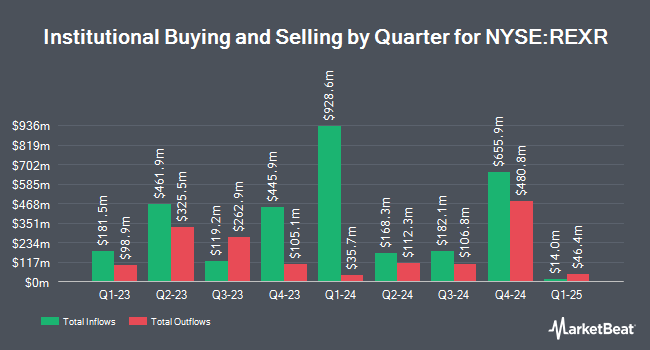

Cbre Investment Management Listed Real Assets LLC lowered its position in Rexford Industrial Realty, Inc. (NYSE:REXR - Free Report) by 65.3% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 1,169,568 shares of the real estate investment trust's stock after selling 2,198,052 shares during the quarter. Cbre Investment Management Listed Real Assets LLC owned about 0.49% of Rexford Industrial Realty worth $45,789,000 at the end of the most recent reporting period.

A number of other institutional investors also recently bought and sold shares of REXR. Teacher Retirement System of Texas grew its stake in shares of Rexford Industrial Realty by 198.3% in the 1st quarter. Teacher Retirement System of Texas now owns 39,028 shares of the real estate investment trust's stock valued at $1,528,000 after buying an additional 25,945 shares during the period. GAMMA Investing LLC grew its position in Rexford Industrial Realty by 211.2% in the first quarter. GAMMA Investing LLC now owns 1,441 shares of the real estate investment trust's stock worth $56,000 after acquiring an additional 978 shares during the period. M&T Bank Corp grew its position in Rexford Industrial Realty by 1.2% in the first quarter. M&T Bank Corp now owns 26,857 shares of the real estate investment trust's stock worth $1,052,000 after acquiring an additional 317 shares during the period. Bessemer Group Inc. lifted its stake in shares of Rexford Industrial Realty by 118.4% in the 1st quarter. Bessemer Group Inc. now owns 747 shares of the real estate investment trust's stock valued at $29,000 after purchasing an additional 405 shares during the last quarter. Finally, Oppenheimer Asset Management Inc. grew its holdings in shares of Rexford Industrial Realty by 40.5% during the 1st quarter. Oppenheimer Asset Management Inc. now owns 36,792 shares of the real estate investment trust's stock worth $1,440,000 after purchasing an additional 10,603 shares during the period. 99.52% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other Rexford Industrial Realty news, General Counsel David E. Lanzer sold 26,449 shares of the firm's stock in a transaction on Monday, July 21st. The stock was sold at an average price of $36.87, for a total value of $975,174.63. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. 1.20% of the stock is owned by company insiders.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on REXR shares. Evercore ISI lowered shares of Rexford Industrial Realty from an "outperform" rating to an "in-line" rating and reduced their price objective for the company from $39.00 to $38.00 in a report on Friday, July 18th. Truist Financial lifted their price target on shares of Rexford Industrial Realty from $37.00 to $42.00 and gave the company a "buy" rating in a research report on Wednesday, August 20th. Barclays reduced their price target on shares of Rexford Industrial Realty from $38.00 to $35.00 and set an "underweight" rating on the stock in a research note on Wednesday, April 30th. Scotiabank dropped their target price on shares of Rexford Industrial Realty from $39.00 to $37.00 and set a "sector perform" rating for the company in a report on Monday, May 12th. Finally, Robert W. Baird set a $43.00 target price on Rexford Industrial Realty in a research report on Tuesday, May 6th. Two investment analysts have rated the stock with a Buy rating, seven have assigned a Hold rating and one has issued a Sell rating to the company's stock. Based on data from MarketBeat.com, Rexford Industrial Realty has an average rating of "Hold" and a consensus target price of $40.27.

Check Out Our Latest Report on REXR

Rexford Industrial Realty Stock Down 0.8%

Shares of Rexford Industrial Realty stock traded down $0.3150 on Monday, reaching $40.1050. 934,911 shares of the company were exchanged, compared to its average volume of 2,071,634. The stock's 50 day moving average price is $37.14 and its 200-day moving average price is $36.90. The company has a debt-to-equity ratio of 0.37, a current ratio of 5.59 and a quick ratio of 5.59. Rexford Industrial Realty, Inc. has a 1-year low of $29.68 and a 1-year high of $52.61. The company has a market cap of $9.49 billion, a P/E ratio of 29.71, a price-to-earnings-growth ratio of 4.49 and a beta of 1.10.

Rexford Industrial Realty (NYSE:REXR - Get Free Report) last posted its quarterly earnings results on Wednesday, July 16th. The real estate investment trust reported $0.59 EPS for the quarter, topping the consensus estimate of $0.58 by $0.01. Rexford Industrial Realty had a net margin of 32.04% and a return on equity of 3.62%. The company had revenue of $241.57 million during the quarter, compared to analysts' expectations of $251.72 million. During the same quarter in the previous year, the business posted $0.60 EPS. The firm's revenue was up 5.0% on a year-over-year basis. Rexford Industrial Realty has set its FY 2025 guidance at 2.370-2.410 EPS. As a group, equities analysts forecast that Rexford Industrial Realty, Inc. will post 2.38 EPS for the current year.

Rexford Industrial Realty Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, October 15th. Investors of record on Tuesday, September 30th will be paid a dividend of $0.43 per share. The ex-dividend date is Tuesday, September 30th. This represents a $1.72 dividend on an annualized basis and a dividend yield of 4.3%. Rexford Industrial Realty's payout ratio is presently 127.41%.

Rexford Industrial Realty Company Profile

(

Free Report)

Rexford Industrial Realty, Inc is a self-administered and self-managed real estate investment trust, which engages in owning and operating industrial properties in infill markets. The company was founded by Richard S. Ziman on January 18, 2013 and is headquartered in Los Angeles, CA.

Featured Stories

Before you consider Rexford Industrial Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rexford Industrial Realty wasn't on the list.

While Rexford Industrial Realty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.