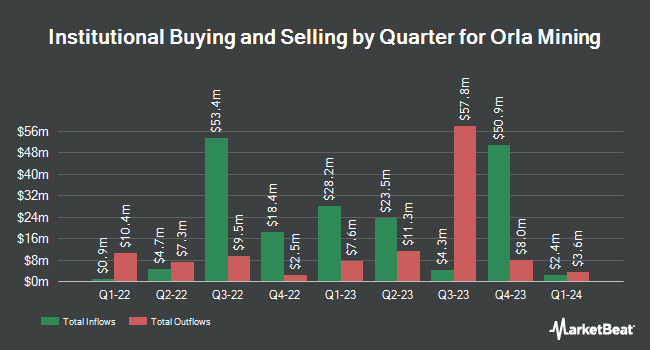

Ritholtz Wealth Management raised its position in Orla Mining Ltd. (NYSEAMERICAN:ORLA - Free Report) by 174.0% in the 2nd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 48,186 shares of the company's stock after purchasing an additional 30,598 shares during the period. Ritholtz Wealth Management's holdings in Orla Mining were worth $483,000 as of its most recent filing with the SEC.

Several other large investors have also recently bought and sold shares of the company. Connor Clark & Lunn Investment Management Ltd. increased its stake in Orla Mining by 119.8% in the first quarter. Connor Clark & Lunn Investment Management Ltd. now owns 3,843,000 shares of the company's stock valued at $35,898,000 after purchasing an additional 2,094,800 shares in the last quarter. Amundi increased its position in shares of Orla Mining by 49.9% during the first quarter. Amundi now owns 3,711,381 shares of the company's stock worth $35,147,000 after acquiring an additional 1,235,692 shares in the last quarter. TD Asset Management Inc increased its position in shares of Orla Mining by 15.7% during the first quarter. TD Asset Management Inc now owns 2,780,946 shares of the company's stock worth $25,969,000 after acquiring an additional 378,015 shares in the last quarter. Goehring & Rozencwajg Associates LLC increased its position in shares of Orla Mining by 2.2% during the first quarter. Goehring & Rozencwajg Associates LLC now owns 1,397,753 shares of the company's stock worth $12,951,000 after acquiring an additional 30,722 shares in the last quarter. Finally, Goldman Sachs Group Inc. increased its position in shares of Orla Mining by 14.1% during the first quarter. Goldman Sachs Group Inc. now owns 1,061,455 shares of the company's stock worth $9,925,000 after acquiring an additional 131,577 shares in the last quarter. Institutional investors own 43.04% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, CIBC reissued an "outperform" rating on shares of Orla Mining in a research report on Tuesday, July 15th. Two investment analysts have rated the stock with a Strong Buy rating, one has given a Buy rating and two have assigned a Hold rating to the company. According to data from MarketBeat.com, Orla Mining has an average rating of "Buy" and an average target price of $23.00.

Get Our Latest Stock Analysis on Orla Mining

Orla Mining Stock Down 10.1%

Orla Mining stock opened at $12.15 on Monday. The company has a market cap of $3.96 billion, a P/E ratio of 243.05 and a beta of 0.33. Orla Mining Ltd. has a 1-year low of $3.81 and a 1-year high of $13.91. The company has a fifty day simple moving average of $11.01 and a 200 day simple moving average of $10.66. The company has a current ratio of 0.85, a quick ratio of 0.66 and a debt-to-equity ratio of 0.76.

Orla Mining Company Profile

(

Free Report)

Orla Mining Ltd. acquires, explores, develops, and exploits mineral properties. The company explores for gold, silver, zinc, lead, and copper deposits. It owns 100% interests in the Camino Rojo project that consists of seven concessions covering an area of 138,636 hectares located in Zacatecas, Mexico; Cerro Quema project totaling an area of 15,000 hectares located in the Azuero Peninsula, Panama; and the South Railroad project consisting of an area of 21,000 hectares located in Elko, Nevada.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Orla Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Orla Mining wasn't on the list.

While Orla Mining currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.