Russell Investments Group Ltd. increased its stake in shares of Revvity Inc. (NYSE:RVTY - Free Report) by 15.8% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 53,693 shares of the company's stock after acquiring an additional 7,306 shares during the period. Russell Investments Group Ltd.'s holdings in Revvity were worth $5,677,000 as of its most recent filing with the Securities & Exchange Commission.

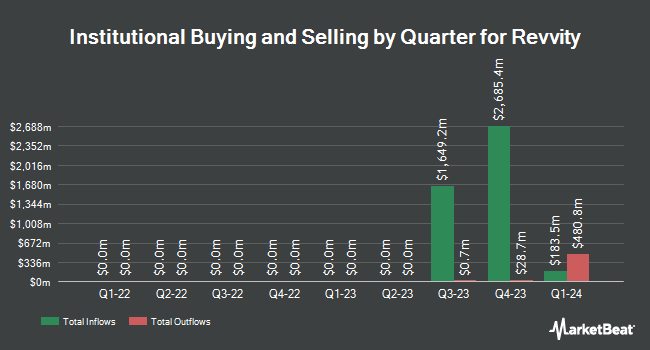

Several other hedge funds and other institutional investors have also recently bought and sold shares of RVTY. T. Rowe Price Investment Management Inc. grew its holdings in Revvity by 16.7% in the fourth quarter. T. Rowe Price Investment Management Inc. now owns 20,761,308 shares of the company's stock valued at $2,317,170,000 after purchasing an additional 2,969,326 shares during the period. Vanguard Group Inc. lifted its position in Revvity by 0.6% during the first quarter. Vanguard Group Inc. now owns 14,382,849 shares of the company's stock worth $1,521,705,000 after buying an additional 92,638 shares in the last quarter. Price T Rowe Associates Inc. MD lifted its position in Revvity by 17.8% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 7,631,597 shares of the company's stock worth $851,764,000 after buying an additional 1,151,821 shares in the last quarter. Janus Henderson Group PLC lifted its position in Revvity by 0.4% during the fourth quarter. Janus Henderson Group PLC now owns 6,358,952 shares of the company's stock worth $709,725,000 after buying an additional 23,650 shares in the last quarter. Finally, EdgePoint Investment Group Inc. lifted its position in Revvity by 51.1% during the fourth quarter. EdgePoint Investment Group Inc. now owns 4,058,231 shares of the company's stock worth $452,939,000 after buying an additional 1,372,456 shares in the last quarter. 86.65% of the stock is owned by institutional investors and hedge funds.

Revvity Price Performance

NYSE:RVTY traded down $0.79 during trading hours on Tuesday, reaching $91.35. 2,115,552 shares of the company traded hands, compared to its average volume of 1,186,052. The firm's 50-day moving average is $94.43 and its 200-day moving average is $98.51. The stock has a market cap of $10.60 billion, a P/E ratio of 38.71, a P/E/G ratio of 2.47 and a beta of 0.91. The company has a debt-to-equity ratio of 0.43, a current ratio of 3.33 and a quick ratio of 2.75. Revvity Inc. has a 1-year low of $85.12 and a 1-year high of $129.50.

Revvity (NYSE:RVTY - Get Free Report) last announced its earnings results on Monday, July 28th. The company reported $1.18 EPS for the quarter, beating analysts' consensus estimates of $1.14 by $0.04. Revvity had a return on equity of 7.66% and a net margin of 10.19%.The firm had revenue of $720.28 million for the quarter, compared to analysts' expectations of $711.26 million. During the same quarter in the prior year, the firm earned $1.22 EPS. Revvity's quarterly revenue was up 4.1% on a year-over-year basis. Revvity has set its FY 2025 guidance at 4.850-4.950 EPS. Equities research analysts expect that Revvity Inc. will post 4.94 earnings per share for the current fiscal year.

Revvity Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, November 7th. Stockholders of record on Friday, October 17th will be issued a dividend of $0.07 per share. The ex-dividend date is Friday, October 17th. This represents a $0.28 annualized dividend and a dividend yield of 0.3%. Revvity's dividend payout ratio (DPR) is 11.86%.

Wall Street Analysts Forecast Growth

A number of equities research analysts have commented on the company. Stifel Nicolaus reduced their target price on Revvity from $120.00 to $110.00 and set a "hold" rating on the stock in a research report on Tuesday, July 29th. JPMorgan Chase & Co. lowered their target price on Revvity from $120.00 to $100.00 and set a "neutral" rating for the company in a research note on Tuesday, April 29th. Raymond James Financial reissued an "outperform" rating and set a $115.00 target price (down from $120.00) on shares of Revvity in a research note on Tuesday, July 29th. Wall Street Zen cut Revvity from a "buy" rating to a "hold" rating in a research report on Sunday, August 3rd. Finally, Bank of America lowered their price objective on Revvity from $116.00 to $110.00 and set a "buy" rating for the company in a research report on Thursday, June 26th. Ten equities research analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $120.07.

View Our Latest Analysis on Revvity

Revvity Profile

(

Free Report)

Revvity, Inc provides health sciences solutions, technologies, and services in the Americas, Europe, and Asia, and internationally. The Life Sciences segment provides instruments, reagents, informatics, software, subscriptions, detection, imaging technologies, warranties, training, and services. Its Diagnostics segment provides instruments, reagents, assay platforms, and software products for the early detection of genetic disorders, such as pregnancy and early childhood, as well as infectious disease testing in the diagnostics market.

Featured Articles

Before you consider Revvity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revvity wasn't on the list.

While Revvity currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.