, a PE ratio of 11.19 and a beta of 0.89. The business's fifty day moving average is $37.67 and its 200-day moving average is $35.55. The company has a debt-to-equity ratio of 0.16, a quick ratio of 0.94 and a current ratio of 0.96.

Renasant Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, September 30th. Stockholders of record on Tuesday, September 16th were given a dividend of $0.22 per share. The ex-dividend date was Tuesday, September 16th. This represents a $0.88 annualized dividend and a dividend yield of 2.4%. Renasant's dividend payout ratio (DPR) is 34.65%.

Renasant Company Profile

(

Free Report)

Renasant Corporation operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers. The company operates through Community Banks, Insurance, and Wealth Management segments. The Community Banks segment offers checking and savings accounts, business and personal loans, asset-based lending, and factoring equipment leasing services, as well as safe deposit and night depository facilities.

See Also

Want to see what other hedge funds are holding RNST? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Renasant Co. (NASDAQ:RNST - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Renasant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Renasant wasn't on the list.

While Renasant currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.