Goldman Sachs Group Inc. trimmed its holdings in Rimini Street, Inc. (NASDAQ:RMNI - Free Report) by 42.8% in the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 163,035 shares of the company's stock after selling 121,765 shares during the quarter. Goldman Sachs Group Inc. owned about 0.18% of Rimini Street worth $567,000 as of its most recent SEC filing.

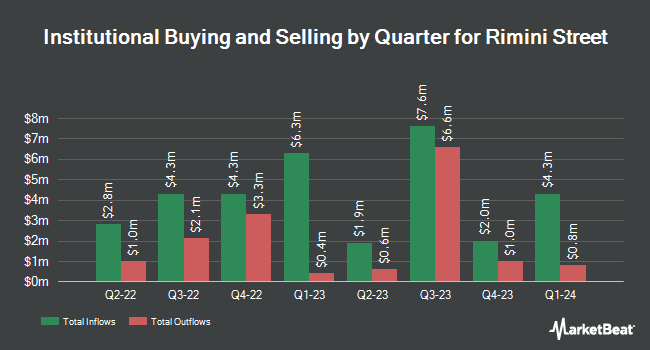

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in RMNI. Strs Ohio purchased a new stake in shares of Rimini Street during the first quarter worth approximately $422,000. Acadian Asset Management LLC grew its holdings in Rimini Street by 2.2% in the first quarter. Acadian Asset Management LLC now owns 2,272,975 shares of the company's stock valued at $7,906,000 after purchasing an additional 48,993 shares during the last quarter. Jane Street Group LLC grew its holdings in Rimini Street by 120.2% in the first quarter. Jane Street Group LLC now owns 33,179 shares of the company's stock valued at $115,000 after purchasing an additional 18,112 shares during the last quarter. NewEdge Advisors LLC acquired a new stake in Rimini Street in the first quarter valued at $66,000. Finally, Jacobs Levy Equity Management Inc. acquired a new stake in Rimini Street in the first quarter valued at $271,000. Hedge funds and other institutional investors own 73.75% of the company's stock.

Analysts Set New Price Targets

A number of research firms recently commented on RMNI. Roth Capital set a $6.50 price objective on Rimini Street and gave the stock a "buy" rating in a research report on Thursday, July 10th. Wall Street Zen lowered Rimini Street from a "strong-buy" rating to a "buy" rating in a research note on Saturday, August 2nd. Three investment analysts have rated the stock with a Buy rating, According to MarketBeat.com, Rimini Street has a consensus rating of "Buy" and an average target price of $6.25.

Get Our Latest Research Report on Rimini Street

Insider Buying and Selling at Rimini Street

In related news, CFO Michael L. Perica sold 100,249 shares of the company's stock in a transaction on Tuesday, September 2nd. The stock was sold at an average price of $4.20, for a total transaction of $421,045.80. Following the transaction, the chief financial officer directly owned 146,032 shares of the company's stock, valued at approximately $613,334.40. The trade was a 40.71% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Nancy Lyskawa sold 24,344 shares of the company's stock in a transaction on Thursday, August 7th. The shares were sold at an average price of $4.00, for a total value of $97,376.00. Following the transaction, the executive vice president directly owned 160,609 shares in the company, valued at $642,436. The trade was a 13.16% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 231,422 shares of company stock worth $969,055 in the last ninety days. 41.20% of the stock is owned by company insiders.

Rimini Street Price Performance

NASDAQ:RMNI opened at $4.78 on Friday. Rimini Street, Inc. has a 12-month low of $1.53 and a 12-month high of $5.38. The firm has a market capitalization of $442.25 million, a P/E ratio of -119.47 and a beta of 1.46. The business has a 50 day simple moving average of $4.39 and a 200 day simple moving average of $3.86.

About Rimini Street

(

Free Report)

Rimini Street, Inc provides enterprise software products, services, and support. The company engages in the provision of support services for Oracle and SAP enterprise software products. It also provides Rimini ONE, an outsourcing option that offers a set of unified and integrated services to run, manage, support, customize, configure, connect, protect, monitor, and optimize its clients' application, database, and technology enterprise software; Rimini Support, a mission-critical support for Oracle, SAP, proprietary and open-source database, and technology software; Rimini Manage, a suite of managed services for application and database software; Rimini Protect, a suite of personalized software security services and solutions; and Rimini Connect, a suite of managed interoperability solutions for browsers, operating systems, and email systems.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rimini Street, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rimini Street wasn't on the list.

While Rimini Street currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.