Robeco Institutional Asset Management B.V. lowered its stake in shares of Pinterest, Inc. (NYSE:PINS - Free Report) by 39.0% in the second quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 749,473 shares of the company's stock after selling 479,927 shares during the quarter. Robeco Institutional Asset Management B.V. owned about 0.11% of Pinterest worth $26,876,000 at the end of the most recent quarter.

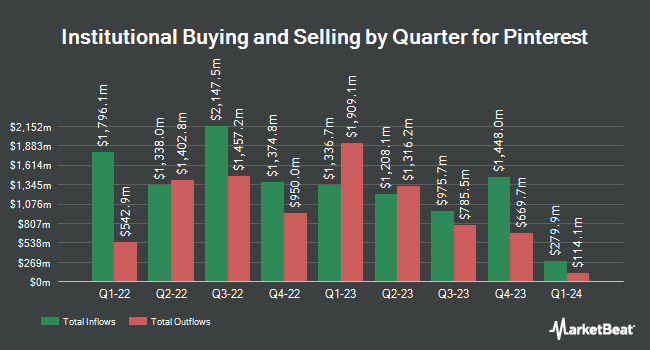

A number of other large investors have also recently added to or reduced their stakes in the stock. Vanguard Group Inc. boosted its position in Pinterest by 2.2% during the first quarter. Vanguard Group Inc. now owns 58,008,711 shares of the company's stock worth $1,798,270,000 after purchasing an additional 1,263,863 shares during the period. Price T Rowe Associates Inc. MD boosted its position in shares of Pinterest by 25.4% in the first quarter. Price T Rowe Associates Inc. MD now owns 31,892,284 shares of the company's stock valued at $988,662,000 after acquiring an additional 6,460,143 shares during the period. Ameriprise Financial Inc. boosted its position in shares of Pinterest by 13.7% in the first quarter. Ameriprise Financial Inc. now owns 15,498,454 shares of the company's stock valued at $480,452,000 after acquiring an additional 1,862,654 shares during the period. Amundi boosted its position in shares of Pinterest by 618.9% in the first quarter. Amundi now owns 14,254,741 shares of the company's stock valued at $441,897,000 after acquiring an additional 12,271,958 shares during the period. Finally, Swedbank AB boosted its position in shares of Pinterest by 27.3% in the second quarter. Swedbank AB now owns 7,430,885 shares of the company's stock valued at $266,472,000 after acquiring an additional 1,591,400 shares during the period. Institutional investors own 88.81% of the company's stock.

Insider Buying and Selling at Pinterest

In other Pinterest news, CFO Donnelly Julia Brau sold 22,821 shares of the stock in a transaction on Wednesday, September 24th. The stock was sold at an average price of $34.85, for a total transaction of $795,311.85. Following the completion of the transaction, the chief financial officer directly owned 312,422 shares in the company, valued at $10,887,906.70. This represents a 6.81% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Benjamin Silbermann sold 102,083 shares of the stock in a transaction on Wednesday, August 20th. The stock was sold at an average price of $34.96, for a total value of $3,568,821.68. The disclosure for this sale can be found here. Insiders have sold 967,635 shares of company stock valued at $34,866,344 over the last quarter. Corporate insiders own 7.06% of the company's stock.

Analysts Set New Price Targets

PINS has been the subject of several research reports. Benchmark increased their price objective on Pinterest from $45.00 to $48.00 and gave the company a "buy" rating in a research report on Thursday, July 24th. Monness Crespi & Hardt increased their price objective on Pinterest from $40.00 to $46.00 and gave the company a "buy" rating in a research report on Friday, August 8th. Guggenheim reissued a "buy" rating on shares of Pinterest in a research report on Tuesday, September 2nd. Cowen reissued a "buy" rating on shares of Pinterest in a research report on Friday, August 8th. Finally, Sanford C. Bernstein upped their target price on Pinterest from $40.00 to $45.00 and gave the company an "outperform" rating in a research note on Tuesday, July 22nd. One research analyst has rated the stock with a Strong Buy rating, twenty-four have given a Buy rating and five have given a Hold rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $42.63.

Get Our Latest Stock Analysis on Pinterest

Pinterest Price Performance

Pinterest stock opened at $31.91 on Friday. The stock has a fifty day moving average price of $35.94 and a two-hundred day moving average price of $33.15. Pinterest, Inc. has a 52-week low of $23.68 and a 52-week high of $40.90. The firm has a market capitalization of $21.70 billion, a P/E ratio of 11.44, a P/E/G ratio of 1.34 and a beta of 0.81.

Pinterest (NYSE:PINS - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The company reported $0.33 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.34 by ($0.01). Pinterest had a return on equity of 8.44% and a net margin of 49.31%.The company had revenue of $998.23 million for the quarter, compared to analyst estimates of $973.42 million. During the same quarter in the prior year, the company earned $0.29 earnings per share. The business's revenue was up 16.9% compared to the same quarter last year. Pinterest has set its Q3 2025 guidance at EPS. On average, equities research analysts predict that Pinterest, Inc. will post 0.6 EPS for the current fiscal year.

About Pinterest

(

Free Report)

Pinterest, Inc operates as a visual search and discovery platform in the United States and internationally. Its platform allows people to find ideas, such as recipes, home and style inspiration, and others; and to search, save, and shop the ideas. The company was formerly known as Cold Brew Labs Inc and changed its name to Pinterest, Inc in April 2012.

Recommended Stories

Want to see what other hedge funds are holding PINS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Pinterest, Inc. (NYSE:PINS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pinterest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinterest wasn't on the list.

While Pinterest currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report